Updated on March 16th, 2021 by Nikolaos Sismanis

Founded by David Greenspan in 2012, Slate Path Capital is a New York-based hedge fund counting 7 clients and $3.2 billion of assets under management (AUMs). The fund maintains a low profile, sharing no information about how it is run, the strategies it employs, or the philosophies it stands by.

Yet, Slate Path has been able to generate spectacular returns over the past few years. Thankfully, around half of the company’s assets are allocated in public equities, which should help us get a glimpse of the fund’s investing style, despite missing much of the secret sauce.

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of 38.9%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.5% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet (with metrics that matter) of Slate Path Capital’s current 13F equity holdings below:

Keep reading this article to learn more about Slate Path Capital.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Slate Path Capital’s Portfolio

- Notable Portfolio Changes

- Slate Path Capital’s 10 Largest Holdings

- Final Thoughts

Slate Path Capital’s Portfolio

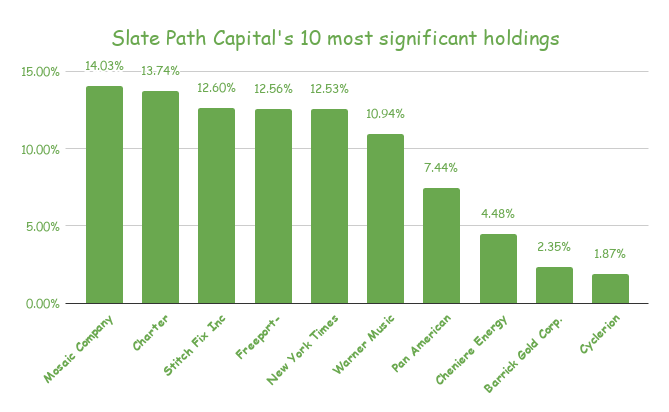

According to the company’s latest 13F filing, Slate Path’s public portfolio consists of 20 individual stocks, with the 10 largest holdings accounting for around 92.5% of its total weight.

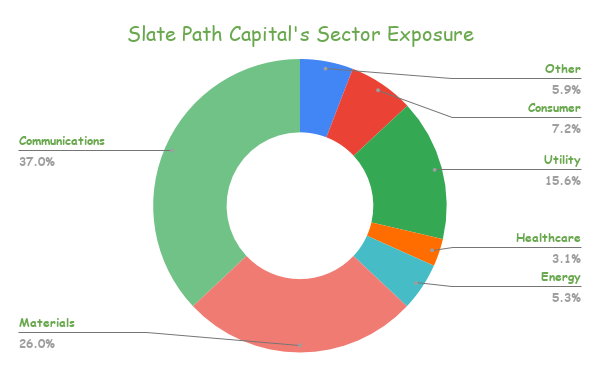

Source: Company Filings, Author

As expected, due to its limited number of investments, Slate Path faces overweight exposure in some sectors. As a result, its holdings in Basic Materials and Communications collectively account for more than 63% of its total holdings.

Source: Company Filings, Author

However, what’s the most impressive and unique feature of the fund’s portfolio is that it has 0% exposure to technology. In fact, Slate Path has not touched a single tech stock for 12 consecutive quarters. This is utterly striking.

Tech’s prolonged rally has fueled most of the overall market’s gains both post-COVID-19 as well as those of the past few years. The pandemic boosted this trend, as the staying-at-home economy has further integrated technology into our lives, accelerating the sector’s growth.

Meanwhile, the fund has been able to deliver market-beating returns by a wide margin by completely avoiding the sector. Let’s break down the fund’s 10 largest investments and hopefully get a better insight into Slate Path’s investing style.

Notable Portfolio Changes

During its latest 13F filing, Slate Path Capital executed the following notable portfolio adjustments:

New Stakes:

Apart from Cheniere, which accounts for around 4.5% of the fund’s holdings, the rest are minor positions, occupying anywhere from 0.6% to 1.5% of Slate’s total portfolio.

- Cheniere Energy, Inc. (LNG)

- NOV Inc (NOV)

- SM Energy Co. (SM)

- California Resources Corp. (CRC)

- United States Steel Corp. (X)

- Cliffs Natural Resources Inc. (CLF)

- Oasis Petroleum Inc. (OAS)

- 5:01 Acquisition Corp. (FVAM)

- GrafTech International Ltd (EAF)

Stake Disposals:

During Q4, Slate Path disposed of the following position completely:

- Green Plains Inc (GPRE)

- Snap Inc Class A (SNAP)

- CNX Resources Corporation (CNX)

- Alnylam Pharmaceuticals Inc (ALNY)

- Zillow Group Inc Class C (Z)

- Kirby Corp (KEX)

Slate Path Capital’s 10 Largest Holdings

The Mosaic Company (MOS)

Slate Path has been building its stake in the Mosaic Company since Q1-2018. During the past quarter, management trimmed its position by around 16%, most likely due to the stock’s prolonged rally. Despite the trim, the stock is currently Slate Path’s largest holding, occupying around 14% of its portfolio.

The company has struggled to produce sustainable profits as its agricultural operations remain an extremely low-margin business. However, Mosaic’s Q4 was rather impressive, delivering revenue growth of 18.3% to $2.46 billion.

Management is also seeing improving market dynamics through 2021, as global demand for grains and oilseeds remains quite high. Farm economics remain robust as well.

Charter Communications (CHTR)

Charter Communications is Slate Path’s second-largest holding, currently occupying around 13% of its holdings. Shares have more than doubled over the past 2 years, as the company’s cable and internet services have been delivering robust financials while they are also pandemic-proof. The company is highly committed to delivering solid shareholder returns, executing massive stock buybacks to return cash to shareholders.

