Updated on March 20th, 2020 by Nate Parsh

Up until recently, the restaurant industry was on its way back to growth. The steady U.S. economic growth had fueled rising traffic and sales across the restaurant space over the past few years. The industry remained highly competitive, with casual restaurants facing particularly fierce competition from newer, fresher concepts. But overall, the restaurant industry was in strong shape heading into 2020.

More harmful than competition, however, has been the spread of COVID-19, better known as the coronavirus. In an attempt to slow the spread of the virus as to not overwhelm the U.S. healthcare system, many states have restricted the number of people that can gather at a location. Included in this has been dining in at restaurants. Most locations still offer carryout or delivery options.

This has caused unprecedented carnage in the restaurant industry. Most publicly-traded restaurant stocks have been brutally punished in the past few weeks. But for bargain hunters, this could be a long-term buying opportunity, as many restaurant stocks have extremely low valuations.

With this in mind, we have created a list of approximately 100 publicly-traded restaurant stocks, many of which could generate phenomenal returns to shareholders when conditions return to normal.

You can download a free Excel spreadsheet of our list of ~100 restaurant stocks (with metrics that matter like dividend yields and payout ratios) by clicking the link below:

Markets have experienced a drastic decline over the past few weeks as economic activity has come to a halt in many areas of the country. Still, investors with a long-term horizon could do well picking up shares of beaten up companies. Listed below are our seven favorite restaurant stocks today.

Table of Contents

We have ranked our top seven picks in the restaurant industry, according to annual expected returns over the next five years. Stocks are ranked in order of expected returns, from lowest to highest. You can use the following links to instantly jump to any specific stock:

- Darden Restaurants (DRI)

- McDonald’s Corporation (MCD)

- Domino’s Pizza (DPZ)

- Wendy’s Company (WEN)

- Cracker Barrel Old Country Store (CBRL)

- Jack in the Box (JACK)

- Dine Brands Global (DIN)

Restaurant Stock #7: Darden Restaurants (DRI)

Darden Restaurants Inc. is a restaurant company with a portfolio of brands including Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Yard House, The Capital Grille, Seasons 52, Bahama Breeze, and Eddie V’s. The company ended its fiscal year with over 1,700 restaurants in the United States and Canada, the vast majority of which are company-owned.

On March 19th the company reported financial results for its fiscal third quarter.

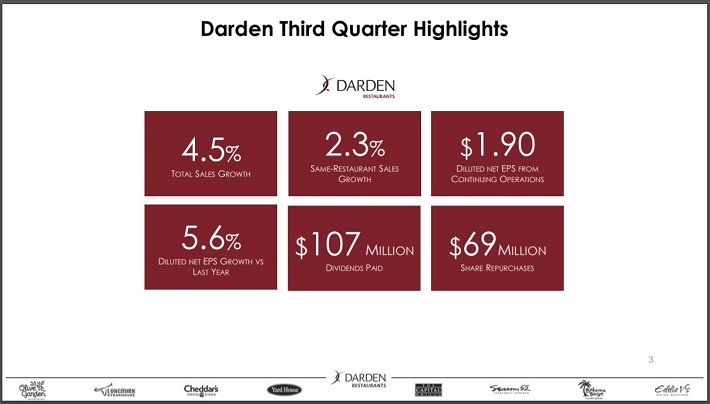

Source: Darden Restaurnats’ Third Quarter Earnings Presentation, slide 3

For the third quarter, total sales increased 4.4% to $2.35 billion driven by the addition of 40 net new restaurants. Same-restaurant sales, which measures sales at locations open at least one year, increased 2.3%. Adjusted EPS from continuing operations increased 5.6%, due to sales growth and share repurchases.

The best-performing brands for Darden in the third quarter were Olive Garden, LongHorn Steakhouse, , Eddie V’s and The Capital Grille which each grew same-restaurant sales by 2.1% to 4.2%. The company’s remaining brands all posted increases for fiscal the quarter.

Due to concerns regarding the impact of restaurant closures to slow the spread of the coronavirus, Darden has pulled its guidance for the fiscal year and suspended its dividend. We maintain our expected EPS growth rate of 7.8% over the next five years due to the strength in its core segments. However, due to the suspension of the company’s dividend, we do not recommend the stock for income investors.

Restaurant Stock #6: McDonald’s Corporation (MCD)

McDonald’s is arguably the most highly-regarded restaurant stock, because of its tremendous dividend history. McDonald’s has raised its dividend for 43 consecutive years since paying its first dividend in 1976. This places it on the Dividend Aristocrats list, a group of stocks with 25+ consecutive years of dividend increases.

