Updated on May 31st, 2019 by Nathan Parsh

Insurance companies often enjoy a high level of profitability, because they make money in two ways. First, insurance companies collect premium income on the policies they underwrite.

Second, they are able to make money by investing the large sums of accumulated premiums that have not been paid out as claims.

Due to this, insurance companies have been among the most rewarding to own over the past several decades. In fact, many of the Dividend Aristocrats and Dividend Achievers are in the insurance industry.

The Dividend Aristocrats are a select group of 57 S&P 500 stocks with 25+ years of consecutive dividend increases.

The requirements to be a Dividend Aristocrat are:

- Be in the S&P 500

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

You can download an Excel spreadsheet of all 57 (with metrics that matter) by clicking the link below:

The insurance industry has created many great fortunes. That’s because it’s slow changing and highly profitable, if the business is done well. Investing in insurance stocks is how Shelby Davis made $900 million from $50,000 starting in his late 30’s.

In recent years, the insurance industry (and other parts of the financial sector like banks) have benefited from the key growth catalyst of rising interest rates. Higher interest rates widen the spread between what insurance companies can earn on their invested capital, versus what they pay out in claims.

As the Federal Reserve appears likely to maintain short term interest rates at current levels, this catalyst may not provide insurance companies much growth in the short term.

Still, there are a number of insurers that look attractively priced today that are poised to deliver strong total annual returns over the next five years. This article will rank the top 6 insurance stocks in order of projected total annual returns through 2024.

Table Of Contents

- Aflac (AFL)

- The Travelers Companies (TRV)

- Everest Re Group (RE)

- Allstate Corporation (ALL)

- A.J. Gallagher (AJG)

- Old Republic International (ORI)

Top Insurance Company #6: Aflac Incorporated (AFL)

With 37 consecutive years of dividend growth, Aflac is a Dividend Aristocrat, which are a select group of stocks with at least 25 consecutive years of dividend increases. Shares offer a yield of 2.1% at the moment.

Aflac sells supplemental insurance products that are designed to compensate policy holders in the event that they become unable to work due to illness or injury. Approximately 75% of the company’s premium income comes from Japan. This means that company’s earnings-per-share are largely dependent on the exchange rates between the yen and the dollar.

When the yen rises against the dollar, it helps Aflac because each yen is more valuable. But when the yen weakens, it results in fewer dollars to be reported. Fortunately for Aflac, the yen has shown signs of strengthening in recent years.

Aflac reported operating revenues of $21.8 billion in 2018 compared to $21.7 billion in 2017. Earnings-per-share grew 22% for the year. A stronger yen played a positive role in each case. Currency, however, is a purely financial impact. It is more important to focus on the health of the underlying business.

Aflac’s business fundamentals are sound. The company continues to see the potential for growth in both the U.S. and Japan. The over-arching factor behind the outlooks for both countries is their aging populations.

Source: Investor Presentation

Aflac’s strategic initiates to grow the U.S. business include a two-channel distribution model. This will allow the company to continue to focus on the expansion of its core distribution procedures, as well as increased adoption of ‘one day pay’, to increase customer satisfaction.

At the same time, Aflac’s operational goals in Japan include further expansion of the company’s third-sector product sales. Third-sector products are non-traditional supplemental polices. One such product that has experienced strong growth is cancer insurance. Aflac expects low single digit gains for third-sector products in the years to come.

Aflac reported first-quarter financial results on 4/25/2019. Earnings-per-share increased 6.7% to $1.12, which was $0.06 above the average analysts’ estimate. Revenue grew 3.5% to $5.7 billion, topping expectations by $200 million. This was the highest revenue result and year-over-year growth rate since the fourth quarter of 2016. The yen/dollar exchange rate in the first quarter was 2% weaker than the average rate in the first quarter of 2018.

Aflac’s Japan operations saw a slight decrease in revenue as limited-pay products reached paid-up status. Net investment income improved 5.4% due to higher income from dollar-denominated floating rate assets. U.S. operations produced a 1.5% increase in sales. Net investment income for this segment grew 1.1%. The company had a $131 investment pool at the conclusion of the first quarter.

Aflac’s earnings-per-share have grown at a rate of 7.8% over the last decade. To help account for the swings in currency translation, we anticipate a 6% annual growth rate through 2024.

Aflac reiterated its guidance of $4.20 per share for the year. Using the current share price of $52, the stock has a price-to-earnings ratio of 12.4. The stock’s 10-year average price-to-earnings ratio is 10. If shares were to trade at this ratio by 2024 then valuation would negatively impact total returns by 4.2% per year.

