Data updated daily

Constituents updated annually

The consumer staples sector is home to some of the most well-known dividend growth stocks in the world.

There is also a wide body of evidence that suggests that the consumer staples sector outperforms over long periods of time. With that in mind, we’ve compiled a database of all consumer staples stocks, which you can access below:

The list of stocks was derived from a few major consumer staples ETFs:

- Consumer Staples Select Sector SPDR ETF (XLP)

- Invesco Dynamic Food & Beverage ETF (PBJ)

- Invesco S&P Small Cap Consumer Staples ETF (PSCC)

Keep reading this article to learn more about the merits of investing in consumer staples stocks.

How To Use The Consumer Staples Stocks List To Find Investment Ideas

Having an Excel document containing each dividend-paying consumer staples stocks is very useful.

This tool becomes even more potent when combined with a solid, fundamental knowledge of how to manipulate data with Microsoft Excel. Quantitative investing screeners allow investors to remove many of the cognitive biases that impair long-term investing returns.

With that in mind, this section will provide a step-by-step explanation of how to use the dividend-paying consumer staples stocks list to find the best consumer staples investment ideas by using simple screening techniques.

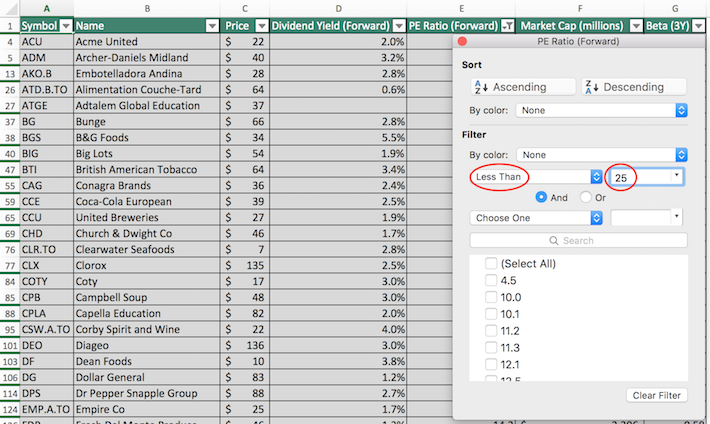

The first screen that we will implement is for stocks with price-to-earnings ratios below 25,

Screen 1: Avoiding Overvalued Stocks

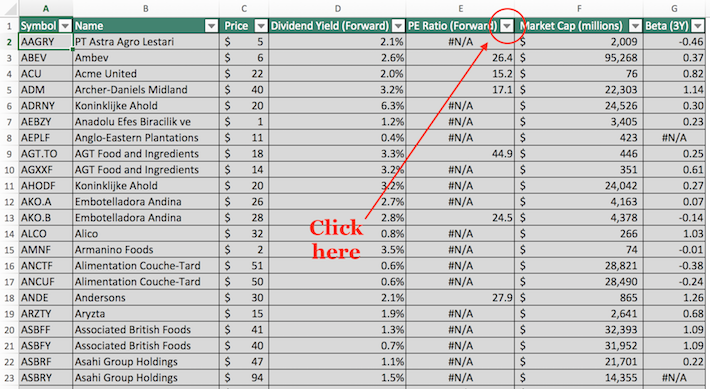

Step 1: Download your free spreadsheet of all 71 consumer staples stocks at the link above.

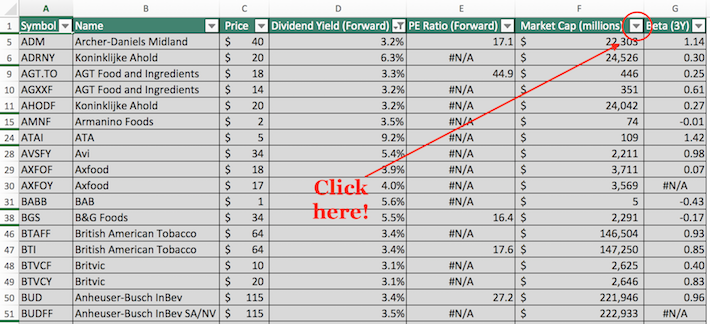

Step 2: Click on the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter setting to “Less Than” and input 25 into the field beside it, as shown below.

The remaining stocks in the spreadsheet are consumer staples with price-to-earnings ratio less than 25.

The next screen that we’ll implement is for ‘blue chip stocks’ – those with dividend yields above 3% and market capitalizations above $10 billion.

Screen 2: Blue Chip Stocks

Step 1: Download your free spreadsheet of all 71 consumer staples stocks at the link above.

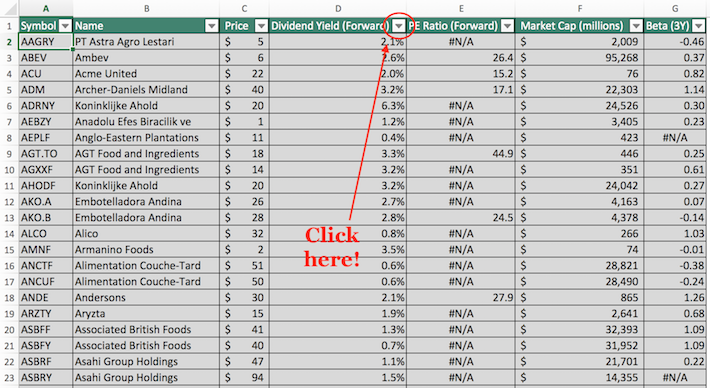

Step 2: We’ll first filter by dividend yield and then by market capitalization. Importantly, order doesn’t matter – you could also filter by market capitalization and then dividend yield and the screen would output the same results.

To filter by dividend yield, click the filter icon at the top of the dividend yield icon, as shown above.

\

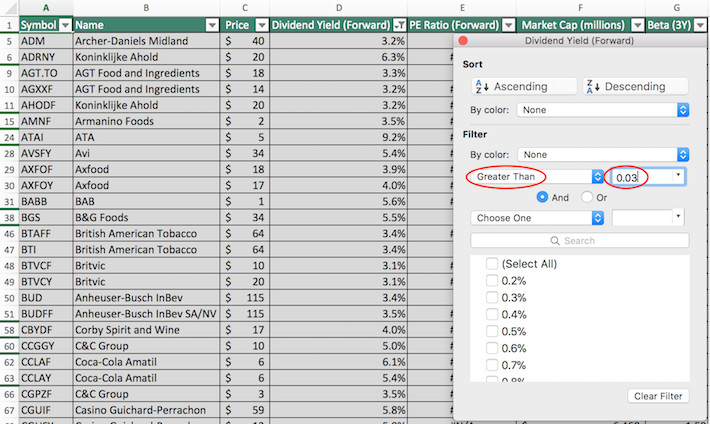

\

Step 3: To filter for dividend yields greater than 3%, change the filter setting to ‘Greater Than’, and input 0.03 into the field beside it.

Step 4: Next we’ll execute the screen for market capitalization. Close of out of the previous window (by clicking exit, not by clicking ‘clear filter’ at the bottom of the filter window). Then, click the filter icon at the top of the market capitalization column, as shown below.

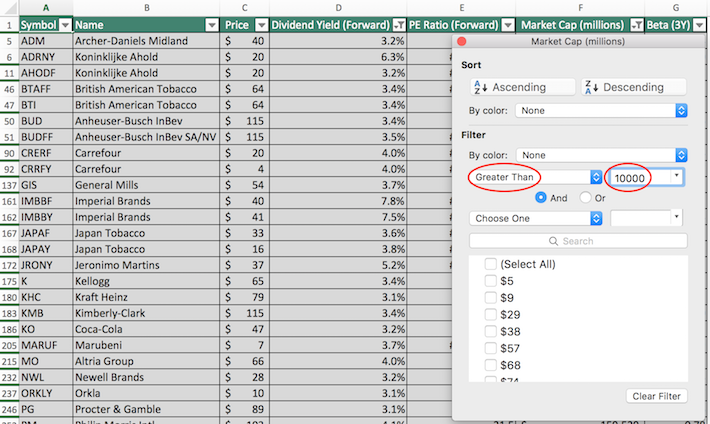

Step 5: Change the filter setting to ‘Greater Than’ and input 10000 into the field beside it. Notice that since market capitalization is measured in millions of dollars in this spreadsheet, then filtering for stocks with market capitalizations above ‘$10,000 million’ is equivalent for screening for securities with market capitalizations above $10 billion.

The remaining stocks in this spreadsheet are those with dividend yields above 3% and market capitalizations above $10 billion.

You now have a solid understanding of how to use the dividend-paying consumer staples stocks spreadsheet to find compelling investment ideas. The next section will provide a summary of why the consumer staples sector merits an allocation in your investment portfolio.

Why Invest In Consumer Staples Stocks?

Consumer staples stocks are an appealing investment category for a number of reasons.

First of all, consumer staples stocks are very recession-resistant by definition. Consumer staples companies make products or deliver services that are considered to be ‘staples’ – in other words, consumers can’t do without them.

Food stocks within the consumer staples sector are an excellent example of this. Consumers are likely to buy more food products during recessions as they cut back on dining out to conserve funds during difficult economic times.

Alcohol stocks are another example. People tend to drink at least the same amount (if not more) when times get tough.

This means that consumer staples stocks tend to hold up very well during periods of economic turmoil. This can be seen by studying the sector’s performance during the 2007-2009 financial crisis.

During 2008, for example, the consumer staples sector returned -15%. While this seems bad on the surface, it is actually very good on a relative basis. Here’s the performance of some other sectors during the same calendar year:

- Financials: -55%

- Materials: -44%

- Technology: -41%

Clearly, the performance of the consumer staples sector beat these other industries by a wide margin despite being negative itself. In fact, the consumer staples was the single best performing during calendar year 2008.

The consumer staples sector stands up well during times of recessions, implying that the sector presents less risk than many of its counterparts.

Amazingly, the sector’s long-term performance has also been one of the best. The sector has demonstrated a remarkable ability to generate consistently high returns on invested capital, avoiding the mean reversion experienced by many other highly profitable industries.

While traditional academic theory tells us that investors must assume extra risk to generate incremental returns, the outperformance of the recession-resistant consumer staples sector tells us that this isn’t true in practice. The sector’s combination of high returns and low risk make it a uniquely appealing sector for conservative total return investors.

Final Thoughts

The consumer staples sector is an intriguing place to looks for high-quality dividend investment ideas.

If you’re willing to look outside of this sector while hunting for investment opportunities, the following stock databases are highly useful:

- The Dividend Aristocrats List: S&P 500 Index stocks with 25+ years of consecutive dividend increases

- The Dividend Achievers List: dividend stocks with 10+ years of consecutive dividend increases

- The Dividend Kings List: dividend stocks with 50+ years of consecutive dividend increases

Investing is a unique craft because we have the ability to ‘cheat’ off the moves of the world’s greatest investors.

Large, institutional investment managers with more than $100 million in assets under management are required to disclose their portfolio holdings on a quarterly basis through a regulatory filing called a 13F. With this in mind, there is no better investor than Berkshire Hathaway’s Warren Buffett. We provide a detailed quarterly analysis on Warren Buffett’s stock portfolio, which you can access below: