Updated on October 1st, 2021 by Bob Ciura

The vast majority of dividend stocks make payments to shareholders once per quarter. Others pay dividends even less frequently, such as a semi-annual or annual payment schedule. This can cause cash flow issues for investors who might want monthly income.

There are some companies, however, that make monthly dividend payments. In fact, there are 49 monthly dividend stocks that we currently cover.

You can see the full list of monthly dividend stocks (along with important investing metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

This article examines the 10 highest yielding monthly dividend payers for investors looking for both monthly income and high dividend yields.

You can learn more about monthly paying dividend stocks in the following video.

It is important to note that high yielding monthly dividend payers are, on average, far riskier than most dividend stocks. There is elevated risk of a dividend cut with high payout ratios – which are often associated with very high yields.

While some of the highest-yielding monthly dividend stocks are attractive for investment, others are potentially flashing warning signals to investors.

Table Of Contents

The 10 highest-yielding monthly dividend stocks selected for this article are listed in order by dividend yield, from lowest to highest.

- Broadmark Realty Capital Inc. (BRMK)

- PennantPark Floating Rate Capital (PFLT)

- San Juan Basin Royalty Trust (SJT)

- AGNC Investment Corp. (AGNC)

- Prospect Capital (PSEC))

- Ellington Financial Inc. (EFC)

- American Finance Trust, Inc. (AFIN)

- Oxford Square Capital (OXSQ)

- ARMOUR Residential REIT (ARR)

- Orchid Island Capital (ORC)

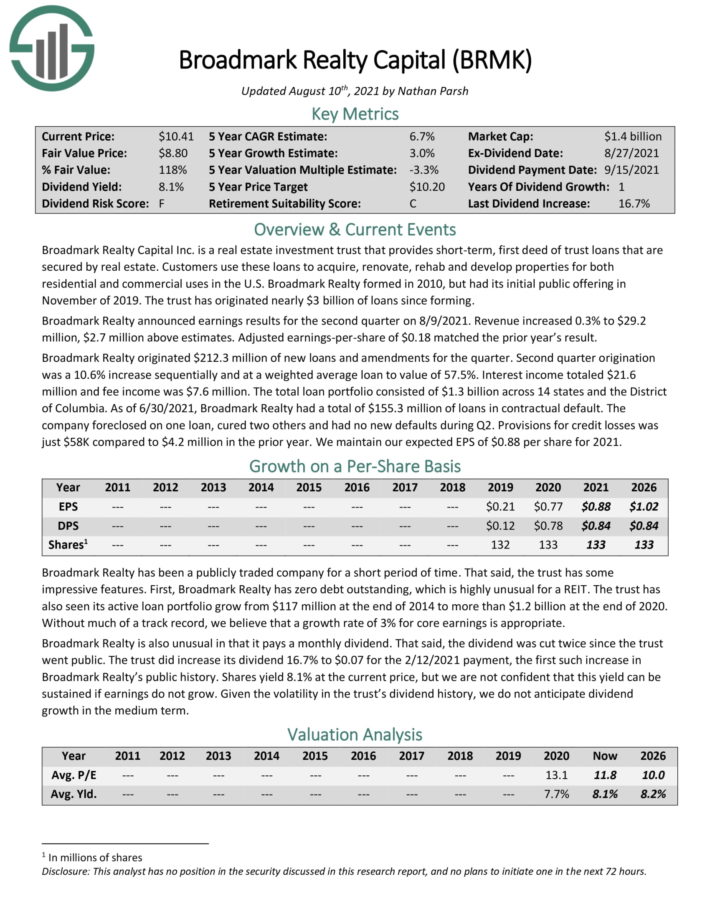

High Yield Monthly Dividend Stock #10: Broadmark Realty Capital (BRMK)

- Dividend Yield: 8.4%

Broadmark Realty Capital Inc. is a Real Estate Investment Trust that provides short–term, first deed of trust loans that are secured by real estate. Customers use these loans to acquire, renovate, rehab and develop properties for both

residential and commercial uses in the U.S. Broadmark Realty formed in 2010, but had its initial public offering in

November of 2019. The trust has originated nearly $3 billion of loans since forming.

Broadmark Realty announced earnings results for the second quarter on 8/9/2021. Revenue increased 0.3% to $29.2 million, $2.7 million above estimates. Adjusted earnings–per–share of $0.18 matched the prior year’s result.

Click here to download our most recent Sure Analysis report on BRMK (preview of page 1 of 3 shown below):

High Yield Monthly Dividend Stock #9: PennantPark Floating Rate Capital (PFLT)

- Dividend Yield: 8.9%

PennantPark Floating Rate Capital Ltd. is a business development company that seeks to make secondary direct, debt, equity, and loan investments. The fund also aims to invest through floating rate loans in private or thinly traded or small market–cap, public middle market companies, equity securities, preferred stock, common stock, warrants or options received in connection with debt investments or through direct investments.

It generally invests in the United States and to a limited extent non–U.S. companies. It aims to invest in companies not rated by national rating agencies. The firm has a market capitalization of approximately $509.1 million and produced roughly $82.8 million in revenue in 2020.

Click here to download our most recent Sure Analysis report on PFLT (preview of page 1 of 3 shown below):

High Yield Monthly Dividend Stock #8: San Juan Basin Royalty Trust (SJT)

- Dividend Yield: 9.0%

SJT is a royalty trust, established in November 1980. The trust is entitled to a 75% royalty interest in various oil and gas properties across over 150,000 gross acres, in the San Juan Basin of northwestern New Mexico. More than 90% of the trust’s production is comprised of gas, with the remainder consisting of oil.

The trust does not have a specified termination date. It will terminate if royalty income falls below $1,000,000 per year over any consecutive two-year period.

Click here to download our most recent Sure Analysis report on SJT (preview of page 1 of 3 shown below):

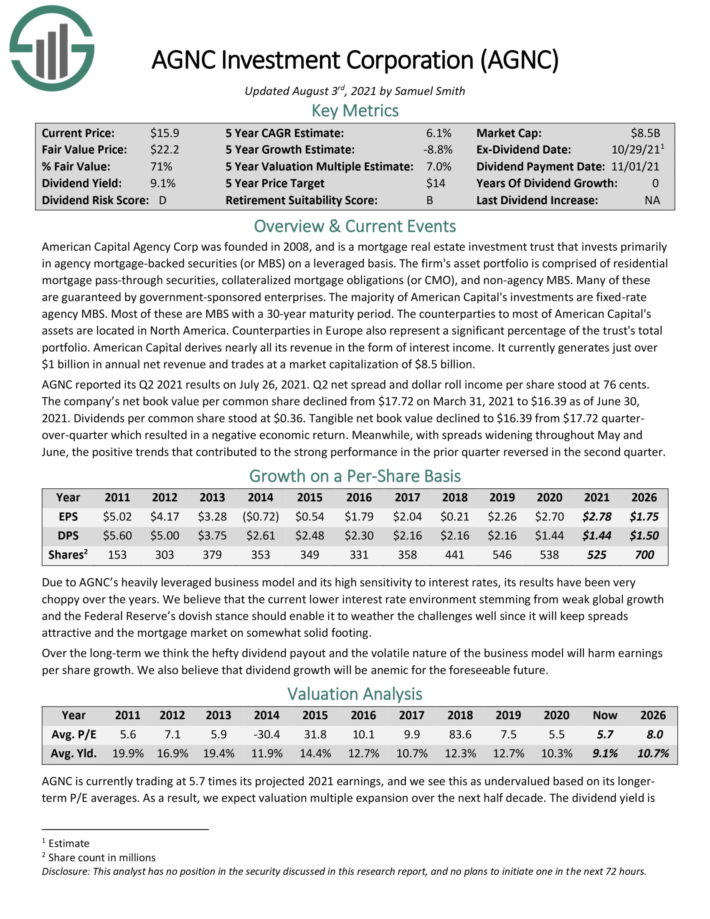

High Yield Monthly Dividend Stock #7: AGNC Investment Corp. (AGNC)

- Dividend Yield: 9.0%

AGNC Investment Corp is a mortgage real estate investment trust. The REIT invests in agency mortgage-backed securities and produces income mostly through borrowing structured as repurchase agreements. Repurchase agreements are those where one party purchases an asset at a price and then also agrees to buy back the asset at a predetermined, higher price at a later date.

Click here to download our most recent Sure Analysis report on AGNC (preview of page 1 of 3 shown below):

High Yield Monthly Dividend Stock #6: Prospect Capital (PSEC)

- Dividend Yield: 9.3%

Prospect Capital Corporation is an investment company that hopes to achieve high income and capital gains for its shareholders through the use of debt and other equity investments.

As a business development company, or BDC, Prospect Capital invests in small and medium size companies. Businesses in the initial stages of development seek capital from BDCs to help grow. BDCs like Prospect Capital pay no income tax if they meet certain requirements, such as distributing at least 90% of their taxable income to shareholders.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

High Yield Monthly Dividend Stock #5: Ellington Financial Inc. (EFC)

- Dividend Yield: 9.8%

Ellington Financial Inc. acquires and manages mortgage, consumer, corporate, and other related financial assets in the United States. The company acquires and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Additionally, it manages RMBS, for which the U.S. government guarantees the principal and interest payments. It also provides collateralized loan obligations, mortgage–related and non–mortgage–related derivatives, equity investments in mortgage originators and other strategic investments.

Click here to download our most recent Sure Analysis report on EFC (preview of page 1 of 3 shown below):

High Yield Monthly Dividend Stock #4: American Finance Trust, Inc. (AFIN)

- Dividend Yield: 10.4%

American Finance Trust is an externally managed real estate investment trust (REIT), focusing on acquiring and

managing a diversified portfolio of primarily service–oriented and traditional retail and distribution–related commercial properties located primarily in the United States.

The trust’s assets consist primarily of 864 single–tenant properties net leased to investment–grade and other creditworthy tenants and a portfolio of 33 multi–tenant retail properties consisting primarily of power and lifestyle centers. Its 939 properties comprise 19.9 million rentable square feet, which were 94.9% leased at the time of its latest filing. American Finance Trust generates around $330 million in annual revenues.

Click here to download our most recent Sure Analysis report on AFIN (preview of page 1 of 3 shown below):

High Yield Monthly Dividend Stock #3: Oxford Square Capital (OXSQ)

- Dividend Yield: 10.4%

Oxford Square Capital Corp. is a BDC (Business Development Company) specializing in financing early and middle–stage businesses through loans and CLOs. The company holds an equally split portfolio of First–Lien, Second–Lien, and CLO equity assets spread across 8 industries, with the highest exposure in business services and healthcare, at 37.8% and 22.2%, respectively.

The company’s assets have a gross investment value of around $404.8 million in 59 positions, with 59.8% of debt securities being secured. OXSQ generates around $50 million in annual interest payments.

On July 27th, Oxford Square reported its Q2 results for the quarter ended June 30th, 2021. The company generated approximately $7.8 million of total investment income, a decline of 17% compared to the previous quarter, or 4.8% lower on a YoY basis. Once again, this was due to the declining rates over this period, which affected the company’s investment yields.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

High Yield Monthly Dividend Stock #2: ARMOUR Residential REIT (ARR)

- Dividend Yield: 11.1%

ARMOUR Residential (ARR) is a mortgage REIT that was formed in 2008. The trust invests primarily in residential

mortgage–backed securities that are guaranteed or issued by a United States government entity including Fannie Mae, Freddie Mac and Ginnie Mae. ARMOUR has a $852 million market capitalization and produces about $114 million in net revenues.

ARMOUR reported Q2 results on July 22nd, 2021. The trust’s liquidity including cash and unencumbered securities amounted to $832 million with $11.28 in book value per common share at quarter end. Core income in Q2 fell from 23 cents in Q1 to 21 cents per common share in Q2. The debt–to–equity ratio improved to 3.6–to–1 from 4.2–to–1.

Click here to download our most recent Sure Analysis report on ARR (preview of page 1 of 3 shown below):

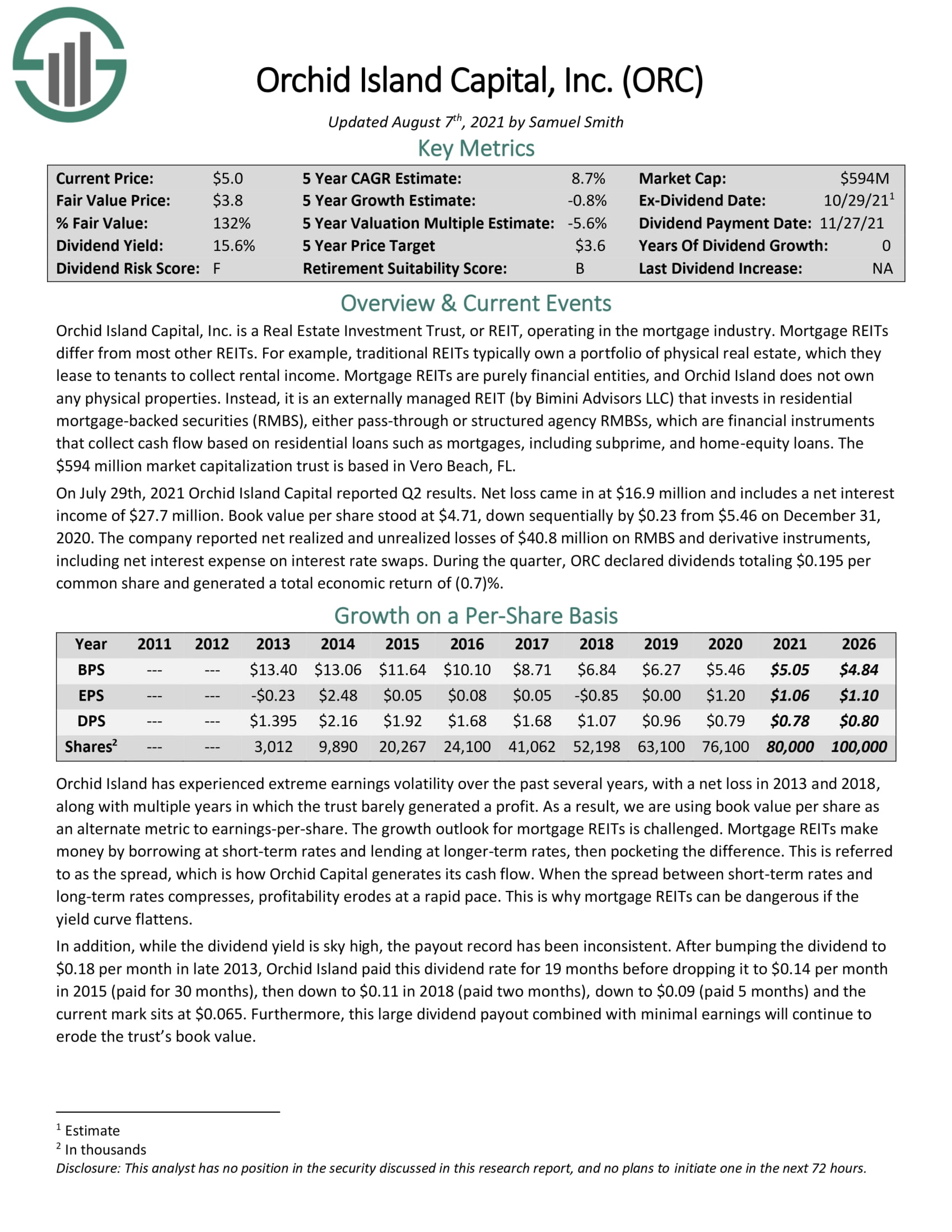

High Yield Monthly Dividend Stock #1: Orchid Island Capital (ORC)

- Dividend Yield: 15.9%

Orchid Island is a specialty finance company that invests in residential mortgage-backed securities, or MBS. The principal and interest of these securities are guaranteed by the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation and the Government National Mortgage Association, known as Fannie Mae, Freddie Mac and Ginnie Mae, respectively.

Click here to download our most recent Sure Analysis report on ORC (preview of page 1 of 3 shown below):

Final Thoughts

Monthly dividend stocks are appealing for income investors who desire more frequent payouts than the more typical quarterly or semi-annual dividend stocks. High yielding monthly dividend stocks have even greater appeal, but investors need to take caution with extreme high-yielders. Abnormally high yields nearing 10% are sometimes a sign of deteriorating company fundamentals.

For this reason, only those investors with a higher risk tolerance should consider these high-yield monthly dividend stocks.