Total returns would be made up of the following:

- 6% earnings-per-share growth

- 2.1% dividend yield

- 4.2% multiple reversion

We expect that shares of Aflac will offer a total annual return of just 3.9% through 2024. The dividend will represent the majority of future returns. Fortunately, Aflac is a high-quality dividend growth stock. It is a Dividend Aristocrat, and the dividend appears highly secure. The following YouTube video further illustrates our view of the company’s dividend safety.

Aflac has a long history of dividend growth and should benefit from aging populations in the U.S. and Japan. Still, the stock’s valuation, while low compared to the rest of the market, removes much of our expected total return.

As a result, investors should wait for a lower entry point before purchasing shares of Aflac.

Top Insurance Company #5: The Travelers Companies (TRV)

With a market capitalization of nearly $39 billion, Travelers is one of the largest insurance companies on this list. In 2018, the company generated a full year record of $27.7 billion in net premiums written. This was a 6% increase from the previous year.

Its policies were split into the following categories:

- Business & International Insurance (59% of premiums written)

- Personal Insurance (33% of premiums written)

- Bond & Specialty Insurance (8% of premiums written)

Travelers operates a highly profitable business and generates solid growth each year. As such, the company has been able to reward shareholders with dividend growth for many years.

Source: Investor Relations

After increasing its dividend by 6.5% for the 6/28/2019 payment, Travelers has now raised its dividend for 15 consecutive years. This makes the company a member of the Dividend Achievers, which is a group of stocks with at least 10 consecutive years of dividend growth.

And, Travelers has paid dividends to shareholders for nearly 150 years. Over the past 10 years, it has increased dividends by 9.1% compounded annually. Shares currently yield 2.3%.

Travelers has been able to accomplish such strong dividend growth rates because of its effective strategy for creating shareholder value.

Source: Earnings Presentation

The company’s long-term goal is to reach a return on equity in the mid-teens each year. Travelers has reached this goal almost every year since 2005.

Source: Earnings Presentation

One reason for this is that Travelers works to keep costs of capital low. The company has a ‘AA’ credit rating, which helps in that regard. As a result, it only raises enough capital that is necessary to support the business and future growth objectives, so long as it does not endanger its credit rating.

Any excess capital generated by the business is returned to shareholders. Travelers not only pays a dividend, but it also has spent vast sums of capital repurchasing shares. Since initiating its share repurchase program in 2006, the company has returned more than $40 billion to investors in combined dividends and repurchases.

These strategies have worked well for the company’s shareholders. Over the past 20 years, Traveler’s book value has compounded by nearly 7% annually.

The company reported first quarter financial results on 4/18/2019. Results were strong as earnings-per-share grew 15% to $2.83. This was $0.10 above the average analysts’ estimate. Revenue increased 4.9% to $6.9 billion, thought this was $88 million below expectations.

Gross written premiums improved 6% to a new record of $7.8 billion. Net written premiums grew 3% to a $7.1 billion. The company’s profitability increased as catastrophe losses were lower.

The underlying combined ratio improved 80 bps to 91.6% due to lower losses and higher margins. Traveler’s share count was lowered by 3% compared to the first quarter of 2018. The company’s book value increased 7% during the quarter.

Traveler’s is expected to earn $11.00 per share in 2019, which would be an increase of almost 19% from 2018. Over the next five years, we expect earnings-per-share to grow at a rate of 6%. This is above the company’s 10-year average growth of 3.5%. Higher revenues and lower share count will be the drivers of this growth.

Shares of Traveler’s currently trade for $148. Using our estimates for earnings-per-share for the current year, the stock has a price-to-earnings ratio of 13.5. We have a 2024 price-to-earnings ratio target of 11x earnings. If shares were to revert to this target, valuation would be a 4% headwind to total annual returns.

Total annual returns will consist of the following:

- 6% earnings-per-share growth

- 2.3% yield

- 4% multiple reversion

Added up and we expect Travelers to offer a total annual return of 4.3% through 2024.

Traveler’s size gives it scale that is largely unmatched by other insurers. The company continues to return capital to shareholders and offers a dividend yield above the market average.

That said, we expect low single digit returns over the next five years at the current price. We encourage investors to wait for a pullback before purchasing shares of Travelers or to consider another stock on our list.

Top Insurance Company #4: Everest Re Group (RE)

Everest Re Group is a holding company that provides customers with insurance and reinsurance services.

Source: Investor Overview

Nearly three quarters of the company’s business comes from reinsurance with insurance composing the rest of sales. The company trades with a market capitalization of $10.2 billion, making it one of the smaller companies on this list.

