Published December 16th, 2016 by Bob Ciura

Real Estate Investment Trusts, also known as REITs, have long been a plentiful source of dividend stocks. REITs typically sport dividend yields two-to-three times the S&P 500 Index average.

REITs are generally exempt from tax at the corporate level. In return, they are required to distribute 90% of their taxable income annually in shareholder dividends.

This is why REITs pay such high dividend yields, which makes them attractive to income investors.

Realty Income (O) is one of the strongest REITs out there. It has an amazing dividend history. It is a Dividend Achiever, a group of companies that have increased dividends for at least the past 10 consecutive years.

You can see the entire list of all 273 Dividend Achievers here.

This article will discuss Realty Income’s business model, growth prospects, and why it is an attractive stock for dividend investors.

Business Overview

Realty Income has a highly-diversified portfolio. It owns over 4,700 properties, spread across 47 industries and 247 commercial tenants.

The property types are diversified as follows:

- 79% Retail

- 13% Industrial

- 7% Office

- 2% Agriculture

Realty Income has a high-quality tenant portfolio. Among its top 20 tenants are many large, established companies with strong brands.

Source: 3Q Investor Presentation, page 15

Realty Income has a strong business model, supported by a key competitive advantage. The vast majority of Realty Income’s properties operate under the ‘triple-net’ lease structure.

Under this type of lease, not only is the tenant responsible for monthly rent, but they also handle various operating expenses including taxes, maintenance, and insurance.

The structure also allows Realty Income to raise rents on a regular basis. Over the first nine months of 2016, average rents increased 1.2%.

Triple-net leases reduce Realty Income’s costs and leaves more cash flow to grow the dividend.

Growth Prospects

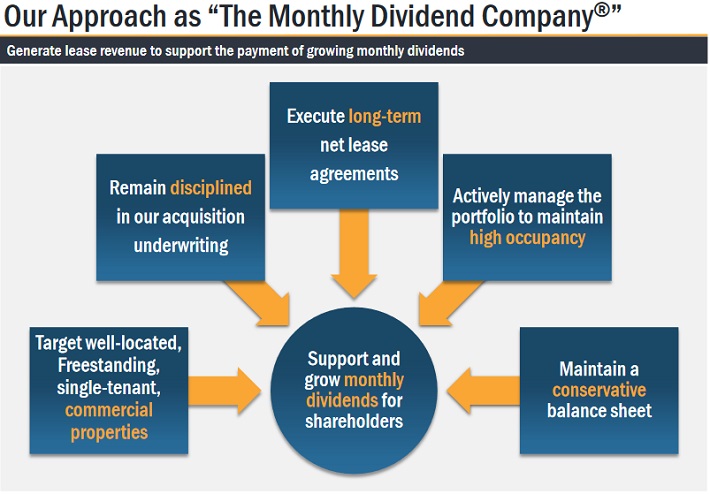

At the center of the company’s growth strategy is a continuous focus on providing shareholders with a growing dividend.

Source: 3Q Investor Presentation, page 5

This approach has worked well. Adjusted FFO increased 3.9% over the first nine months of 2016.

Realty Income has positive growth prospects. Its basic growth plan is to use cash flow from rents to purchase new properties.

Last quarter, it Invested $410 million in 93 new properties. Through the first nine months of the year, Realty Income invested $1.1 billion in property acquisitions.

These acquisitions then generate cash flow of their own, which allows the company to acquire even more properties.

This dynamic creates a snowball effect that has fueled its steady growth for so many years.

Valuation & Expected Total Returns

REITs are not typically valued based on traditional earnings-per-share. That is because REITs have many significant non-cash items, such as depreciation, that skew earnings-per-share.

A better metric to use when performing valuation on REITs is Funds from Operation, or FFO. This gives investors a better picture of the cash flow generated by the underlying business.

In the past four quarters, Realty Income generated FFO of $2.82 per share. Based on its current share price, the stock trades for a price-to-FFO ratio of 19.

This is the equivalent to a price-to-earnings ratio. Realty Income’s price-to-FFO ratio has expanded significantly over the past several years. The high demand for dividend stocks has caused REIT valuations to rise.

One could easily argue that Realty Income is not undervalued, and that it deserves this premium valuation.

Source: 3Q Investor Presentation, page 32

Still, it is difficult to image further expansion of the valuation multiple. With that in mind, future returns will likely be comprised of FFO growth and dividends. A reasonable set of expectations could be as follows:

- 6%-8% FFO growth

- 4.5% dividend yield

Under this scenario, investors would generate approximately 10.5%-12.5% total returns per year.

One potential risk factor that investors should be aware of is interest rates. The Federal Reserve recently announced another rate hike, and indicated plans to raise rates another three times in 2017.

REITs are especially sensitive to changes in interest rates, since they utilize debt heavily to finance property acquisitions. Higher interest rates could inhibit Realty Income’s future growth by increasing its cost of capital.

Fortunately, Realty Income has mitigated this risk by taking a conservative approach to its capital structure. It has proven the ability to grow through all interest rate cycles.

Source: 3Q Investor Presentation, page 31

Realty Income’s interest rate risk is manageable, because 90% of its debt is fixed rate. And, it has a modest 4.1% weighted average cost of debt. Thanks to its strong business model, the company should be able to generate returns above its cost of debt.

Dividend Analysis

Realty Income’s dividend is arguably the biggest reason to invest in the stock. The company is extremely committed to paying consistent dividends. In fact, Realty Income trademarked the name The Monthly Dividend Company, to emphasize how seriously it takes the dividend.

It has not disappointed in this regard.

First, Realty Income pays its dividend each month. This is unique, as most stocks subscribe to the quarterly or semi-annual dividend payment schedules. By paying its dividend each month, Realty Income compounds investors’ wealth faster. There are only a handful of companies that pay monthly dividends.

Furthermore, Realty Income has paid 556 consecutive monthly dividends—a streak that goes back 46 years. And, it has increased its dividend for the past 77 quarters in a row.

Source: 3Q Investor Presentation, page 34

Investors should fully expect Realty Income’s dividend growth to continue. It is not a high dividend growth stock, but it should continue raising the dividend above inflation. For example, since 1994 the company raised its dividend by 4.6% per year on average.

Final Thoughts

Realty Income has outperformed the market and its peer group for many years. According to the company, the stock has generated a 17.9% compound annual return since its 1994 listing on the New York Stock Exchange.

The recipe for Realty Income’s success is an advantageous business model, with a high-quality tenant base and a disciplined property acquisition strategy.

Higher interest rates pose a concern moving forward, but Realty Income remains a best-in-class REIT for dividends and growth.