Published on April 27th, 2022 by Bob Ciura

Stock prices come in all sizes. A few trade above $1,000 per share, such as Amazon.com (AMZN) and Alphabet (GOOG). Meanwhile, Warren Buffett’s Berkshire Hathaway (BRK.A) currently trades above $500,000 per share.

Most companies do not have such high share prices. When a share price gets very high, many companies will split their stock to lower the share price. In the eyes of some, this makes the stock more approachable for investors who may not have thousands of dollars to invest at a time.

In the same vein, investors can screen for stocks with low share prices. Although, a low share price is not by itself a measure of an investment-worthy company.

In general, we recommend investors who are looking for high-quality dividend growth stocks start with the Dividend Aristocrats. Dividend Aristocrats are elite companies that satisfy the following:

- Are in the S&P 500 Index

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

You can download an Excel spreadsheet with the full list of all 66 Dividend Aristocrats (with additional financial metrics such as price-to-earnings ratios and dividend yields) by clicking the link below:

But for investors who may not have a great deal of capital to deploy in such a high-priced stock as Amazon or Alphabet, there are some stocks that can be bought for under $5 per share.

This article will discuss our top 6 dividend stocks under $5 with Dividend Risk Scores of ‘D’ or better, and positive expected returns, ranked by expected returns according to the Sure Analysis Research Database.

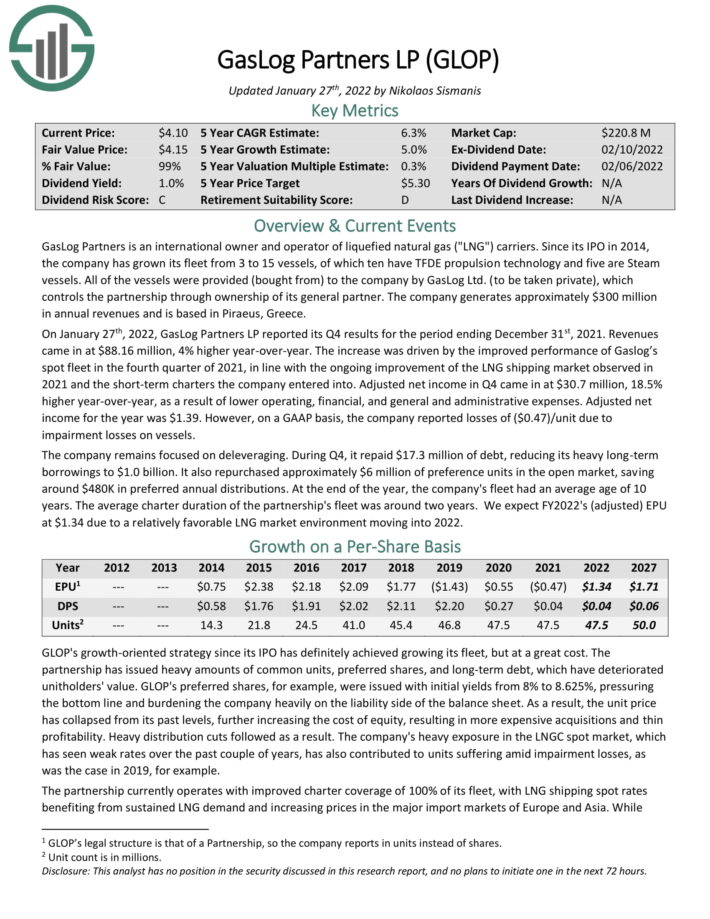

#6 Top Stock Under $5: Gaslog Partners LP (GLOP)

- 5-year expected annual returns: 4.7%

GasLog Partners is an international owner and operator of liquefied natural gas (“LNG”) carriers. Since its IPO in 2014, the company has grown its fleet from 3 to 15 vessels, of which ten have TFDE propulsion technology and five are Steam vessels. All of the vessels were provided (bought from) to the company by GasLog Ltd. (to be taken private), which controls the partnership through ownership of its general partner. The company generates approximately $300 million in annual revenues and is based in Piraeus, Greece.

