Updated on October 6th, 2021 by Bob Ciura

Insurance companies often produce a high level of profits each year, because they make money in two ways. First, insurance companies collect premium income on the policies they underwrite.

Second, they are able to make money by investing the large sums of accumulated premiums that have not been paid out as claims.

Due to this, insurance companies have been among the most rewarding to own over the past several decades. In fact, many of the Dividend Aristocrats and Dividend Achievers are in the insurance industry.

You can download our Excel spreadsheet list of nearly 200 insurance stocks (with important metrics that matter such as P/E ratios and dividend yields) for free by clicking the link below:

The insurance industry has created many great fortunes. That’s because it’s slow changing and highly profitable, if the business is done well. Investing in insurance stocks is how Shelby Davis made $900 million from $50,000 starting in his late 30’s.

In recent years, the insurance industry (and other parts of the financial sector like banks) have struggled from low interest rates, which narrow the spread between what insurance companies can earn on their invested capital, versus what they pay out in claims.

In turn, higher interest rates would be a positive catalyst for insurance stocks, which would see their net investment income rise.

Still, there are a number of insurers that look attractively priced today that are poised to deliver strong total annual returns over the next five years. This article will rank the top 5 insurance stocks now, in order of expected total annual returns.

Table Of Contents

- Best Insurance Stock #5: Unum Group (UNM)

- Best Insurance Stock #4: Manulife Financial Corporation (MFC)

- Best Insurance Stock #3: Allstate Corporation (ALL)

- Best Insurance Stock #2: The Progressive Corporation (PGR)

- Best Insurance Stock #1: Cigna Corporation (CI)

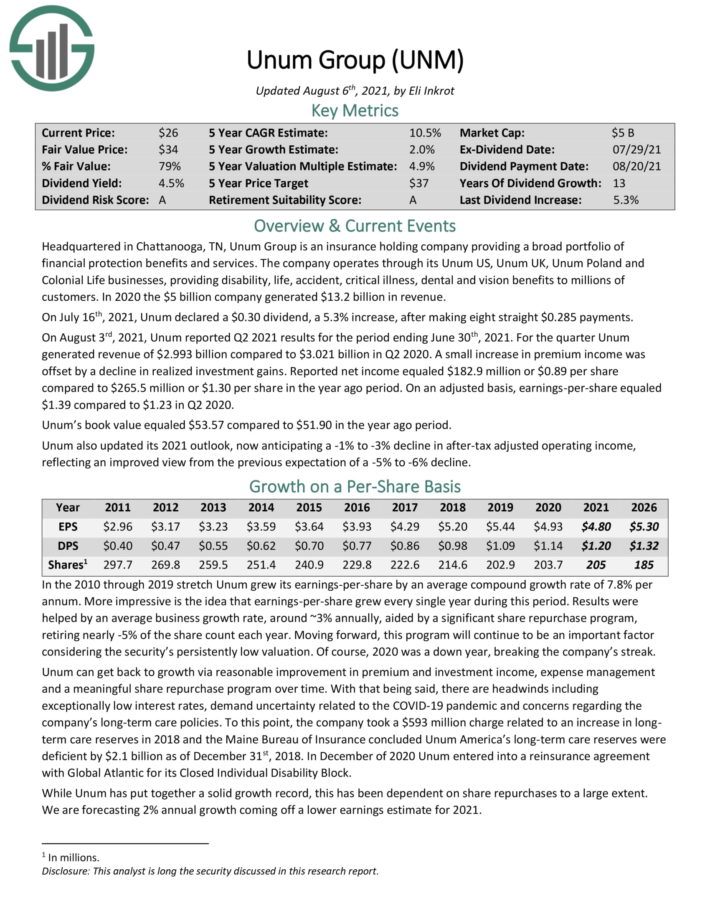

Best Insurance Stock #5: Unum Group (UNM)

- 5-year expected annual returns: 10.5%

Unum Group is an insurance holding company providing a broad portfolio of financial protection benefits and services. The company operates through its Unum US, Unum UK, Unum Poland and Colonial Life businesses, providing disability, life, accident, critical illness, dental and vision benefits to millions of customers. In 2020 the company generated $13.2 billion in revenue.

Unum is expected to generate annual returns of 10.5% per year over the next five years, comprised of 2% annual earnings-per-share growth, the 4.5% dividend yield, and a 4% annual return from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on UNM (preview of page 1 of 3 shown below):

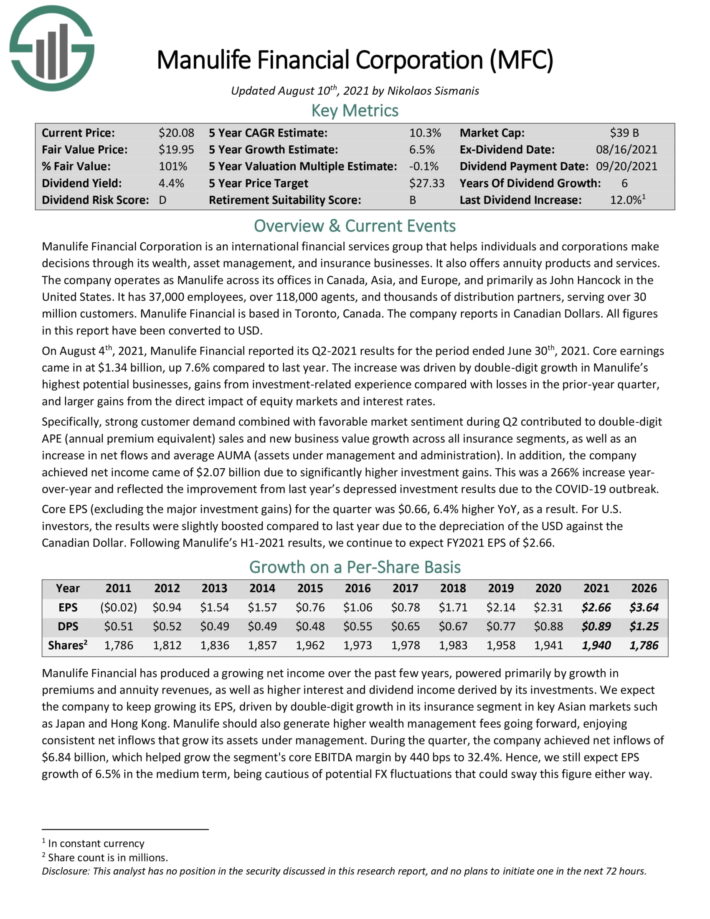

Best Insurance Stock #4: Manulife Financial Corporation (MFC)

- 5-year expected annual returns: 10.8%

Manulife Financial Corporation is an international financial services group that helps individuals and corporations make decisions through its wealth, asset management, and insurance businesses. It also offers annuity products and services.

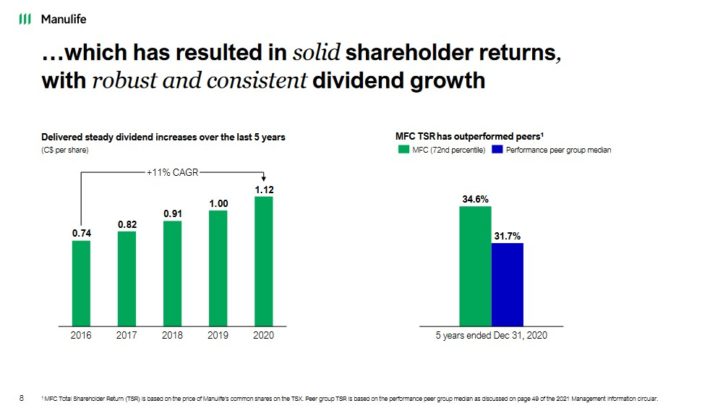

Manulife stock has rewarded investors with high dividend growth and strong total returns in the past five years.

Source: Investor Presentation

The company operates as Manulife across its offices in Canada, Asia, and Europe, and primarily as John Hancock in the United States. It has 37,000 employees, over 118,000 agents, and thousands of distribution partners, serving over 30 million customers.

We expect 10.8% annual returns for Manulife stock over the next five years, due to a combination of 6.5% annual EPS growth, the 4.5% dividend yield, and a nearly flat P/E multiple.