Over the past three years alone, the company has repurchased and retired around 25% of its total shares outstanding, delivering massive tangible capital returns. Slate Path held its position steady during the quarter, retaining its high conviction position for the stock.

Considering that the funds hold shares since early 2013, it’s likely that Charter will continue to be a significant holding in the future and a high-conviction pick for the fund.

Stitch Fix, Inc. (SFIX)

Stitch Fix climbed to Slate Path’s top 10 holdings, as the fund initiated a massive position during the Q3, purchasing nearly $70 million worth of shares. In Q4, Slate path trimmed its stake by 11%, though the stock still ascended as its third-largest position due to the various other stake disposals.

The stock had been struggling over the past few years, as the company has remained unprofitable while lacking any exciting, explosive growth.

However, with management’s plans to expand Stich Fix’s margins to deliver profitability, the stock has started climbing higher over the past few months and currently trading above its IPO price. Slate Path’s conviction must be quite strong, as the fund currently owns around 3.6% of the company’s total shares. Hence, the stake could potentially be developed into an active-influence stake in the future.

Barrick Gold (GOLD), Pan American Silver Corp. (PAAS), and Freeport-McMoRan Inc. (FCX)

Gold has been trading higher over the past few years, as the Fed’s non-stop expansionary policy and recent money-printing stimulus to sustain the economy have flooded the market with cash, increasing gold’s value as an anti-inflationary hard asset. Goldminers such as Barrick Gold have shared this rally, booking record profits.

Barrick Gold achieved $2.32 billion in profits during FY 2020, which ended up being one of its most profitable years. However, shares have fallen significantly over the past few months. Still, since Slate Path bought Barrick in 2018, the fund has made substantial unrealized gains. Its average purchase price stands at around $13.70 per share.

While the stock’s valuation at around 15X earnings may be seemingly attractive, investors must be wary, as gold miners can be extremely volatile, incur huge losses during downturns, and are highly dependent on a single commodity’s price.

Quite similarly, Pan American Silver Corp. extracts and processes silver. The fund’s position is probably for diversification purposes, increasing the portfolio’s margin of safety against a potential correction in gold itself.

Finally, Slate Path’s stake in Freeport-McMoRan, another precious metals mining company, could be due to its non-American operations. This adds another layer of geographical diversification in its basic materials exposure.

The three companies account for around 22.4% of Slate Path’s public-equity portfolio.

The New York Times Company (NYT)

The New York Times has gradually expanded its gross margins, and subsequently profitability, over the past several years. As a result, shares recently passed its previous all-time high from 2003.

Slate Path has been holding the stock since early 2018 and boasts an average purchase below $28, marking over 78% capital gains in just around 2 years. The fund increased its position by around 9% during the quarter.

Warner Music Group Corp. (WMG)

Around 10.6% of Slate Path’s funds are allocated to Warner Music, the well-known and easily recognizable company that operates through its recorded music and music publishing segments. The company completed its IPO this past summer, with the fund adding shares to its portfolio from very early on.

With platforms like Spotify (SPOT) and Apple Music consistently increasing their user bases, artists and labels have been able to extract larger royalties. Consequently, Warner Music’s revenues were already increasing annually before its public listing, as the company’s IPO documents revealed.

Warner Music recently reported its Q4 results, marking the first profitable quarter in its publicly-traded history. Hopefully, the company will be able to leverage its IPO proceeds to grow its financials in the medium term further, capitalizing on the rise of digital music platforms. Still, considering that the company’s IPO remains quite fresh, investors should be aware of the potential risks attached.

Cheniere Energy, Inc. (LNG)

Cheniere Energy is Slate Path’s eighth-largest holding after the company initiated a position during Q4. The liquid natural gas giant weathered the storm of COVID-19 better than its industry peers, as its infrastructure assets were proven critical for businesses and households.

Its performance remained stable during 2020, posting revenues of $9.39 billion, against $9.3 billion during 2019. The fund’s average purchasing price is around $60, which means its position has already translated into unrealized gains now that shares hover around ~$73.

Cyclerion Therapeutics, Inc. (CYCN)

Cyclerion is Slate Path’s tenth-largest holding. The fund initially bought the stock in Q2-2019, currently holding 18.2% of the company’s total shares, meaning it more than likely has an active involvement in how it’s run. While Slate Path had initially bought the stock in the low teens, it has averaged its stake down, currently featuring an average purchasing price of around $5.40.

However, with the company’s biopharma products still in the clinical stages, Cyclerion is burning cash by the quarter to stay active. Slate Path’s commitment by averaging its stake definitely sends positive signals. Still, such stocks are better avoided by retail investors unless one possesses a deep understanding of the complex nature of the biopharma industry.

Final Thoughts

Slate Path Capital is a truly unique fund. The company has apparently no interest in being in the spotlight, sharing nothing about its operations to outsiders. Simultaneously, its returns have been astounding while lacking any tech sector exposure, despite the tech sector being the overall market’s primary growth driver.

While the fund’s portfolio is quite concentrated among a limited number of equities, Slate Path’s strategy seems to be revolving around equities with the potential to expand their margins, coupled with a strong hedge towards the precious metals industry.

Despite lacking further information on how the fund hand-selects its picks, investors can glean valuable insights from the company’s f13 filings. These filings can generate some unique opportunities for investors, to consider replicating.

You can download an Excel spreadsheet (with metrics that matter) of Slate Path Capital’s current 13F equity holdings below: