Updated on August 23rd, 2019 by Nathan Parsh

This article examines the investment prospects of 9 of the top beverage stocks in detail. The companies analyzed sell a mix of alcoholic and non-alcoholic beverages.

We have compiled a list of over 20 stocks that manufacture beverages. The list was derived from the holdings of two of the top beverage industry exchange-traded funds:

- First Trust Consumer Staples Fund (FXG)

- Invesco Dynamic Food & Beverage ETF (PBJ)

You can download the full spreadsheet with all beverage stocks below:

Furthermore, you can view a preview of our beverage stocks spreadsheet below:

| TAP | Molson Coors Brewing Co. | 51.82 | 3.1 | 11,281 | 12.5 | 39.3 | 0.61 |

| STZ | Constellation Brands, Inc. | 204.24 | 1.5 | 38,789 | 15.7 | 23.0 | 0.82 |

| PEP | PepsiCo, Inc. | 132.32 | 2.8 | 184,642 | 14.6 | 41.2 | 0.44 |

| KDP | Keurig Dr Pepper, Inc. | 27.84 | 2.2 | 39,233 | 40.6 | 87.3 | 0.48 |

| MNST | Monster Beverage Corp. | 58.16 | 0.0 | 31,515 | 30.1 | 0.0 | 0.88 |

| MO | Altria Group, Inc. | 45.96 | 7.0 | 85,988 | 13.6 | 94.8 | 0.53 |

| KO | The Coca-Cola Co. | 54.15 | 2.9 | 230,392 | 32.9 | 96.6 | 0.40 |

| ABEV | Ambev SA | 4.67 | 0.0 | 24.9 | 0.0 | 0.67 | |

| BF.B | Brown-Forman Corp. | 58.58 | 1.1 | 27,768 | 33.6 | 37.5 | 0.80 |

| DEO | Diageo Plc | 168.78 | 2.1 | 24.9 | 51.8 | 0.39 | |

| BUD | Anheuser-Busch InBev SA/NV | 96.35 | 1.6 | 43.4 | 69.1 | 0.59 | |

| UL | Unilever Plc | 62.02 | 2.9 | 15.3 | 44.7 | 0.38 | |

| SBUX | Starbucks Corp. | 96.13 | 1.5 | 114,469 | 33.6 | 50.6 | 0.74 |

| DNKN | Dunkin' Brands Group, Inc. | 83.25 | 1.7 | 6,873 | 29.8 | 51.8 | 0.67 |

| KHC | The Kraft Heinz Co. | 25.22 | 8.2 | 30,670 | -2.8 | -22.5 | 0.49 |

| SJM | The J. M. Smucker Co. | 113.61 | 3.0 | 13,066 | 25.1 | 74.6 | 0.18 |

| DF | Dean Foods Co. | 1.03 | 0.0 | 89 | -0.2 | 0.0 | 0.10 |

| NBEV | New Age Beverages Corp. | 3.52 | 0.0 | 273 | -12.1 | 0.0 | 2.18 |

| DPS | Dr Pepper Snapple Group, Inc. | 0.00 | 0.0 | 0 | 0.00 | ||

| FIZZ | National Beverage Corp. | 42.52 | 0.0 | 2,018 | 14.1 | 0.0 | 0.54 |

| HEINY | Heineken NV | 52.62 | 1.4 | 28.0 | 39.6 | 0.44 | |

| NSRGY | Nestlé SA | 110.18 | 0.0 | 35.1 | 0.0 | 0.26 | |

| LVMHF | LVMH Moët Hennessy Louis Vuitton SE | 395.00 | 1.8 | 198,830 | 26.3 | 47.3 | 1.11 |

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio | Beta |

In addition to the Excel spreadsheet above, this article covers our top 9 beverage stocks today, as ranked using expected total returns from the Sure Analysis Research Database.

We rank these 9 companies by our expected total annual return estimate over the next five years, which is a combination of future earnings-per-share growth, current dividend yield, and the impact of multiple expansion or contraction.