Click here to download our most recent Sure Analysis report on MFC (preview of page 1 of 3 shown below):

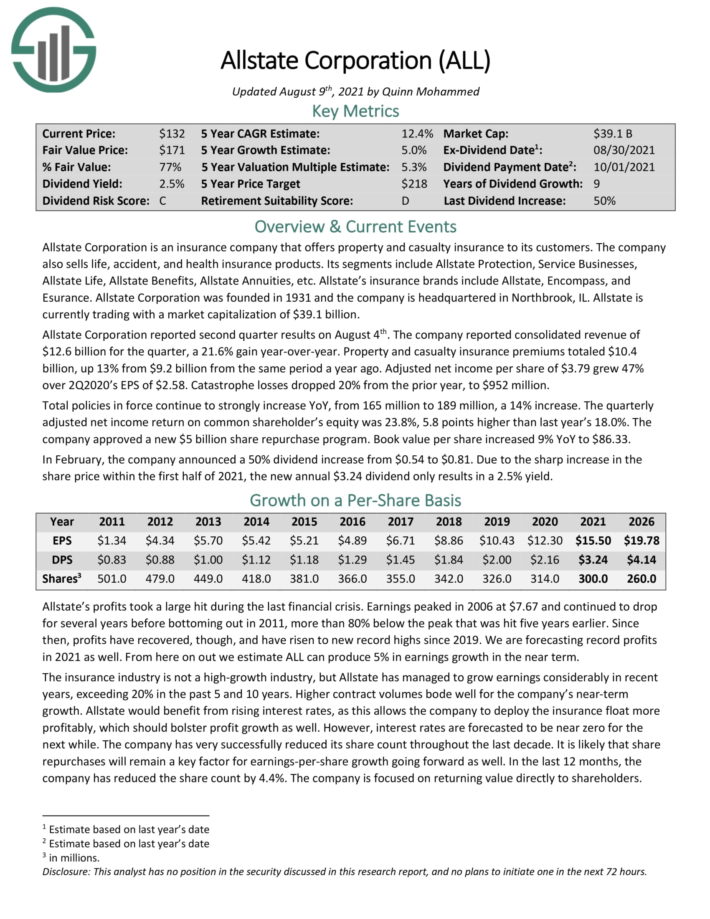

Best Insurance Stock #3: Allstate Corporation (ALL)

- 5-year expected annual returns: 13.1%

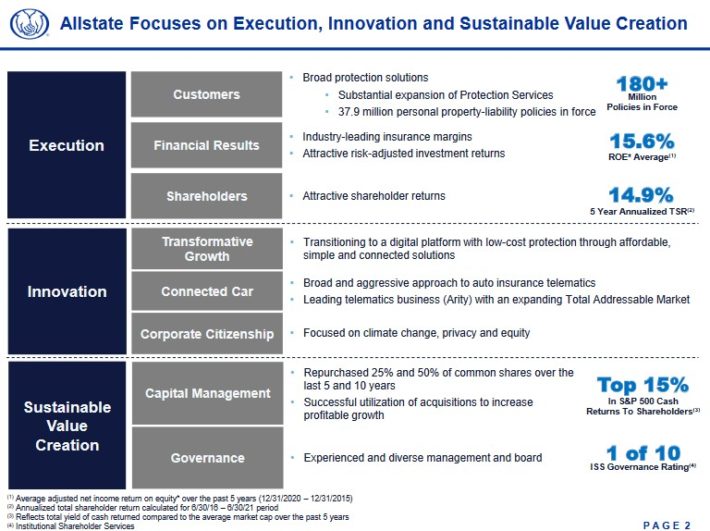

With a market cap of $32 billion, Allstate Corporation is one of the larger insurance companies in the stock market. Allstate offers property and causality insurance to its customers. In addition, the company provides life, accident and health insurance products. Allstate is composed of several brands, including Allstate, Encompass and Esurance.

Source: Investor Presentation

We expect annual returns just above 13% per year for Allstate stock, due to a combination of 5% EPS growth, the 2.5% dividend yield, and a sizable boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on ALL (preview of page 1 of 3 shown below):