McDonald’s is the world’s leading global foodservice company with more than 38,000 restaurants in more than 100 countries. Approximately 93% of restaurants worldwide and are owned and operated by independent franchisees.

The company has three main business segments: the U.S. market, where the company has more than 14,000 stores, International Operated Markets, which includes developed markets France, the U.K, Canada and Australia, International Developed Licensee, which includes high-growth markets such as China, Italy and Russia. McDonald’s has a current market capitalization of $111 billion.

On 1/29/2020, McDonald’s reported fourth quarter and full year results.

Source: Investor Relations

Revenue grew 3.6% to $5.35 billion for the quarter while EPS was flat year-over-year. Global comparable sales were up 5.9% versus 5.3% consensus estimates. U.S. sales increased 5.1%, the International segment grew 6.2% and the International Development Licensed segment was up 6.6%.

For the year, revenues were flat while earnings-per-share improved 4.5%. Global same-store sales were higher by 5.9%, with 5% growth in the U.S., a 6.1% incrase for International Operated segment and a 7.2% improvement for the International Development Licensed segment.

McDonald’s has invested heavily its Experience of the Future concept in recent years. This has involved remodeling of stores on a massive scale. 500 stores were remodeled in the fourth quarter for a total of 2,000 for 2019. Nearly 10,000 of the company’s U.S. stores have been updated by the end of 2019.

McDonald’s added DoorDash and GrubHub (GRUB) as delivery partners in the fourth quarter to go along with its existing relationship with Uber (UBER). Nearly 25,000 McDonald’s around the world, about two-thirds of worldwide restaurants, now offer delivery. This endeavor has paid off as delivery sales have quadrupled to $4 billion in just three years.

McDonald’s has guided towards earnings-per-share of $8.25 for 2020. Shares trade with a price-to-earnings ratio of 18.1 today, slightly above our 2025 P/E target of 18. Reverting to our target would reduce annual returns by 0.1% over the next five years.

Add in an expected EPS growth rate of 6% through 2025 and a current dividend yield of 3.3%, we forecast that McDonald’s can offer an annual return of 9.3% over the next five years.

Given the company’s global reach, popularity, value menu and strength in digital and delivery, we believe McDonald’s might be one of the more resilient restaurant companies in the current environment. While the stock technically trades just below our typical threshold for a buy rating (10% annual returns), few stocks offer the same reliable dividend growth history of McDonald’s.

Restaurant Stock #5: Domino’s Pizza (DPZ)

Domino’s Pizza is the largest pizza company in the world based on global retail sales. The company operates more than 17,000 stores in over 90 countries. It currently generates 49% of its sales in the U.S. while 98% of its stores worldwide are owned by independent franchisees.

On February 20th, 2020, Domino’s reported financial results for the fourth quarter of fiscal 2019. The company continued its impressive trajectory of sales growth in the fourth quarter, generating global retail sales growth of 7.6%, U.S. same store sales growth of 3.4%, and international same stores sales growth of 1.7%. The company grew its store count by 492 in the quarter, net of store closures. Earnings-per-share grew 19.1% year-over-year, due to revenue growth and a 2.7% reduction in its share count.

For 2019, global retail sales improved 8%, U.S. comparable were higher by 3.2% and the company had global net store growth of 1,106.

Domino’s has made significant growth investments over the past several years, which have paid off as the company maintains an excellent long-term track record. Last quarter marked the 104th consecutive quarter of positive international same store sales growth and the 35th consecutive quarter of positive U.S. same store sales growth.

Source: Investor Presentation, slide 20

We expect 12% annual EPS growth over the next five years, made up of 9% sales growth, 2% growth from buybacks, and 1.0% annual margin expansion.

Domino’s has ample room to keep growing moving forward. Its management sees potential for the addition of 5,400 new stores in its top 15 markets. Management expects to grow sales by 8%-12% per year for the next five years.

Domino’s has traded at an average price-to-earnings ratio of 24.6 over the last decade. Using our 2020 EPS estimate of $11.50, the stock is trading at a P/E ratio of 28.1 today. The stock is richly valued at current prices, relative to Domino’s historical average. If Domino’s P/E ratio reverts to its 10-year average of 24.6 over the next five years, this will reduce its total returns by 2.6% per year during this time period.

Annual EPS growth (12%) and dividends (1.0%) can offset the impact of overvaluation. With projected returns of 10.4%, Domino’s is just over our usual 10% threshold to earn a buy recommendation, but with the economies of the world in a slow down due to the coronavirus, we recommend waiting for a pullback before purchasing. Shares receive a hold recommendation at this time.

Restaurant Stock #4: Wendy’s Company (WEN)

Wendy’s is the third-largest hamburger quick-service restaurant chain in the world, with more than 6,700 restaurant locations globally and a market capitalization of $2.4 billion. More than 90% of the company’s locations are in the United States.

On February 26th, 2020, Wendy’s reported their fourth-quarter results.

Source: Wendy’s Fourth Quarter Earnings Presentation, slide 7

The company grew its global sales by 5.9% for the quarter and 4.4% for the year. Net restaurant openings were 45 in the quarter. North America same-restaurant sales growth, came in at 4.3% for the quarter and 2.8% for 2019. International sales increased nearly 10% for both the quarter and year.

Adjusted earnings-per-share of $0.08 dropped 50% due to increased franchising, digital investment and general expenses. For the year, adjusted earnings-per-share were flat at $0.59, due primarily to share repurchases. Revenue grew 4.1% to $10.9 billion for the year.

For 2020, Wendy’s expects revenue to grow at least 10%. Adjusted earnings-per-share is expected to range from $0.60 to $0.62 for the year, which represents growth of 3.4% at the midpoint. Net store openings has not yet been released. Future growth will be generated by new services, such as mobile order and delivery, and new offering, such as breakfast.

Just 2.5% of U.S. sales came from digital ordering in 2019, which was double that of fourth quarter 2018 results. Wendy’s expects digital ordering to eventually ramp up to 10% of U.S. sales, showing that the company has a lot of room for growth in this area.

Share repurchases are another driver of Wendy’s EPS growth. In the last five years, Wendy’s has reduced its share count by 15%. The company has $100 million remaining on its share repurchasing authorization. Due to new stores, solid same-store sales growth and share repurchases, Wendy’s can be reasonably expected to grow EPS at a 7% average annual rate in the next five years.

Wendy’s stock trades for a 2020 price-to-earnings ratio of just 17.5. Our fair value estimate is a P/E ratio of 28. If the stock approaches its fair P/E ratio over the next five years, it will add 9.9% to annual returns over this period of time.

The combination of 7% annual EPS growth, P/E expansion of 9.9% per year, and the current dividend yield of 4.5% result in expected total returns of 21.4% per year through 2025. Wendy’s earns a buy recommendation from Sure Dividend due to high projected returns.

Restaurant Stock #3: Cracker Barrel Old Country Store Inc (CBRL)

Cracker Barrel Old Country Store pays homage to America’s heritage in both its menu options and atmosphere. Some of the more popular menu items include meatloaf, grits and signature biscuits. Cracker Barrel locations also operate a gift store inside of its locations. The company has nearly 700 locations in 45 states.

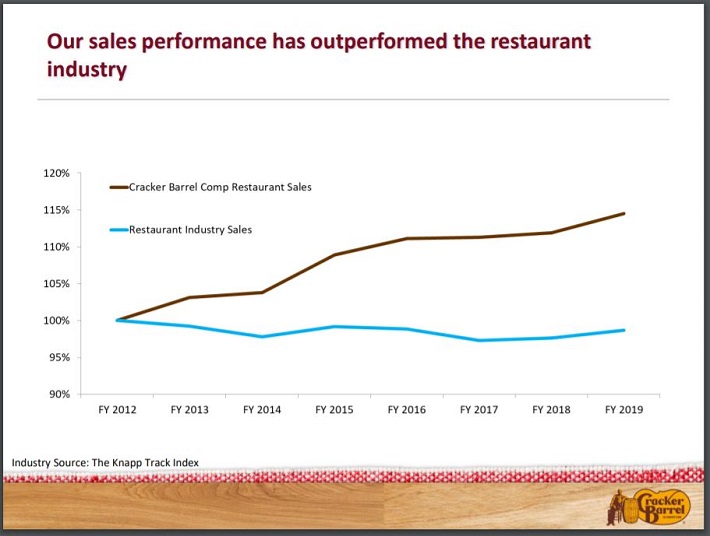

Cracker Barrel has outperformed the rest of the casual dinning industry over the past few years.

Source: Investor Presentation

While sales for the restaurant industry have remained essentially flat since 2012, Cracker Barrel’s sales have increased at a high rate over this period of time. That continued into the most recent quarter. Cracker Barrel reported second quarter results for fiscal 2020 on February 25th. Sales of $846 million were a 4.2% improvement from the previous year. EPS increased more than 7% to $2.70.