Everest Re is composed of several segments. The U.S. Reinsurance provides property and casualty reinsurance services as well as a special lines of business such as maritime, aviation and health. The company also has operations in Canada, Singapore and Bermuda. Everest Re is also one of the youngest companies on our list as it was founded in 1999.

While a relatively young company, shareholders of Everest Re have seen solid returns.

Source: Investor Overview

Between gains in book value and dividends, shareholders have seen a compound annual growth rate of 12% since inception.

Everest Re has only paid shareholders a dividend since 2002 and has just six consecutive years of dividend growth. This is the shortest dividend growth streak among the stocks on this list. Over the past five years, dividends have been compounded at a rate of 6.6% annually. Everest Re’s stock yields 2.4%.

The company reported first quarter results on 5/6/2019. Everest Re earned $6.91 per share, $1.01 above estimates and a 29% increase from the previous year. Revenue grew 10.7% to $1.9 billion, which was $30 million more than expected.

Gross written premiums were up 10% to $2.1 billion while worldwide reinsurance premiums grew 7% to $1.5 billion. Growth came from an increase in casualty and property premiums as well as new business. Direct insurance premiums were higher by 18%. Everest’s combined ratio improved 460 bp and the company repurchased $16.2 million worth of shares during the quarter.

Everest Re has guided towards $23.83 per share in earnings this year. This would be more than 5x last year’s results, which were low due to catastrophe losses. We expect earnings to grow at 5.8% annually through 2024 due to improved business performance and share repurchases.

Everest Re’s stock is currently valued at $250 per share. Using the company’s guidance for the year, the stock’s price-to-earnings ratio is 10.5. We believe that a fair valuation is 9x earnings. If this were to occur by 2024 then annual returns would be reduced by 3% annually over this time period.

Everest Re’s total annual returns are projected to be as follows:

- 5.8% earnings-per-share growth

- 2.4% dividend yield

- 3% multiple reversion

Added up, we forecast that Everest Re’s total annual return potential is 5.2%. As such, the stock receives a hold recommendation at this time.

Top Insurance Company #3: Allstate Corporation (ALL)

With a market cap of $32 billion, Allstate Corporation is one of the larger insurance companies in the stock market. Allstate offers property and causality insurance to its customers. In addition, the company provides life, accident and health insurance products. Allstate is composed of several brands, including Allstate, Encompass and Esurance.

Shares off Allstate sport a 2% dividend yield, the lowest yield on this list. Still, this is slightly above the average yield of the S&P 500.

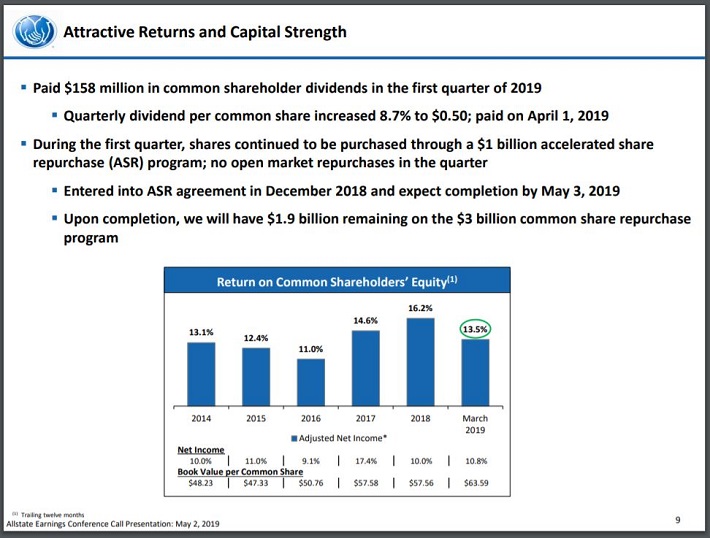

Despite the low yield, Allstate has made it a goal to provide sizable returns on shareholders’ equity.

Source: Earnings Presentation

Return on equity has shown strong improvement over the last two years. While the most recent quarter saw a slight dip, the return is still above what Allstate produced prior to 2017. Book value has improved by 3.6% annually from 2014 to 2018. Book value in the first quarter, however, grew 8.5% year-over-year and 10.5% from the fourth quarter of 2018.