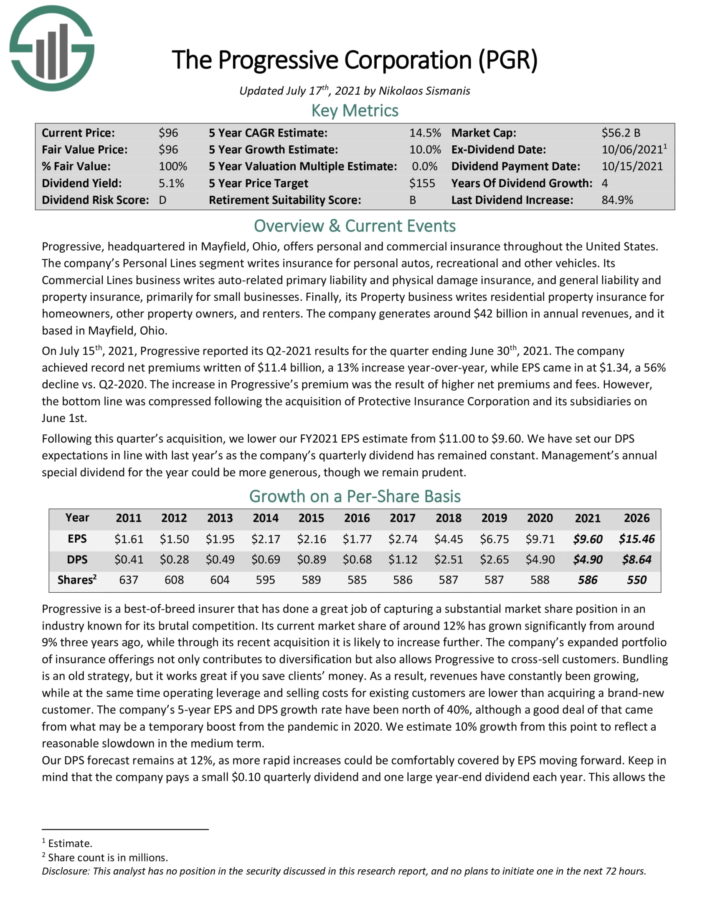

Best Insurance Stock #2: The Progressive Corporation (PGR)

- 5-year expected annual returns: 15.7%

Progressive, headquartered in Mayfield, Ohio, offers personal and commercial insurance throughout the United States. The company’s Personal Lines segment writes insurance for personal autos, recreational and other vehicles. Its Commercial Lines business writes auto–related primary liability and physical damage insurance, and general liability and property insurance, primarily for small businesses.

Finally, its Property business writes residential property insurance for homeowners, other property owners, and renters. The company generates around $42 billion in annual revenues.

We expect 10% annual EPS growth, while the stock has a 5%+ dividend yield largely as a result of a $4.50 per share annual payout earlier this year.

Click here to download our most recent Sure Analysis report on PGR (preview of page 1 of 3 shown below):

Best Insurance Stock #1: Cigna Corporation (CI)

- 5-year expected annual returns: 22.2%

Cigna is a leading provider of insurance products and services. The company’s products include dental, medical, disability and life insurance that it provides through employer–sponsored, government–sponsored and individual coverage plans.

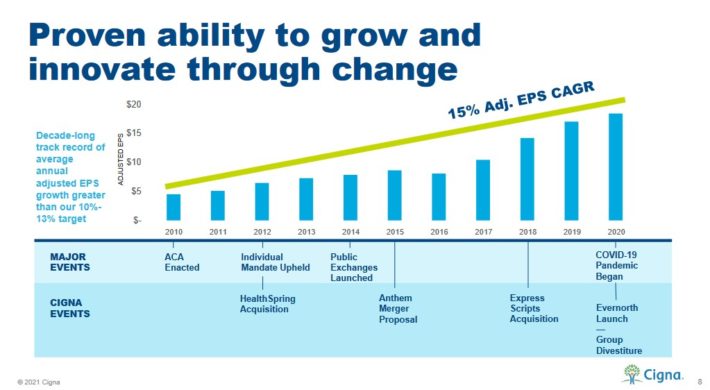

Cigna has a long history of strong growth.

Source: Investor Presentation

Cigna operates four business segments, including Evernorth, which provides pharmacy services and benefit management, U.S. Medical, which provides commercial and government health insurance, International Markets and Group Disability. Evernorth contributes 70% of annual revenues while U.S. Medical accounts for 24%. Cigna has annual revenues of $170 billion.

We expect high annual returns above 22% per year for Cigna stock, comprised of 15% annual EPS growth, the 2% dividend yield and a significant boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on CI (preview of page 1 of 3 shown below):

Final Thoughts

Insurance is often considered to be a boring industry, but investors looking for solid annual returns and dividend income should consider insurance stocks. Many insurance stocks have increased dividends for at least a decade. Some have done so for multiple decades.

Not only has nearly every company on this list exhibited a pattern of steady dividend growth for many years, all have an above-market average dividend yield as well. As a result, these stocks are appealing for income investors.

Investors looking for exposure to this industry could see the strongest returns from Cigna, our top ranked insurance stock right now.

Further Reading: Learn how Shelby Davis went from $50,000 to $900 million investing mainly in insurance stocks starting at the age of 38.