Although restaurant traffic declined 0.2%, the average check was up 4%. Comparable sales increased 3.8%, ahead of consensus estimates of 2.2%. Helping with results was a 2.2% increase in menu prices. Retail sales were up 1.3% year-over-year.

Cracker Barrel purchased Maple Street Biscuit Company in an all-cash transaction in the first quarter of the fiscal year. This added 28 stores to the company’s portfolio. Cracker Barrel also opened one store during the second quarter while closing another.

Cracker Barrel expects adjusted earnings-per-share of $9.38 for fiscal 2020, giving the stock a price-to-earnings ratio of 7.5 today. This compares quite favorably to our target multiple of 15x EPS. Valuation would be a 14.9% tailwind to annual returns if the stock reached this target by 2025.

The company is expected to grow earnings-per-share at an annual rate of 5% for the next five years and shares sport a dividend yield of 7.4%. In total, we expect Cracker Barrel to offer a total annual return of 27.3% through 2025. Despite the uncertainty in markets today, Cracker Barrel is poised to deliver outsized gains over the next half decade. We rate shares as a buy.

Restaurant Stock #2: Jack in the Box (JACK)

Jack in the Box is a fast-food chain that operates and franchises hamburger chains in the U.S., with more than 2,200 restaurants in 21 states and Guam. It has a market capitalization of $534 million. Jack in the Box previously owned the Qdoba brand, but sold it to Apollo Global Management in 2018 to focus on its core brand.

Near the end of February, Jack in the Box reported (2/19/20) financial results for the first quarter of fiscal 2020. Its comparable sales increased 1.7%, but its restaurant-level margin decreased from 26.2% to 24.8% due to wage and commodity inflation. Adjusted EPS declined 13% for the quarter.

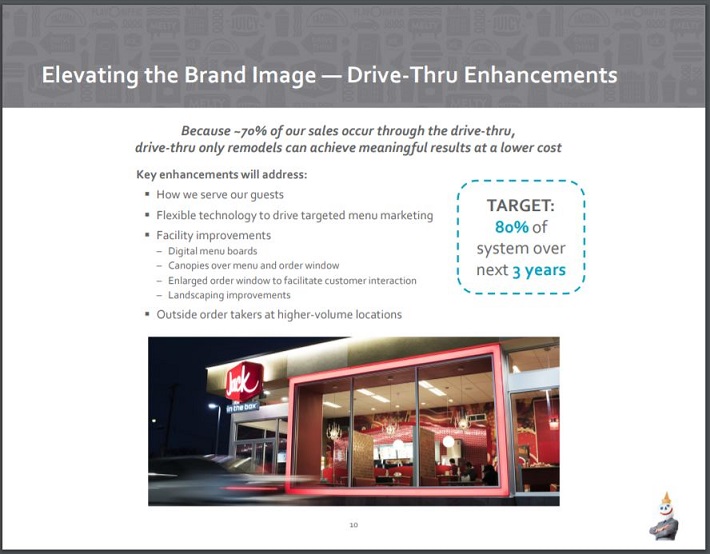

One of the company’s major growth catalysts is accelerating its drive through-only strategy. The company expects to roll out this model to 80% of system restaurants over the next three years.

Source: Investor Presentation, slide 10

Management continues to expect same-store sales growth of 1.5% to 3% for the current year with an operating margin of ~25%. Over the next four years, management expects to return $1.0 billion to its shareholders in the form of dividends and buybacks.

Jack in the Box has repurchased its shares at an aggressive pace in the last five years. During this period, it has reduced its share count by 36%. Share repurchases will be a major component of future EPS growth. During the last decade, the company has grown its EPS at a 5.9% average annual rate.

Given the strong level of buybacks, we expect the company to grow EPS by 7.0% per year on average over the next five years. Jack in the Box is expected to earn $4.65 in fiscal 2020, giving the stock a price-to-earnings ratio of 5.1, which is lower than its 10-year average of 20. If the stock trades up to our target valuation of 18x earnings, it will incur a 28.7% annualized tailwind due to valuation over this period.

The combination of EPS growth (7%), dividends (6.8%), and valuation changes (28.7%) is expected to lead to annual total returns of 42.5% per year over the next five years. While the current economic landscape will be challenging for restaurants, investors could see high levels of total returns from Jack in the Box over the next five years. The stock is rated as a strong buy.

Restaurant Stock #1: Dine Brands Global (DIN)

Dine Brands Global (Dine Equity until early 2018) is a casual and family dining restaurants company that owns and franchises restaurants. Its brands include Applebee’s and IHOP. The company has nearly 3,600 restaurants in the U.S. and multiple international markets.

Dine Brands Global reported its fourth quarter earnings results on February 24th. Revenue of $227.5 million increased 6.2% from the same quarter last year. The strong revenue growth was the result of higher royalties and franchise fees. Removing advertising revenues, results were higher by 12.1%.

Applebee’s comparable sales fell 2.5% year over year, while IHOP comparable sales were up 1.1% compared to the previous year’s fourth quarter. For the quarter, adjusted EPS improved 4.7% from the previous year’s quarter. For the year, revenue was up nearly 17% while adjusted EPS improved 29%.

Dine Brands has engineered a remarkable turnaround over the past few years. Slowing sales at Applebee’s caused the company’s sales and earnings to suffer. It invested heavily in renovating restaurants, closing under-performing locations, and adding new items to its menu to win back customers.

Dine Brands increased its dividend 10.1% in early March of 2020. This is the second consecutive ~10% dividend increase after the company cut its dividend by 35% in February of 2018. Dine Brands has been able to raise its dividend because the company has seen growth in its business.

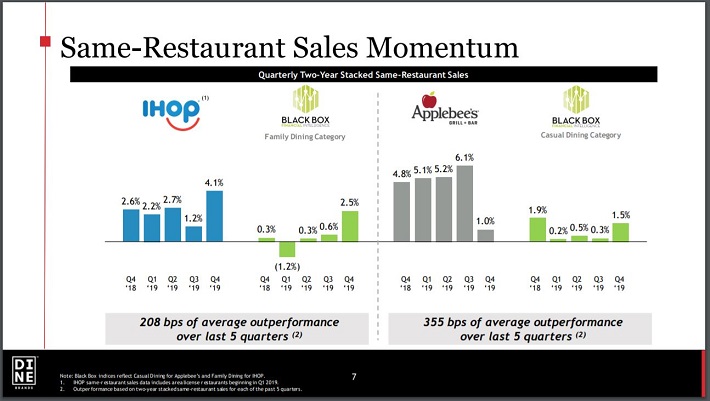

Source: Investors Presentation, slide 7

Dine Brands Global’s franchisees are openings new restaurants while also closing down underperforming restaurants. The decision to close down underperforming restaurants will be positive in the long run, as this allows for focusing on more promising restaurants that generate higher margins.

In a reversal from the previous year, IHOP restaurants delivered stronger comp sales growth than Applebee’s during 2019, but both segments are expected to see improvements in same-store sales in 2020. Franchisees are also opening new restaurants around the world. These new restaurants do not require any capital investment from Dine Brands Global. The low need for capital expenditures is why Dine Brands Global produces high free cash flows.

Dine Brands Global generated free cash flows of $155.2 million during fiscal 2019, a 10% increase from the previous year. This strong cash generation allows the company to make dividend payments and to reduce the share count at the same time.

Dine Brands management expects 2020 to be another step forward in its transformation. For the full year, the company forecasts same restaurant sales growth of 0% to 2% while earnings-per-share are forecasted to fall into a range of $7.08 to $7.28, which would result in an earnings-per-share growth rate of 3.3% for 2020.

With expected EPS of $7.18 for 2020, Dine Brands stock trades for a P/E ratio of 2.5, well below our fair value estimate of 13. A rising valuation multiple could add 39% to annual shareholder returns. Combined with 3.5% expected EPS growth and the 17.1% dividend yield, we expect total returns of 59.6% per year for Dine Brands stock over the next five years.

Of course, a dividend yield this high could be a warning of an upcoming dividend cut, which would significantly impact our expected return projection. Again, this industry is challenged, but investors willing to accept that risk could be handsomely rewarded by owning Dine Brands.

Final Thoughts

The coronavirus has upended life in much of the U.S. This is a challenging time for the economy and restaurant stocks in particular. Many of the names on this list have seen steep declines over the past few weeks. There have already been announcements of dividend suspensions in the industry (Darden) and more are likely to follow. And, while we believe many of these stocks are deeply undervalued today, their valuations could remain low for an extended period.

Longer-term, we see the restaurant industry as strong. The names in this article are those that we seen outperforming over the next five years. While there remains risk in the near-term, we believe investors buying the top names on this list will be rewarded in the long run.