On January 27th, 2022, GasLog Partners LP reported its Q4 results for the period ending December 31st, 2021. Revenues came in at $88.16 million, 4% higher year-over-year. The increase was driven by the improved performance of Gaslog’s spot fleet in the fourth quarter of 2021, in line with the ongoing improvement of the LNG shipping market observed in 2021 and the short-term charters the company entered into.

Source: Investor Presentation

Adjusted net income in Q4 came in at $30.7 million, 18.5% higher year-over-year, as a result of lower operating, financial, and general and administrative expenses. Adjusted net income for the year was $1.39. However, on a GAAP basis, the company reported losses of ($0.47)/unit due to impairment losses on vessels.

The company remains focused on deleveraging. During Q4, it repaid $17.3 million of debt, reducing its heavy long-term borrowings to $1.0 billion. It also repurchased approximately $6 million of preference units in the open market, saving around $480K in preferred annual distributions.

At the end of the year, the company’s fleet had an average age of 10 years. The average charter duration of the partnership’s fleet was around two years. We expect FY2022’s (adjusted) EPU at $1.34 due to a relatively favorable LNG market environment moving into 2022.

Click here to download our most recent Sure Analysis report on GLOP (preview of page 1 of 3 shown below):

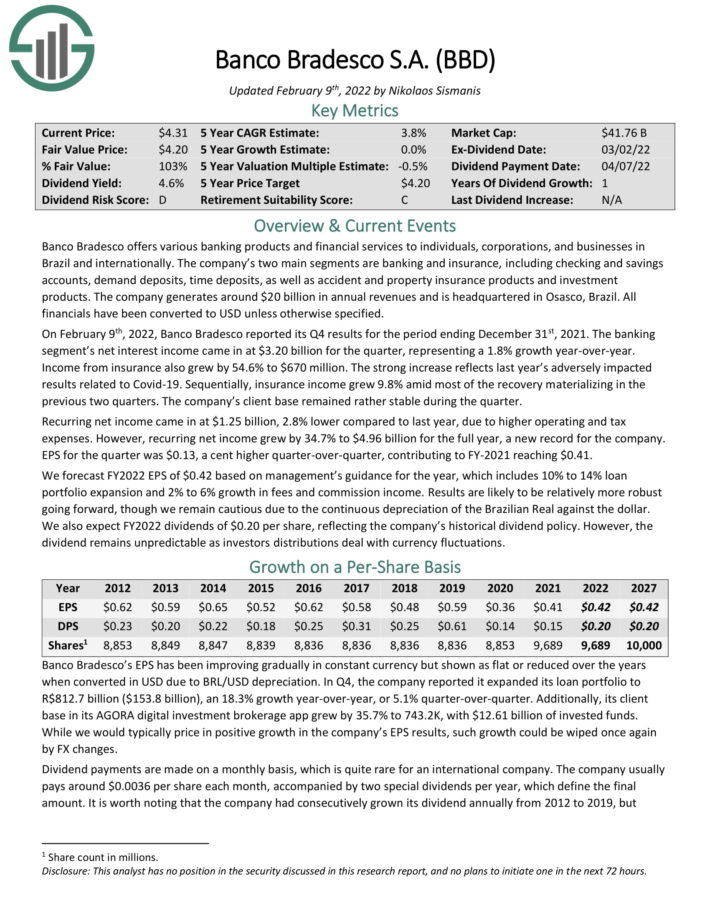

#5 Top Stock Under $5: Banco Bradesco S.A. (BBD)

- 5-year expected annual returns: 7.5%

Banco Bradesco offers various banking products and financial services to individuals, corporations, and businesses in Brazil and internationally. The company’s two main segments are banking and insurance, including checking and savings accounts, demand deposits, time deposits, as well as accident and property insurance products and investment products. The company generates around $20 billion in annual revenues and is headquartered in Osasco, Brazil.

On February 9th, 2022, Banco Bradesco reported its Q4 results for the period ending December 31st, 2021. The banking segment’s net interest income came in at $3.20 billion for the quarter, representing a 1.8% growth year-over-year. Income from insurance also grew by 54.6% to $670 million. The strong increase reflects last year’s adversely impacted results related to Covid-19. Sequentially, insurance income grew 9.8% amid most of the recovery materializing in the previous two quarters.

Source: Investor Presentation

The company’s client base remained rather stable during the quarter. Recurring net income came in at $1.25 billion, 2.8% lower compared to last year, due to higher operating and tax expenses. However, recurring net income grew by 34.7% to $4.96 billion for the full year, a new record for the company. EPS for the quarter was $0.13, a cent higher quarter-over-quarter, contributing to FY-2021 reaching $0.41.

We forecast FY2022 EPS of $0.42 based on management’s guidance for the year, which includes 10% to 14% loan portfolio expansion and 2% to 6% growth in fees and commission income. Results are likely to be relatively more robust going forward, though we remain cautious due to the continuous depreciation of the Brazilian Real against the dollar. We also expect FY2022 dividends of $0.20 per share, reflecting the company’s historical dividend policy.

Click here to download our most recent Sure Analysis report on BBD (preview of page 1 of 3 shown below):

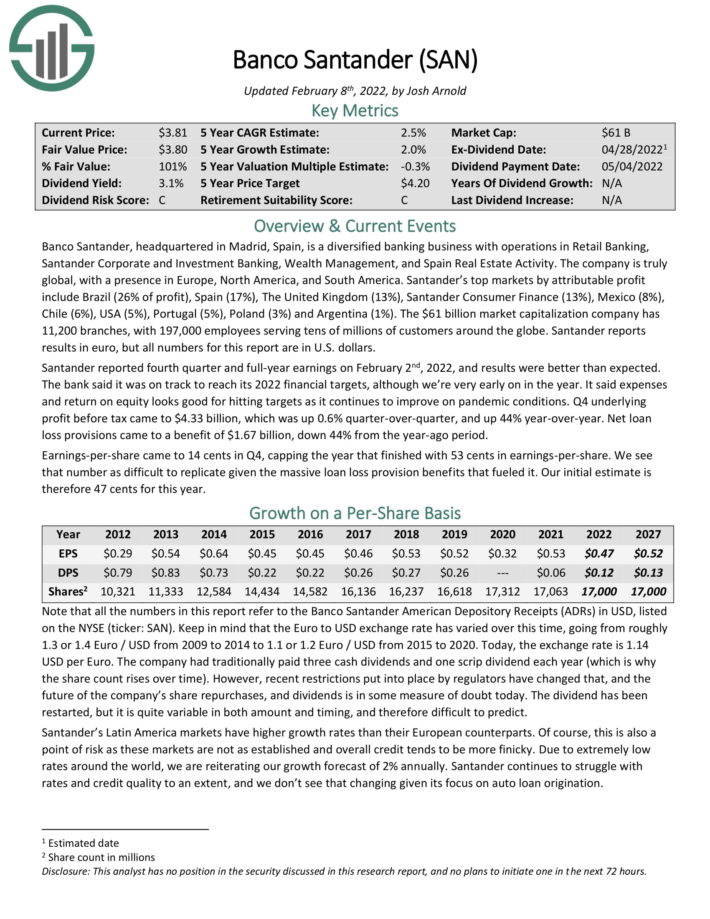

#4 Top Stock Under $5: Banco Santander S.A. (SAN)

- 5-year expected annual returns: 9.7%

Banco Santander, headquartered in Madrid, Spain, is a diversified banking business with operations in Retail Banking, Santander Corporate and Investment Banking, Wealth Management, and Spain Real Estate Activity.

The company is global, with a presence in Europe, North America, and South America. Santander’s top markets by attributable profit include Brazil (26% of profit), Spain (17%), The United Kingdom (13%), Santander Consumer Finance (13%), Mexico (8%), Chile (6%), USA (5%), Portugal (5%), Poland (3%) and Argentina (1%).