Table of Contents

- Dunkin Brands Group Inc (DNKN)

- Ambev S.A. (ABEV)

- Constellation Brands (STZ)

- Unilever PLC (UL)

- Diageo plc (DEO)

- Keurig Dr. Pepper (KDP)

- J.M. Smucker (SJM)

- Molson Coors Brewing Company (TAP)

- Altria Group, Inc. (MO)

Top Beverage Stock #9: Dunkin Brands (DNKN)

- Estimated total annual return through 2024: 3.4%

Dunkin Brands Group is a leading global quick service restaurant that is composed of two distinct segments, Dunkin’ and Baskin-Robbins, and three operating segments, Dunkin U.S., Baskin-Robbins U.S. and International. The company’s U.S. operations account for more than 80% of total revenues, with Dunkin U.S. being the largest contributor to total revenues.

There are more than 9,400 Dunkin’ U.S. stores and 3,400 International Dunkin’ stores. Baskin-Robbins has 2,500 U.S. stores and 5,500 International stores. 100% of stores are franchised.

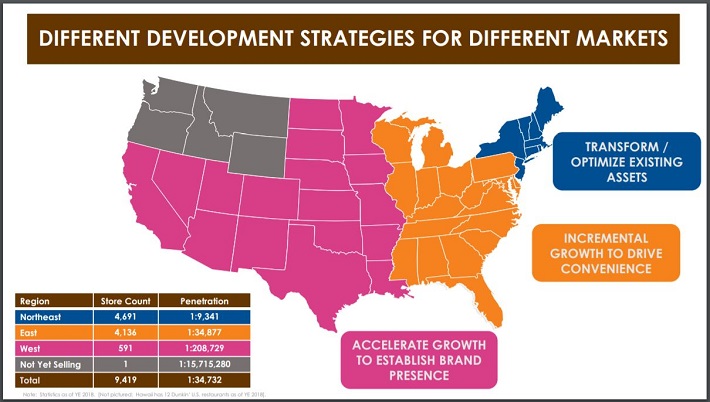

Dunkin Brands Group remains in the growth phase as it has only recently expanded to the western United States.

Source: Q2 Earnings Presentation

Western states, particularly California, should allow the company to grow its business even more.

Dunkin Brands Group has only been a publicly traded company since 2011, but earnings-per-share have more than tripled during this period of time. We forecast that the company can grow earnings-per-share at an 8% annual rate due to 1% to 3% comparable sales, increased store count, an aggressive share buyback and margin expansion.

Dunkin Brands Group has paid a dividend every year since 2012. Shares offer a yield of 1.8% as of the most recent closing price.

The stock trades at $83 today. Using our expected earnings-per-share estimate of $3.04 for 2019, Dunkin Brands Group has a P/E ratio of 27.3. We have a 2024 target P/E ratio of 20. If the stock were to retreat to this target by 2024, then valuation would be a 6.4% headwind to total annual returns.

We expect that earnings growth (8%), dividend yield (1.8%) and multiple reversion (6.4%) will lead to total annual returns of 3.4% over the next five years.

Despite having one of the higher expected earnings growth rates on this list, Dunkin Brands Group’s valuation removes much of our total return forecast. We rate shares as a hold.

Top Beverage Stock #8: Ambev SA (ABEV)

- Estimated total annual return through 2024: 4.0%

Ambev S.A. is a producer and distributor of alcoholic beverages, primarily beer. Headquartered in Sao Paulo, Brazil, Ambev is the successor of two of the oldest breweries in Brazil. The company’s brands include Skol, Labatt, Brahma, Antarctica and Presidente. Ambev merged with Anheuser-Busch (BUD) in 2008.

The company has operations in 16 countries, most of which are located in Latin America. Ambev is the dominate beer company in each of its markets. U.S. investors can purchase shares of the company through its ADR.

With a large presence in Latin America, Ambev’s success is tied to the performance of the economies in these countries. The company is seeing improving trends in several of its markets. For example, consumers in Brazil, one of Ambev’s largest markets, are seeing their disposable income grow after years of decline.

Source: Q2 Earnings Presentation, slide 8

Currency has often impacted Ambev’s financial results, but we expect earnings-per-share to grow at a rate of 3% going forward. We feel this is an appropriate target given the emergence of a middle class in Latin America and the market share for Ambev’s products.

Currency exchange rates have also impacted Ambev’s dividend. The stock currently has a yield of 3%, which is above the long-term average yield.

Shares of Ambev closed recently at $4.65. Using expected earnings-per-share of $0.21, the stock trades with a P/E ratio of 22.1, slightly above our 2024 target P/E ratio of 20. If shares were to revert to our target by 2024, then valuation would reduce annual returns by 2% over this period of time.

In total, we expect shares of Ambev to offer an annual return of 4% through 2024. This is based off of earnings growth expectations (3%), dividend yield (3%) and multiple reversion (2%).

Due to mediocre projected annual returns, Ambev receives a hold rating from Sure Dividend.

Top Beverage Stock #7: Constellation Brands (STZ)

- Estimated total annual return through 2024: 4.5%

Founded in the mid-1940s, Constellation Brands is a producer and distributor of beer, wine and spirts. The company’s beer brands include Corona, Modelo Especial, and Pacifico. Constellation Brands also has a robust craft beer portfolio and includes such brands as Ballast Point and Funky Buddha Brewery. Constellation Brands is the third largest beer company in the U.S.

The company also provides wines like Robert Mondavi and Black Box and spirits such as SVEDKA Vodka and Case Noble Tequila. Constellation Brands also has a stake in the cannabis company Canopy Growth

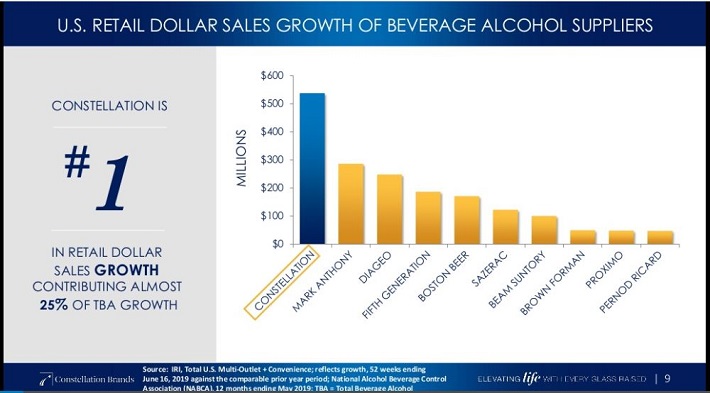

Constellation Brands is one of the top growing alcohol suppliers in the U.S.

Source: Q1 Earnings Presentation, slide 9.

Constellation Brands has increased earnings-per-share at a rate of nearly 19% from 2009 through 2018. Much of this growth has occurred over the past few years as revenue doubled and the company’s net profit margin more than doubled to 23%.

Given the competitiveness of the U.S. alcohol market, we feel it is unlikely that Constellation Brands will be able to maintain this type of growth going forward.

However, the company has shown an ability to adapt with changing consumer tastes as evident by its early entrance into the craft beer market. While we think the past performance is not sustainable, we feel that Constellation Brands should be able to grow earnings-per-share by a rate of 8% due to its ability to continue to meet consumers needs.

Constellation Brands has only paid a dividend since 2015. Since then, the dividend has increased at a CAGR of more than 19%. Investors looking for income might be disappointed with the stock as it yields just 1.5%.

Constellation Brands trades with a P/E ratio of 23.2. Our target 2024 target P/E ratio for the stock is 18, slightly above the long term average. If shares were to revert to this P/E ratio by 2024, then valuation would be a 5% headwind to annual returns.

In total, we expect that Constellation Brands can offer a total annual return of 4.5% over the next five years. We forecast that earnings growth (8%) and dividend yield (1.5%) will be offset by valuation (5%).

Given our projected low returns, Constellation Brands receives a hold recommendation from Sure Dividend at this time.