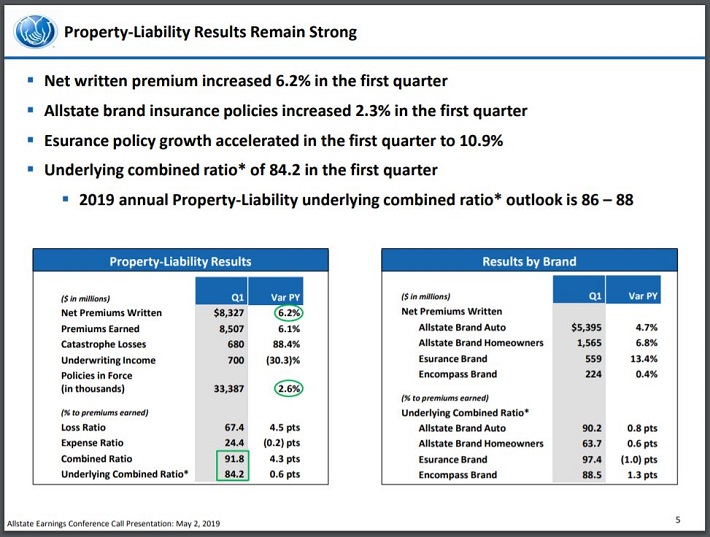

Allstate reported first quarter results on 5/1/2019.

Source: Earnings Presentation

The company earned $2.30 per share in the quarter, missing estimate by $0.02 and declining more than 22% from the previous year. Consolidated revenues grew 12.5% to $11 billion.

The primary reason for a steep drop in profits was due to a nearly 90% increase in catastrophe losses.

Overall, most of Allstate’s businesses performed well. Property and casualty insurance premiums grew almost 7% to $8.7 billion. Allstate brand auto had a 4.7% increase in net written premiums due to more policies in place at a higher average premium. Allstate brand homeowners net written premiums were higher by 6.8%. Services business had a 25% increase in revenues. The combined ratio grew 4.3% year-over-year due to higher catastrophe losses.

Allstate is slated to earn $9.14 per share this year, would be an improvement of almost 14% from the prior year. Earnings-per-share have more than doubled over the past decade. We conservatively estimate that the company can grow earnings at a rate of 4% going forward.

The stock currently trades at $96 a share. Using estimated earnings-per-share for the year, the stock’s price-to-earnings ratio is 10.5. This is slightly below our targeted valuation of 10.9x earnings. Multiple expansion could add 0.4% to annual returns over the next half decade.

Total returns for shares of Allstate would be as follows:

- 4% earnings-per-share growth

- 2% dividend yield

- 0.4% multiple expansion

Allstate’s stock could offer a total annual return of 6.4% going forward. The stock offers the lowest dividend yield on this list and one of the lower growth rates. Shares do offer the potential for a slight tailwind from valuation. We consider the stock to be a hold and would wait for a pullback before purchasing.

If an investor is interested in owning an insurance stock today, we suggest they consider one of the following companies as they all receive buy recommendations from Sure Dividend at this time.

Top Insurance Company #2: A.J. Gallagher (AJG)

A.J. Gallagher has been in business since 1927. It is a commercial insurance broker with an emphasis on risk management. A.J. Gallagher has operations in 33 countries, providing customers with insurance and risk management programs. The stock has a market capitalization of $15.6 billion.

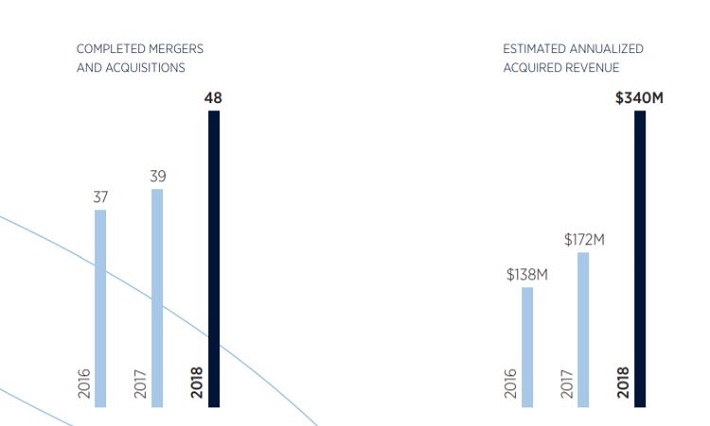

The company has grown over the years through acquisitions.

Source: Annual Report

A.J. Gallagher has added more than 500 businesses since 2002, with 48 acquisitions in 2018 alone. Many of these acquisitions have provided the company a place in new niche areas or regions.

These acquisitions have also added to the company’s financial performance. Acquisitions in 2018 alone added $340 million in revenues. This is a significant amount when you consider that A.J. Gallagher generates approximately $5.7 billion in annual revenues.