The company has 11,200 branches, with 197,000 employees serving tens of millions of customers around the globe. Santander reports results in euro, but all numbers for this report are in U.S. dollars. Santander reported fourth quarter and full-year earnings on February 2nd, 2022, and results were better than expected.

Q4 underlying profit before tax came to $4.33 billion, which was up 0.6% quarter-over-quarter, and up 44% year-over-year. Net loan loss provisions came to a benefit of $1.67 billion, down 44% from the year-ago period. Earnings-per-share came to 14 cents in Q4, capping the year that finished with 53 cents in earnings-per-share.

Click here to download our most recent Sure Analysis report on SAN (preview of page 1 of 3 shown below):

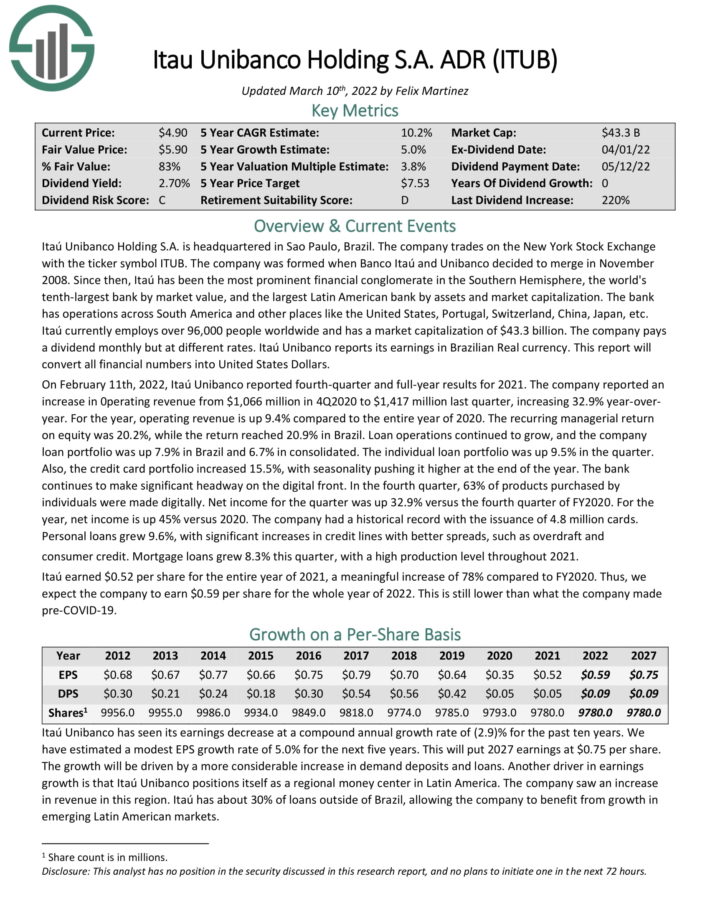

#3 Top Stock Under $5: Itau Unibanco (ITUB)

- 5-year expected annual returns: 10.2%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. Since then, Itaú has been the most prominent financial conglomerate in the Southern Hemisphere, the world’s tenth-largest bank by market value, and the largest Latin American bank by assets and market capitalization. The bank has operations across South America and other places like the United States, Portugal, Switzerland, China, Japan, and more.

Itaú currently employs over 96,000 people worldwide and has a market capitalization of $43.3 billion. The company pays a dividend monthly but at different rates. Itaú Unibanco reports its earnings in Brazilian Real currency. This report will convert all financial numbers into United States Dollars.

We see the path to any growth ahead for Itaú Unibanco as difficult and expect 1.5% annual EPS growth over the next five years. Under normal conditions, we still expect the bank to struggle to grow.

