S&P 500 Technical and Sentiment Indicators Getting Extended

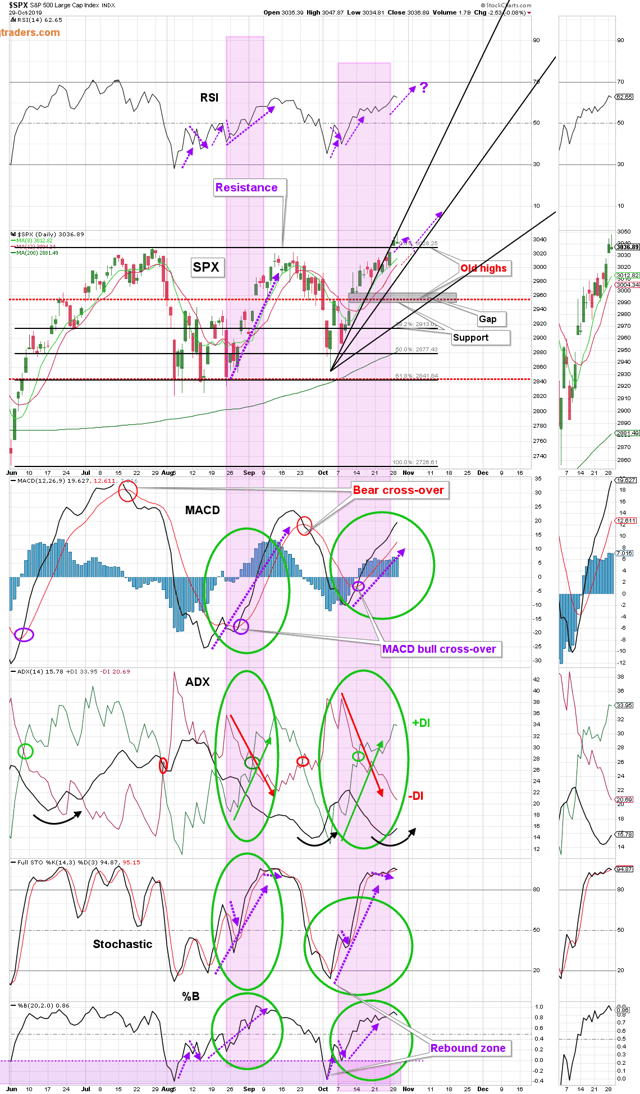

Technically, the SPX has been moving as we suggested in the Weekly Summary; moved to new highs, but is likely to fall back as the momentum indicators become over-extended (chart below).

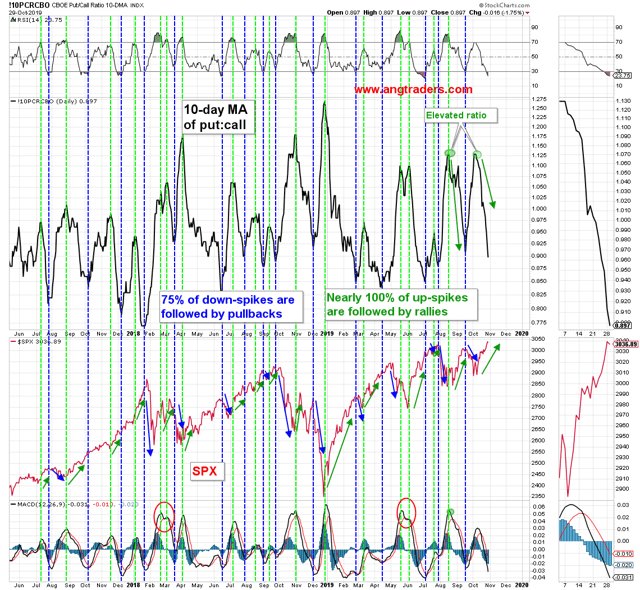

The 10-day MA of the put:call ratio continues to descend (bullish), but like the momentum indicators, it is getting over-extended and could turn around soon (chart below).

During the 2018 correction, our analysis showed that we were not at the start of a new bear market and that the bull market was not in the process of ending. As a result, our subscribers avoided the herd mentality of panicked-selling and the losses it created. We continue to monitor the Treasury cash balance and investor sentiment as the key indicators of the future. Join us at www.angtraders.com and benefit from our 41-years of experience for as little as $13.33/mo.

Source Nicholas Gomez