These improvements in business operations has allowed A.J. Gallagher to raise its dividend every year since 2011. Over the last five years, the dividend has compounded at a rate of 2.6% annually. At the same time, the stock currently yields 2.1%. The stock traded with a 3%+ yield as recently as 2016 and with a 5%+ yield during the last recession. Still, we don’t anticipate the yield or dividend growth to be at a high rate in the near term.

That doesn’t mean the stock isn’t worth owning. A.J. Gallagher’s business has performed quite well recently. Adjusted earnings-per-share increased 8% to $1.63 in the first quarter. This was $0.02 above estimates. Revenue improved 8.6% to $2 billion, which was slightly below expectations.

The brokerage business produced a 13% revenue gain due to 5.7% organic growth as well as contributions from acquisitions. The risk management division provided 6% revenue growth, with 4.1% organic growth and the remainder coming from acquisitions.

We expect A.J. Gallagher to earn $3.90 per share in 2019, which would be a 15% increase from the prior year. The company has compounded earnings-per-share at a 10% rate over the past decade. We forecast earnings to grow by 9% annually through 2024 due to increases in organic revenue growth and acquisitions.

Shares of A.J. Gallagher trade hands for approximately $84. Based off of expected earnings-per-share, the stock has a price-to-earnings ratio of 21.5. This is the highest valuation of the stocks on this list, but not very far above our targeted valuation of 20x earnings. If the stock were to trade at our targeted multiple by 2024 then valuation would reduce annual returns by 1.4% through 2024.

Total returns would be as follows:

- 9% earnings-per-share growth

- 2.1% dividend yield

- 1.4% multiple reversion

A.J. Gallagher is expected to return 9.7% per year for the next five years. While the stock may not yield as much as it did 10 years ago, the yield is still slightly above that of the market. Even better, the company has our highest projected earnings growth over the next five years.

We feel that A.J. Gallagher has a solid combination of earnings growth potential and dividend yield. We rate the stock as a buy currently.

Top Insurance Company #1: Old Republic International (ORI)

Old Republic has the longest dividend growth streak on this list. It has raised its shareholder payout for the past 38 years. The company has paid uninterrupted dividends to shareholders for 78 years. Shares currently yield 3.6%, the highest yield on this list.

Old Republic was founded in 1923 and today trades with a market capitalization of $6.7 billion. This makes the company the smallest insurer on this list. Old Republic markets, underwrites and provides risk management services for a variety of general and title insurances.

The company has a diversified customer base, made up of many different industry groups. Over the years, Old Republic has reduced its exposure to housing, financial and energy industries while increasing its exposure to transportation and general industry

This has helped the company to improve its business over time. Old Republic reported financial results for the first quarter on 4/25/2019. The company earned $0.40 per share, $0.02 above the average estimate. Earnings were flat year-over-year. Revenue grew 2.3% to $1.5 billion, $22 million above estimates.

Net premiums and fees earned grew 2.1% while net investment income grew 5.9%. General insurance grew 5.1%, which was partially offset by a declines of 1.4% in title insurance and 12.3% in corporate. Book value per share grew 13% from the first quarter of 2018.

Shares of Old Republic are estimated to earn $1.90 per share this year, representing 2.2% growth from a year ago. The company has only recently posted a profit since 2013. Since then, earnings have growth at a rate of 7% annually. We expect this growth rate to continue over the next five years.

Old Republic’s stock trades for nearly $23 at the moment. Using expected earnings-per-share for 2019, the price-to-earnings ratio is 12.1. We have a targeted price-to-earnings ratio of 12.5, which is slightly below the six-year average ratio of 14. This helps to account for the lack of profitability of the early years of the last 10-year period. If this target comes to fruition, valuation would add 0.7% to annual returns through 2024.

Total returns would be as follows:

- 7% earnings-per-share growth

- 3.6% dividend yield

- 0.7% multiple expansion

Old Republic is expected to return 11.3% per year through 2024. While the company’s history is slightly uneven compared to the other stocks on this list, shares of Old Republic offer substantially higher yield. There is also a chance to slight multiple expansion over the next five years. For the investor with a slightly higher risk tolerance, Old Republic could prove to be a good purchase at current levels.

Final Thoughts

Insurance is often considered to be boring, but investors looking for solid annual returns and dividend income should consider stocks in this industry. Many of the stocks on this list have increased dividends for at least a decade. Some have done so for multiple decades.

Not only has nearly every company exhibited a pattern of steady dividend growth for many years, all have an above market average dividend yield as well. As a result, these stocks are appealing for income investors.

Investors looking for exposure to this industry could see the strongest returns from A.J. Gallagher or Old Republic, the two stocks currently receiving buy recommendations from Sure Dividend.