Source: Investor Presentation

On February 11th, 2022, Itaú Unibanco reported fourth-quarter and full-year results for 2021. The company reported an increase in 0perating revenue from $1,066 million in 4Q2020 to $1,417 million last quarter, increasing 32.9% year-over-year. For the year, operating revenue is up 9.4% compared to the entire year of 2020. The recurring managerial return on equity was 20.2%, while the return reached 20.9% in Brazil.

Loan operations continued to grow, and the company loan portfolio was up 7.9% in Brazil and 6.7% in consolidated. The individual loan portfolio was up 9.5% in the quarter. Also, the credit card portfolio increased 15.5%, with seasonality pushing it higher at the end of the year. The bank continues to make significant headway on the digital front. In the fourth quarter, 63% of products purchased by individuals were made digitally. Net income for the quarter was up 32.9% versus the fourth quarter of FY2020.

For the year, net income is up 45% versus 2020. The company had a historical record with the issuance of 4.8 million cards. Personal loans grew 9.6%, with significant increases in credit lines with better spreads, such as overdraft and consumer credit. Mortgage loans grew 8.3% this quarter, with a high production level throughout 2021.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

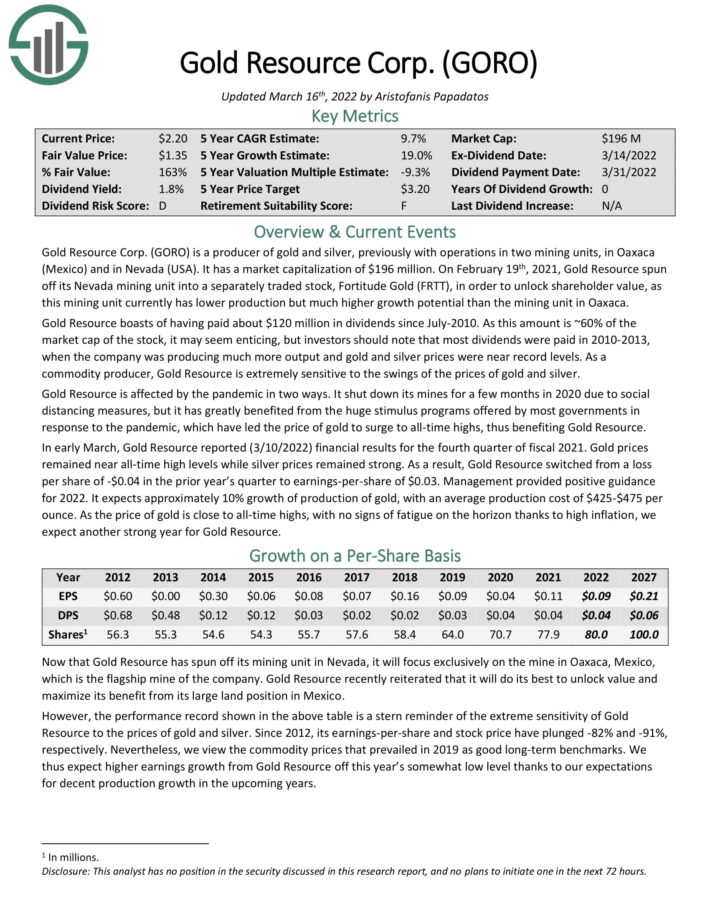

#2 Top Stock Under $5: Gold Resource Corporation (GORO)

- 5-year expected annual returns: 13.8%

Gold Resource Corporation is a producer of gold and silver, previously with operations in two mining units, in Oaxaca (Mexico) and in Nevada (USA). It has a market capitalization of $196 million. On February 19th, 2021, Gold Resource spun off its Nevada mining unit into a separately traded stock, Fortitude Gold (FRTT), in order to unlock shareholder value, as this mining unit currently has lower production but much higher growth potential than the mining unit in Oaxaca.

Source: Investor Presentation

Gold Resource boasts of having paid about $120 million in dividends since July-2010. As this amount is ~60% of the market cap of the stock, it may seem enticing, but investors should note that most dividends were paid in 2010-2013, when the company was producing much more output and gold and silver prices were near record levels.