Top Beverage Stock #6: Unilever plc (UL)

- Estimated total annual return through 2024: 4.7%

Unilever PLC (UL) is one of the largest consumer goods companies in the world. The company produces approximately 400 different brands and sells them in almost every country in the world. 13 brands bring in at least $1 billion in revenue annually. Popular products include Dove, Vaseline, Knorr, Hellmann’s, Lipton, Ben & Jerry’s and Seventh Generation.

Unilever was founded in 1885 and makes its headquarters in London. Unilever Group is the holding comping for both Unilever PLC and Unilever N.V (UN). U.S. investors can invest in Unilever Group through Unilever PLC.

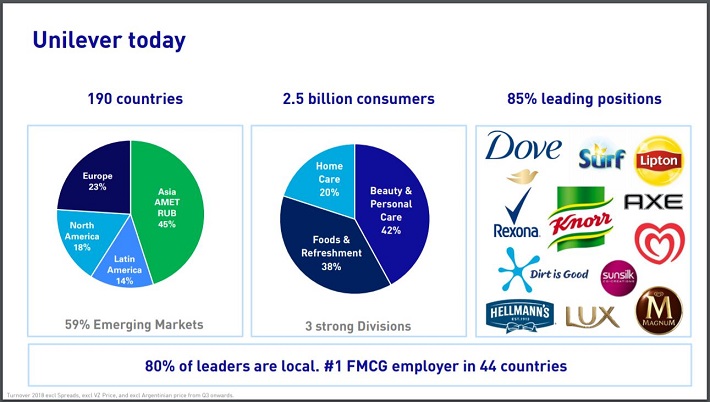

Unilever is truly a global company.

Source: Consumer Analyst Group of New York Conference 2019 Presentation

Unilever’s products are often the leader in their product category. This gives the company pricing power while retaining customer loyalty.

The company has compounded earnings-per-share at a rate of 5.2% over the last decade. Unilever is in the process of aggressively expanding in emerging markets in Asia. These markets have seen rapid population growth which should allow Unilever to continue to produce solid business results. We feel that the company can grow earnings-per-share at an annual rate of 5% over the next five years.

Unilever has increased its dividend (in euros) for 39 consecutive years. U.S. investors may face fluctuations in income from year-to-year due to currency exchange rates. Shares yield 3% today, well below the stock’s 10-year average of 3.5%.

Unilever’s stock trades at $61.85 currently. We forecast that the company will earn $2.90 per share in 2019, giving the stock a P/E ratio of 21.3. This is above the stock’s 10-year average P/E of 18. If shares were to trade at this multiple by 2024, then valuation would reduce annual returns by 3.3% over this period of time.

Added together, we expect a total annual return of 4.7% through 2024. This estimate is based on estimated earnings growth (5%) dividend yield (3%) and multiple compression (3.3%).

While we find Unilever’s business attractive, we feel the stock has gotten ahead of itself. We would encourage investors to wait for a pullback before purchasing shares of the company. Unilever receives a hold recommendation from Sure Dividend at this time.

Top Beverage Stock #5: Diageo plc (DEO)

- Estimated total annual return through 2024: 5.0%

Headquartered in Park Royal, London, Diageo can trace its history back to the 1600s and to the oldest family of Scotch whisky distillers. The company is one of the largest producers and distributors of alcoholic beverages today. Diageo’s brands include Johnnie Walker, Smirnoff, Captain Morgan, Guinness, Crown Royal and more. The company’s brands occupy 20 of the top 100 spirt brands in the world.

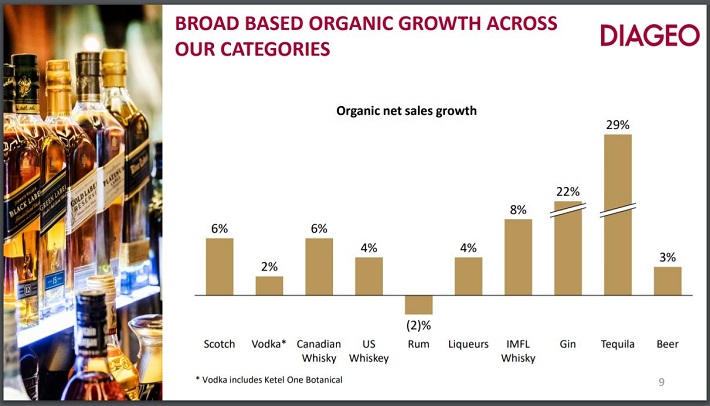

Diageo produced organic growth across nearly its entire portfolio of products in the second half of the company’s fiscal year 2019.