As a commodity producer, Gold Resource is extremely sensitive to the swings of the prices of gold and silver. Gold Resource is affected by the pandemic in two ways. It shut down its mines for a few months in 2020 due to social distancing measures, but it has greatly benefited from the huge stimulus programs offered by most governments in response to the pandemic, which have led the price of gold to surge to all-time highs, thus benefiting Gold Resource.

In early March, Gold Resource reported (3/10/2022) financial results for the fourth quarter of fiscal 2021. Gold prices remained near all-time high levels while silver prices remained strong. As a result, Gold Resource switched from a loss per share of -$0.04 in the prior year’s quarter to earnings-per-share of $0.03.

Management provided positive guidance for 2022. It expects approximately 10% growth of production of gold, with an average production cost of $425-$475 per ounce. As the price of gold is close to all-time highs, with no signs of fatigue on the horizon thanks to high inflation, we expect another strong year for Gold Resource.

Click here to download our most recent Sure Analysis report on GORO (preview of page 1 of 3 shown below):

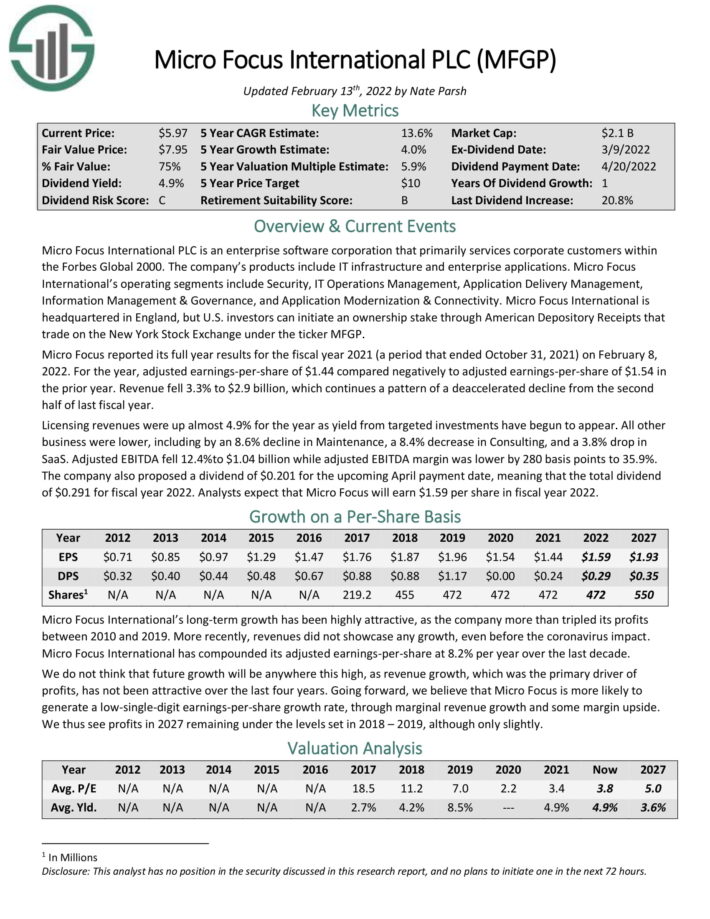

#1 Top Stock Under $5: Micro Focus International plc (MFGP)

- 5-year expected annual returns: 19.1%

Micro Focus International PLC is an enterprise software corporation that primarily services corporate customers within the Forbes Global 2000. The company’s products include IT infrastructure and enterprise applications. Micro Focus International’s operating segments include Security, IT Operations Management, Application Delivery Management, Information Management & Governance, and Application Modernization & Connectivity. Micro Focus International is headquartered in England.

Micro Focus reported its full year results for the fiscal year 2021 (a period that ended October 31, 2021) on February 8, 2022. For the year, adjusted earnings-per-share of $1.44 compared negatively to adjusted earnings-per-share of $1.54 in the prior year.

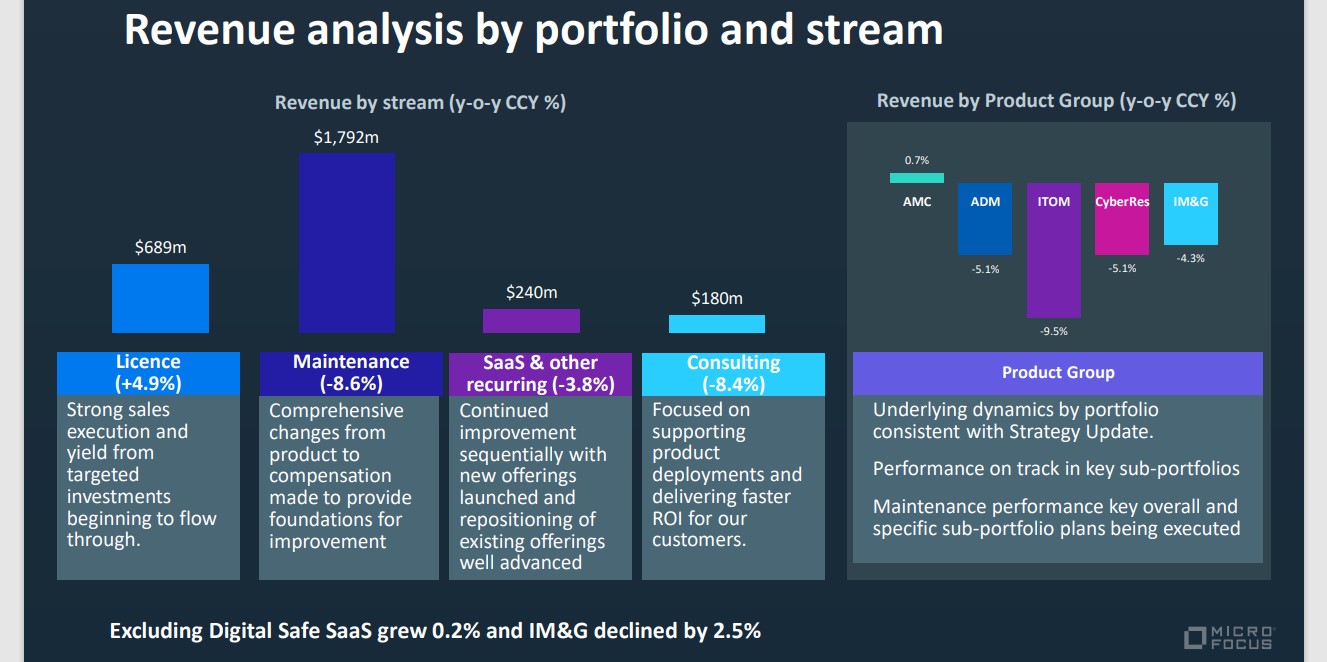

Source: Investor Presentation

Revenue fell 3.3% to $2.9 billion, which continues a pattern of a deaccelerated decline from the second half of last fiscal year. Licensing revenues were up almost 4.9% for the year as yield from targeted investments have begun to appear. All other business were lower, including by an 8.6% decline in Maintenance, a 8.4% decrease in Consulting, and a 3.8% drop in SaaS.

Adjusted EBITDA fell 12.4%to $1.04 billion while adjusted EBITDA margin was lower by 280 basis points to 35.9%.

The company also proposed a dividend of $0.201 for the upcoming April payment date, meaning that the total dividend is $0.291 for fiscal year 2022. Analysts expect that Micro Focus will earn $1.59 per share in fiscal year 2022.

Click here to download our most recent Sure Analysis report on MFGP (preview of page 1 of 3 shown below):

Final Thoughts

High-priced stocks may be unappealing for investors who may not have enough capital. There are many stocks with significantly lower share prices. Of course, a low share price alone does not make a stock a buy. Investors should always conduct their due diligence before buying individual stocks.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 38 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.