Source: Fiscal year 2019 Results Presentation, slide 17.

Diageo’s earnings-per-share have increased at an annual rate of 5.3% over the last decade. The company’s organic growth, coupled with expansion into emerging markets such as China and India, lead us to believe that Diageo can accelerate earnings growth in the near future. We expect earnings growth of 8% annually over the next five years.

Diageo has increased its dividend at a rate of 4.3% over the last ten years. This is slightly more impressive when factoring in the impact of currency exchange on the company’s dividend. Shares offer a yield of 2.5% today, which is above the average yield of the S&P 500.

Shares of the company are expensive, with a P/E ratio of 24.2. The stock’s 10-year average valuation is 18.3x earnings. If Diageo’s stock were to return to its average P/E multiple, then valuation would reduce annual returns by 5.5% over the next half decade.

Combining our forecast for earnings growth (8%), dividend yield (2.5%) and multiple reversion (5.5%), we estimate that that Diageo can offer a total annual return of 5%. We rate shares as a hold today.

Top Beverage Stock #4: Keurig Dr. Pepper (KDP)

- Estimated total annual return through 2024: 6.4%

Keurig Dr. Pepper formed following the 2018 merger between Dr. Pepper Snapple and Keurig Green Mountain.

Source: Merger Presentation, slide 7

The combined new company offers a variety of well-known beverage brands such as Dr. Pepper, 7UP, Fiji Water and Snapple in addition to wide range of specialty beverages in K-Cup pods, such as Starbucks, Dunkin’ Donuts, McCafe and Green Mountain.

Keurig Dr. Pepper began trading on July 10th, 2018. Keurig Dr. Pepper is now the third largest non-alcoholic food and beverage company in the U.S., trailing behind just Coca-Cola (KO) and PepsiCo (PEP). The company operates four business segments: Coffee Systems, packaged Beverages, Beverage Concentrates and Latin America Beverages.

While Keurig Dr. Pepper projects earnings growth of at least 15% for 2019, we are more comfortable estimating 10% annual growth over the next five years. This is the highest earnings growth rate on this list.

Prior to the merger, Dr. Pepper Snapple had increased dividend for eight consecutive years. Keurig Green Mountain was privately held and did not pay a dividend causing some uncertainty regarding dividend growth in future years. Keurig Dr. Pepper does expect to pay $0.60 in dividend per share in 2019, double what the company paid out last year. Shares yield 2.2% today.

Keurig Dr. Pepper trades hands at $27.65 right now. Using expected earnings-per-share of $1.14, the stock has a P/E ratio of 24.3. This is one of the higher valuations on this list. We feel a 2024 target P/E ratio of 18 is more appropriate. If shares were to trade at this P/E ratio by 2024, then valuation would be a 5.8% headwind to total annual returns.

Combining our expectations for earnings growth (10%), dividend yield (2.2%) and multiple reversion (5.8), we estimate that Keurig Dr. Pepper will offer a total annual return of 6.4% over the next five years.

The company’s expected earnings growth rate is compelling, but we feel the stock trades with too high of a valuation. As such, we rate Keurig Dr. Pepper as a hold.

Top Beverage Stock #3: J.M. Smucker (SJM)

- Estimated total annual return through 2024: 7.8%

J.M. Smucker began as a small cider mill in Orrville, Ohio in 1897. Since this time, J.M. Smucker has grown into a worldwide leader of packaged food and beverage products. Some of the company’s brands include Smucker’s, Jif, Crisco, Milk Bone and Folgers.

J.M. Smucker is a leader in a variety of brands and has numerous products that are experiencing high rates of growth.

Source: Investor Presentation

For the most part, the company’s profitability has increased steadily over the years. J.M. Smucker has grown earnings-per-share at a rate of 7.2% per year over the last decade. We feel a 5% earnings growth rate over the next five years is appropriate given that consumer’s tastes have migrated towards healthier and fresher options.

J.M. Smucker has increased its dividend for 22 consecutive years, qualifying the company as a Dividend Achiever (https://www.suredividend.com/dividend-achievers-list/). Shares of the company offer a yield of 3.1% today.

Using the recent closing price of $113.34 and our expected earnings-per-share of $7.00, J.M. Smucker trades with a P/E ratio of 16.2. This is one of the lowest valuations on this list. We predict that the company with trade with a P/E of 16 by 2024. This is slightly below the long-term average, but we feel it is an appropriate target due to changing consumer eating and drinking habits. Trading at this P/E by 2024, would reduce returns by 0.3% per year.

Overall, J.M. Smucker is expected to return 7.8% annually through 2024 due to a combination of earnings growth (5%) and dividend yield (3.1%) partially offset by multiple reversion (0.3%).

J.M. Smucker is a leader in multiple product categories and has a fairly diversified business model. Still, we would prefer to purchase shares lower than the current price. We rate J.M. Smucker as a hold. On a pullback, we would have a more favorable opinion of the stock.

Top Beverage Stock #2: Molson Coors (TAP)

- Estimated total annual return through 2024: 14.9%

Molson Coors was founded in 1873 and has grown into one of the largest U.S. brewers, offering a wide variety of popular brands such as Coors Light, Coors Banquet, Molson Canadian, Crispin Cider and Miller Lite through a joint venture called MillerCoors.

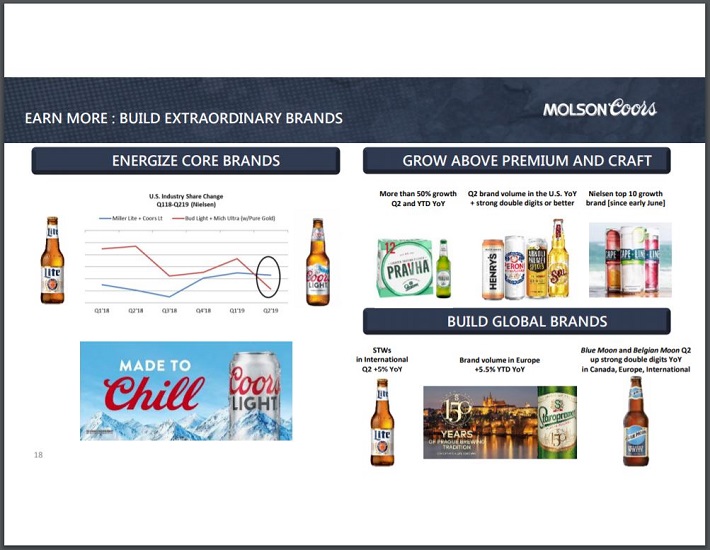

While the company’s earnings-per-share have varied over the last decade, Molson Coors is seeing pockets of strength in its business.

Source: Q2 Earnings Presentation, slide 18

While competitor Anheuser-Busch InBev has seen declines in its Bud Light and Mich Ultra flagship products, Coors Light and Miller Lite have taken market share. Global volumes are also increasing.

Molson Coors is also seeing growth in its premium and craft beer business. While the company was late entering this market, Molson Coors has made a concerted effort in promoting these brands recently. This has led to double digit volume growth in these products.

On top of this, Molson Coors announced in 2018 that the company was establishing a joint venture with HEXO Corp. to develop non-alcoholic, cannabis-infused beverages for the Canadian market.

Molson Coors has compounded earnings-per-share at a rate of 2.8% over the last decade. We think the company can increase EPS growth to 5% annually through 2024 due to a stabilizing beer market, higher sales in the premium and craft beer business.

While the company has only increased its dividend five times since 2009, Molson Coors does offer an attractive yield of 4.4% at the moment.

Shares of the company trade with a multiple of 11.5 today. We have a 2024 target of 15 times earnings. If Molson Coors’ stock were to trade with this P/E by 2024, then valuation would add 5.5% to annual returns over this period of time.

Using earnings growth (5%), dividend yield (4.3%) and multiple expansion, we expect shares of Molson Coors to offer a total annual return of 14.9% through 2024.

This earns the stock a buy rating from Sure Dividend due to double-digit return potential.

Top Beverage Stock #1: Altria Group (MO)

- Estimated total annual return through 2024: 17.1%

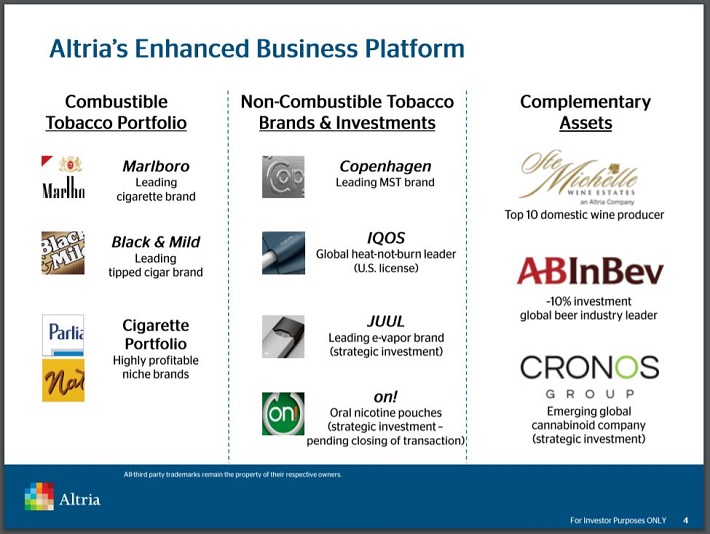

Altria was founded in 1847 and has grown into a giant in the consumer staple sector. The company is primarily known for its tobacco products, but sells beverages as well.

Source: Q2 Investor Presentation, slide 4.

Besides its U.S. market leading Marlboro cigarettes and Black & Mild cigars, Altria also sells Ste. Michelle brand of wine. And the company also has a 10% ownership stake in Anheuser Busch Inbev.

The company has experienced earnings-per-share growth of 8.5% from 2009 through 2018. Altria has been very consistent in this area only seeing earnings-per-share fail to top the previous year’s total one time over the last decade (2011).

This growth is especially impressive given that cigarette usage continues to trend down in the U.S. Due to this, we believe that Altria can grow earnings-per-share at a rate of 4% through 2024.

Altria is a favorite stock among dividend growth investors. The company has increased its dividend 54 times over the past 50 years, including a very recent 5% increase. This makes Altria a member of the exclusive Dividend Kings, which have raised their dividends for at least 50 consecutive years.

No other stock on this list can match Altria’s dividend history. The stock offers a 7.1% yield, which is the highest yield on this list.

You can see a video further detailing our analysis of Altria’s dividend safety below:

Using expected earnings-per-share of $4.21 gives the stock a P/E ratio of 11.1. The last decade has produced an average P/E ratio of 16.2, but we have a 2024 target multiple of 15x earnings due to slowing cigarette consumption. If Altria’s stock were to trade with this P/E ratio by 2024, then valuation would add 6.2% to annual returns over this time frame.

We forecast that Altria will offer a total annual return of 17.1% over the next five years. This estimate is comprised of earnings growth (4%), dividend yield (6.9%) and multiple expansion (6.2%).

Altria offers one of the best potential returns for stocks on this list. The stock also has one of the highest total returns in our coverage universe. We rate shares as a strong buy.

Final Thoughts

The beverage industry offers something different for everyone. Investors have multiple options when it comes to investing in non-alcoholic beverages, alcoholic beverages, wine and spirits.

Of the 10 names on this list, we rate Molson Coors and Altria as a buy. We would require the other names to pullback before recommending investors consider them for purchase.