Spreadsheet data updated daily

Retirees face many unique situations from the perspective of maximizing the utility of their investment portfolio.

In fact, perhaps the most difficult challenge is structuring your portfolio such that it generates a consistent amount of dividend income each month.

This goal is essentially impossible without detailed databases of dividend stocks divided by the calendar month of their payment dates.

That’s where Sure Dividend comes in. We maintain databases of stocks that pay dividends in each month of the calendar year. You can download our database for December below:

The list of stocks that pay dividends in December available for download at the link above contains the following information for each stock in the index:

- Name

- Ticker

- Stock price

- Dividend yield

- Market capitalization

- P/E Ratio

- Payout Ratio

- Beta

Additionally, you can see several of the metrics above in the sortable table below:

| AAON | AAON, Inc. | 47.59 | 0.7 | 2,479.8 | 49.1 | 33.0 |

| AAT | American Assets Trust, Inc. | 47.86 | 2.3 | 2,858.3 | 61.6 | 142.8 |

| ABC | AmerisourceBergen Corp. | 85.98 | 1.8 | 17,911.9 | 19.1 | 35.0 |

| ABX | Barrick Gold Corporation | 0.00 | 0.0 | 0.0 | ||

| ACET | 0.00 | 0.0 | 0.0 | |||

| ACNB | ACNB Corp. | 34.50 | 2.7 | 244.1 | 10.3 | 28.0 |

| ADI | Analog Devices, Inc. | 105.32 | 1.9 | 38,905.8 | 25.8 | 49.9 |

| ADM | Archer-Daniels-Midland Co. | 40.54 | 3.4 | 22,579.7 | 17.3 | 58.5 |

| ADS | Alliance Data Systems Corp. | 107.02 | 2.2 | 5,468.5 | 6.6 | 14.8 |

| AE | Adams Resources & Energy, Inc. | 30.78 | 2.9 | 130.3 | 41.9 | 122.4 |

| AEE | Ameren Corp. | 77.49 | 2.4 | 19,047.3 | 23.9 | 58.0 |

| AEL | American Equity Investment Life Holding Co. | 24.30 | 0.0 | 2,210.8 | 10.4 | 0.0 |

| AEM | Agnico Eagle Mines Ltd. | 58.95 | 0.8 | 13,639.2 | -44.1 | -36.0 |

| AEO | American Eagle Outfitters, Inc. | 16.37 | 3.4 | 2,765.9 | 10.7 | 35.8 |

| AEP | American Electric Power Co., Inc. | 95.72 | 2.7 | 47,266.1 | 23.9 | 65.7 |

| AFL | Aflac, Inc. | 52.56 | 2.0 | 38,914.5 | 12.8 | 25.7 |

| AGCO | AGCO Corp. | 75.56 | 0.8 | 5,760.7 | 15.5 | 12.5 |

| AGM | Federal Agricultural Mortgage Corp. | 84.19 | 3.0 | 900.9 | 9.3 | 28.4 |

| AGN | Allergan Plc | 173.93 | 1.7 | 57,065.9 | -6.8 | -11.4 |

| AGNC | AGNC Investment Corp. | 16.60 | 12.8 | 9,093.8 | -10.8 | -137.7 |

| AHC | A.H. Belo Corp. | 3.80 | 8.4 | 81.7 | 6.3 | 53.3 |

| AIG | American International Group, Inc. | 52.90 | 2.4 | 46,018.1 | -529.0 | -1,280.0 |

| AIZ | Assurant, Inc. | 126.36 | 1.9 | 7,724.5 | 21.5 | 40.1 |

| AJG | Arthur J. Gallagher & Co. | 91.21 | 1.8 | 16,971.4 | 24.4 | 44.9 |

| AJX | Great Ajax Corp. | 15.60 | 8.1 | 306.6 | 8.9 | 71.9 |

| ALE | ALLETE, Inc. | 87.21 | 2.6 | 4,504.9 | 22.9 | 60.2 |

| ALGT | Allegiant Travel Co. | 154.38 | 0.0 | 2,517.3 | 13.6 | 0.0 |

| ALK | Alaska Air Group, Inc. | 68.76 | 1.9 | 8,476.2 | 16.8 | 32.7 |

| ALLE | Allegion Plc | 113.66 | 0.8 | 10,613.1 | 24.5 | 20.7 |

| ALV | Autoliv, Inc. | 82.36 | 3.0 | 7,184.6 | 29.1 | 87.5 |

| AMAT | Applied Materials, Inc. | 55.07 | 1.5 | 50,871.1 | 18.1 | 27.0 |

| AMC | AMC Entertainment Holdings, Inc. | 9.60 | 8.3 | 997.0 | 176.1 | 1,467.9 |

| AME | AMETEK, Inc. | 89.12 | 0.6 | 20,350.2 | 24.8 | 15.6 |

| AMGN | Amgen, Inc. | 203.06 | 2.7 | 121,775.3 | 16.0 | 43.6 |

| AMNB | American National Bankshares, Inc. (Virginia) | 35.88 | 2.8 | 398.8 | 18.6 | 52.8 |

| AMRK | A-Mark Precious Metals, Inc. | 10.63 | 0.0 | 74.7 | 33.6 | 0.0 |

| AMSF | AMERISAFE, Inc. | 63.47 | 1.5 | 1,224.9 | 16.1 | 23.8 |

| AMSWA | American Software, Inc. | 15.74 | 2.8 | 493.7 | 74.5 | 208.1 |

| ANAT | American National Insurance Co. | 116.81 | 2.8 | 3,140.7 | 7.6 | 21.3 |

| ANF | Abercrombie & Fitch Co. | 16.28 | 4.9 | 1,023.4 | 15.4 | 75.5 |

| ANTM | Anthem, Inc. | 259.49 | 1.2 | 66,382.0 | ||

| ANW | Aegean Marine Petroleum Network Inc. | 0.00 | 0.0 | 0.0 | ||

| APC | Anadarko Petroleum Corp. | 72.77 | 1.6 | 36,563.5 | -60.9 | -96.3 |

| APLE | Apple Hospitality REIT, Inc. | 16.48 | 7.3 | 3,689.4 | 19.0 | 138.3 |

| ARGO | Argo Group International Holdings Ltd. | 67.24 | 1.7 | 2,305.6 | 19.6 | 33.8 |

| ARII | American Railcar Industries, Inc. | 0.00 | 0.0 | 0.0 | ||

| ARMK | Aramark | 44.69 | 1.0 | 11,034.4 | 20.5 | 19.9 |

| AROW | Arrow Financial Corp. | 34.72 | 2.9 | 519.7 | 14.2 | 41.3 |

| ARR | ARMOUR Residential REIT, Inc. | 16.82 | 13.6 | 990.5 | -1.8 | -24.3 |

| ASB | Associated Banc-Corp | 20.29 | 3.3 | 3,290.4 | 10.1 | 33.0 |

| ASH | Ashland Global Holdings, Inc. | 76.13 | 1.3 | 4,607.6 | 45.5 | 61.3 |

| ATO | Atmos Energy Corp. | 113.42 | 1.8 | 13,406.4 | 26.8 | 48.6 |

| ATRI | Atrion Corp. | 804.99 | 0.7 | 1,493.3 | 41.4 | 27.7 |

| AVA | Avista Corp. | 47.85 | 3.2 | 3,163.4 | 16.0 | 50.7 |

| AVAL | Grupo Aval Acciones y Valores SA | 7.80 | 4.2 | 2,782.4 | 8.5 | 35.4 |

| AVGO | Broadcom, Inc. | 282.31 | 3.4 | 111,984.2 | 38.1 | 130.8 |

| AVT | Avnet, Inc. | 36.95 | 2.0 | 4,115.9 | 23.5 | 46.6 |

| AVY | Avery Dennison Corp. | 126.20 | 1.7 | 10,625.2 | ||

| AWK | American Water Works Co., Inc. | 122.31 | 1.6 | 22,095.7 | 38.1 | 59.4 |

| AWR | American States Water Co. | 94.34 | 1.2 | 3,474.7 | 45.6 | 53.2 |

| AYR | Aircastle Ltd. | 26.20 | 4.5 | 1,963.7 | 9.7 | 43.6 |

| B | Barnes Group, Inc. | 55.51 | 1.2 | 2,674.2 | 19.1 | 23.1 |

| BA | The Boeing Co. | 344.55 | 2.3 | 193,881.7 | 51.8 | 118.4 |

| BAC | Bank of America Corp. | 31.36 | 2.0 | 284,725.6 | 11.5 | 23.0 |

| BAK | Braskem SA | 14.05 | 0.0 | 2,336.3 | 8.9 | 0.0 |

| BAM | Brookfield Asset Management, Inc. | 53.75 | 1.1 | 54,495.3 | 17.7 | 20.3 |

| BBD | Banco Bradesco SA | 8.89 | 0.5 | 34,821.0 | 13.1 | 6.6 |

| BBDO | Banco Bradesco SA | 8.22 | 0.5 | 32,795.2 | 12.2 | 5.9 |

| BBSI | Barrett Business Services, Inc. | 88.01 | 1.1 | 657.4 | 13.7 | 15.5 |

| BBT | BB&T Corp. | 53.05 | 3.1 | 40,652.4 | 13.2 | 41.4 |

| BBY | Best Buy Co., Inc. | 72.12 | 2.6 | 19,008.9 | 12.8 | 33.8 |

| BC | Brunswick Corp. | 58.43 | 1.4 | 5,006.3 | 26.2 | 36.8 |

| BCO | The Brink's Co. | 85.96 | 0.7 | 4,297.9 | 64.4 | 44.9 |

| BDX | Becton, Dickinson & Co. | 245.90 | 1.2 | 66,381.7 | 84.5 | 105.2 |

| BG | Bunge Ltd. | 54.64 | 3.7 | 7,734.7 | 14.5 | 53.0 |

| BGFV | Big 5 Sporting Goods Corp. | 2.57 | 11.7 | 55.7 | -189.0 | -2,205.9 |

| BHB | Bar Harbor Bankshares | 25.01 | 3.4 | 388.9 | 14.9 | 50.1 |

| BHBK | 0.00 | 0.0 | 0.0 | |||

| BIG | Big Lots, Inc. | 23.28 | 5.2 | 908.3 | 7.6 | 38.9 |

| BKH | Black Hills Corp. | 79.18 | 2.5 | 4,835.0 | 20.9 | 52.4 |

| BKJ | Bancorp of New Jersey, Inc. | 18.19 | 0.0 | 132.7 | 22.6 | 0.0 |

| BLK | BlackRock, Inc. | 454.66 | 2.9 | 70,551.0 | 17.4 | 49.8 |

| BLKB | Blackbaud, Inc. | 85.31 | 0.6 | 4,194.9 | 152.5 | 85.8 |

| BLL | Ball Corp. | 71.80 | 0.6 | 23,837.8 | 46.0 | 28.8 |

| BMI | Badger Meter, Inc. | 58.41 | 1.1 | 1,700.5 | 36.7 | 39.0 |

| BMS | Bemis Co., Inc. | 57.25 | 2.2 | 5,221.2 | 22.8 | 49.8 |

| BMTC | Bryn Mawr Bank Corp. | 36.90 | 2.7 | 742.6 | 12.4 | 34.0 |

| BOH | Bank of Hawaii Corp. | 86.59 | 2.9 | 3,517.8 | 15.7 | 45.2 |

| BOTJ | Bank of the James Financial Group, Inc. | 14.75 | 1.6 | 64.6 | 11.6 | 18.9 |

| BP | BP Plc | 39.21 | 6.2 | 132,251.8 | 14.8 | 92.1 |

| BRG | Bluerock Residential Growth REIT, Inc. | 12.06 | 5.4 | 287.4 | -6.0 | -32.1 |

| BRKR | Bruker Corp. | 43.65 | 0.4 | 6,751.2 | 36.2 | 13.3 |

| BRKS | Brooks Automation, Inc. | 42.42 | 0.9 | 3,063.8 | 85.5 | 80.6 |

| BSET | Bassett Furniture Industries, Inc. | 14.86 | 3.4 | 150.2 | 30.2 | 101.6 |

| BSIG | BrightSphere Investment Group, Inc. | 9.38 | 4.3 | 851.1 | 6.0 | 25.5 |

| BUD | Anheuser-Busch InBev SA/NV | 83.56 | 0.0 | 149,617.4 | 22.1 | 0.0 |

| BVN | Compañía de Minas Buenaventura SAA | 14.16 | 0.0 | 3,546.9 | -78.6 | 0.0 |

| BWA | BorgWarner, Inc. | 39.30 | 1.7 | 8,116.0 | 10.6 | 18.4 |

| BWXT | BWX Technologies, Inc. | 57.40 | 1.1 | 5,463.7 | 26.8 | 30.8 |

| CA | CA, Inc. | 0.00 | 0.0 | 0.0 | ||

| CABO | Cable One, Inc. | 1,292.77 | 0.6 | 7,376.5 | 47.2 | 29.2 |

| CAE | CAE, Inc. | 25.43 | 1.2 | 6,772.6 | 27.8 | 33.0 |

| CASS | Cass Information Systems, Inc. | 53.54 | 1.8 | 775.7 | 25.5 | 45.4 |

| CATY | Cathay General Bancorp | 35.47 | 3.5 | 2,827.2 | 10.3 | 36.0 |

| CBD | Companhia Brasileira de Distribuicao | 20.55 | 0.0 | 3,429.2 | 28.2 | 0.0 |

| CBFV | CB Financial Services, Inc. | 26.48 | 3.5 | 143.9 | 13.5 | 47.5 |

| CBOE | Cboe Global Markets, Inc. | 115.70 | 1.1 | 12,921.6 | 31.9 | 34.2 |

| CBSH | Commerce Bancshares, Inc. (Missouri) | 64.60 | 0.0 | 6,935.8 | 17.2 | 0.0 |

| CBT | Cabot Corp. | 44.70 | 3.0 | 2,582.9 | 12.3 | 36.9 |

| CC | The Chemours Co. | 16.32 | 6.1 | 2,668.0 | 4.6 | 28.3 |

| CCBG | Capital City Bank Group, Inc. | 28.42 | 1.4 | 475.9 | 17.0 | 24.0 |

| CCE | Coca-Cola European Partners plc | 0.00 | 0.0 | 0.0 | ||

| CCF | Chase Corp. | 112.65 | 0.7 | 1,060.3 | 31.4 | 22.3 |

| CCI | Crown Castle International Corp. | 141.71 | 3.2 | 58,951.4 | 71.0 | 225.6 |

| CCL | Carnival Corp. | 43.90 | 4.6 | 23,128.8 | 9.9 | 45.1 |

| CCNE | CNB Financial Corp. (Pennsylvania) | 31.45 | 2.2 | 478.0 | ||

| CCOI | Cogent Communications Holdings, Inc. | 57.95 | 3.9 | 2,713.0 | 82.7 | 325.5 |

| CCUR | CCUR Holdings, Inc. | 3.50 | 0.0 | 31.2 | 43.1 | 0.0 |

| CDK | CDK Global, Inc. | 49.30 | 1.2 | 5,993.8 | 53.1 | 64.5 |

| CDW | CDW Corp. | 124.45 | 0.9 | 18,009.8 | 26.6 | 23.4 |

| CFFN | Capitol Federal Financial, Inc. | 14.30 | 2.4 | 2,022.5 | 20.7 | 49.3 |

| CFR | Cullen/Frost Bankers, Inc. | 92.41 | 2.9 | 5,790.0 | 12.9 | 38.0 |

| CGNX | Cognex Corp. | 52.15 | 0.4 | 8,900.0 | 43.1 | 16.1 |

| CHCT | Community Healthcare Trust, Inc. | 46.40 | 3.5 | 900.5 | 352.6 | 1,234.8 |

| CHD | Church & Dwight Co., Inc. | 75.75 | 1.2 | 18,717.5 | 30.9 | 36.3 |

| CHE | Chemed Corp. | 406.19 | 0.3 | 6,467.4 | 32.3 | 9.6 |

| CHFC | Chemical Financial Corp. | 42.04 | 3.2 | 3,008.3 | 10.9 | 35.2 |

| CHRW | C.H. Robinson Worldwide, Inc. | 87.68 | 2.2 | 11,869.9 | 17.4 | 38.9 |

| CHS | Chico's FAS, Inc. | 3.56 | 9.7 | 419.6 | -40.8 | -395.2 |

| CIG | Companhia Energética de Minas Gerais SA | 3.29 | 0.0 | 3,203.2 | 4.4 | 0.0 |

| CINF | Cincinnati Financial Corp. | 115.27 | 1.9 | 18,827.7 | 15.4 | 29.1 |

| CIR | CIRCOR International, Inc. | 37.50 | 0.0 | 746.4 | -14.6 | 0.0 |

| CIX | CompX International, Inc. | 15.89 | 1.5 | 197.7 | 12.7 | 19.2 |

| CLDT | Chatham Lodging Trust | 17.91 | 7.4 | 840.3 | 33.4 | 245.9 |

| CLRO | ClearOne, Inc. | 1.41 | 0.0 | 23.5 | -0.9 | 0.0 |

| CMCT | CIM Commercial Trust Corp. | 14.60 | 10.3 | 213.2 | 0.7 | 6.7 |

| CME | CME Group, Inc. | 203.25 | 1.4 | 72,782.8 | 39.5 | 56.4 |

| CMI | Cummins, Inc. | 175.43 | 2.6 | 27,680.4 | 10.7 | 27.7 |

| CMP | Compass Minerals International, Inc. | 56.18 | 5.1 | 1,903.6 | 32.3 | 165.8 |

| CNI | Canadian National Railway Co. | 88.58 | 1.7 | 63,731.4 | 19.3 | 32.5 |

| CNK | Cinemark Holdings, Inc. | 36.41 | 3.6 | 4,265.5 | 20.9 | 75.9 |

| CNO | CNO Financial Group, Inc. | 15.68 | 2.6 | 2,446.0 | -6.3 | -16.5 |

| CNP | CenterPoint Energy, Inc. | 30.16 | 3.7 | 15,146.9 | 26.4 | 98.9 |

| CNS | Cohen & Steers, Inc. (New York) | 63.61 | 2.2 | 3,005.0 | 24.3 | 53.9 |

| COL | Rockwell Collins, Inc. | 0.00 | 0.0 | 0.0 | ||

| COP | ConocoPhillips | 56.16 | 2.1 | 62,345.5 | 9.0 | 19.2 |

| CORE | Core-Mark Holding Co., Inc. | 28.60 | 1.5 | 1,312.2 | 23.9 | 36.0 |

| COST | Costco Wholesale Corp. | 297.05 | 0.8 | 130,600.1 | 35.7 | 29.3 |

| COT | Cott Corp. (Canada) | 12.74 | 1.9 | 1,727.7 | -304.8 | -573.0 |

| COTY | Coty, Inc. | 11.78 | 4.2 | 8,885.1 | -2.3 | -9.9 |

| CPA | Copa Holdings SA | 103.36 | 2.9 | 4,389.0 | 104.5 | 306.0 |

| CPAC | Cementos Pacasmayo SAA | 9.70 | 5.1 | 822.3 | 26.8 | 137.4 |

| CPF | Central Pacific Financial Corp. | 28.77 | 3.1 | 821.6 | 13.8 | 42.2 |

| CPG | Crescent Point Energy Corp. | 4.00 | 3.7 | 2,232.6 | -1.3 | -5.0 |

| CPSI | Computer Programs & Systems, Inc. | 22.67 | 1.8 | 325.4 | 17.4 | 30.6 |

| CR | Crane Co. | 81.75 | 1.8 | 4,899.0 | 13.6 | 24.6 |

| CRI | Carter's, Inc. | 100.43 | 1.9 | 4,493.1 | 16.4 | 31.0 |

| CRS | Carpenter Technology Corp. | 48.88 | 1.6 | 2,319.8 | 14.1 | 23.2 |

| CRT | Cross Timbers Royalty Trust | 8.90 | 13.4 | 53.4 | 7.5 | 100.0 |

| CSB | VictoryShares US Small Cap High Div Volatility Wtd ETF | 45.08 | 0.0 | 0.0 | ||

| CSFL | CenterState Bank Corp. | 24.44 | 1.8 | 3,153.4 | 13.2 | 23.2 |

| CSGS | CSG Systems International, Inc. | 50.36 | 1.7 | 1,662.3 | 21.5 | 36.9 |

| CSL | Carlisle Cos., Inc. | 153.63 | 1.1 | 8,696.4 | 19.3 | 21.3 |

| CSS | CSS Industries, Inc. | 4.51 | 0.0 | 39.9 | -0.8 | 0.0 |

| CSV | Carriage Services, Inc. | 21.60 | 1.4 | 384.7 | 36.1 | 50.1 |

| CSX | CSX Corp. | 71.66 | 1.3 | 55,725.5 | 17.0 | 22.3 |

| CTAS | Cintas Corp. | 272.34 | 0.0 | 28,187.2 | 31.3 | 0.0 |

| CTB | Cooper Tire & Rubber Co. | 28.13 | 1.5 | 1,411.5 | 20.4 | 30.5 |

| CTL | CenturyLink, Inc. | 12.77 | 12.4 | 13,929.1 | -1.7 | -21.3 |

| CTRN | Citi Trends, Inc. | 17.98 | 1.8 | 214.1 | 14.6 | 26.0 |

| CTT | CatchMark Timber Trust, Inc. | 11.52 | 4.7 | 564.5 | -3.2 | -14.9 |

| CTWS | Connecticut Water Service, Inc. | 69.98 | 1.8 | 844.6 | 39.4 | 71.3 |

| CUK | Carnival Plc | 41.39 | 4.8 | 7,636.0 | 9.3 | 45.1 |

| CVE | Cenovus Energy, Inc. | 8.76 | 1.7 | 10,788.9 | 51.9 | 89.4 |

| CVGW | Calavo Growers, Inc. | 90.70 | 1.1 | 1,595.9 | 52.8 | 58.2 |

| CVR | Chicago Rivet & Machine Co. | 25.47 | 3.4 | 24.6 | 22.2 | 75.1 |

| CVX | Chevron Corp. | 117.58 | 3.9 | 223,216.2 | 15.1 | 59.4 |

| CW | Curtiss-Wright Corp. | 128.87 | 0.5 | 5,506.6 | 19.0 | 9.1 |

| CWH | Camping World Holdings, Inc. | 9.54 | 3.4 | 840.3 | -20.1 | -67.3 |

| D | Dominion Energy, Inc. | 82.72 | 4.2 | 67,988.8 | 55.5 | 235.2 |

| DAKT | Daktronics, Inc. | 7.11 | 3.7 | 319.6 | 204.9 | 749.3 |

| DAL | Delta Air Lines, Inc. | 53.79 | 2.7 | 34,788.3 | 7.5 | 20.4 |

| DAN | Dana, Inc. | 15.99 | 2.5 | 2,301.3 | 10.3 | 25.7 |

| DBD | Diebold Nixdorf, Inc. | 9.54 | 0.0 | 732.2 | -1.4 | 0.0 |

| DCI | Donaldson Co., Inc. | 52.59 | 1.5 | 6,636.6 | 25.3 | 38.4 |

| DEA | Easterly Government Properties, Inc. | 22.14 | 4.7 | 1,771.4 | 199.3 | 936.1 |

| DF | Dean Foods Co. | 1.13 | 0.0 | 103.8 | -0.2 | 0.0 |

| DFS | Discover Financial Services | 79.74 | 2.1 | 25,376.5 | 9.0 | 18.5 |

| DHI | D.R. Horton, Inc. | 53.98 | 1.1 | 19,962.9 | 12.8 | 13.6 |

| DHIL | Diamond Hill Investment Group, Inc. | 134.31 | 0.0 | 461.3 | 9.4 | 0.0 |

| DHT | DHT Holdings, Inc. | 7.35 | 2.3 | 1,049.6 | -471.2 | -1,086.8 |

| DHXM | DHX Media Ltd. | 1.47 | 0.0 | 251.2 | -2.7 | 0.0 |

| DK | Delek US Holdings, Inc. | 38.13 | 2.8 | 2,872.5 | 5.9 | 16.3 |

| DKS | Dick's Sporting Goods, Inc. | 40.47 | 2.5 | 3,607.9 | 12.0 | 30.0 |

| DLX | Deluxe Corp. | 49.50 | 2.4 | 2,125.1 | 20.4 | 49.4 |

| DNB | The Dun & Bradstreet Corporation | 0.00 | 0.0 | 0.0 | ||

| DNBF | DNB Financial Corp. (Pennsylvania) | 44.32 | 0.6 | 192.1 | 17.4 | 11.0 |

| DNKN | Dunkin' Brands Group, Inc. | 74.02 | 2.0 | 6,122.7 | 26.5 | 51.7 |

| DOV | Dover Corp. | 103.11 | 1.9 | 14,978.4 | 23.0 | 43.1 |

| DPZ | Domino's Pizza, Inc. | 263.60 | 0.9 | 10,782.1 | 28.2 | 26.8 |

| DRE | Duke Realty Corp. | 34.46 | 2.5 | 12,563.7 | 53.5 | 131.2 |

| DSW | DSW, Inc. | 22.51 | 4.4 | 1,765.5 | -86.2 | -383.0 |

| DUK | Duke Energy Corp. | 96.07 | 3.9 | 69,996.7 | 21.2 | 81.9 |

| DVD | Dover Motorsports, Inc. | 1.92 | 0.0 | 70.3 | 16.3 | 0.0 |

| DVN | Devon Energy Corp. | 21.46 | 1.6 | 8,674.1 | 2.6 | 4.2 |

| DWDP | DowDuPont, Inc. | 30.52 | 5.0 | 68,559.8 | 21.5 | 107.0 |

| EAT | Brinker International, Inc. | 42.79 | 3.6 | 1,598.9 | 10.5 | 37.4 |

| EBIX | Ebix, Inc. | 40.42 | 0.7 | 1,232.4 | 13.5 | 10.0 |

| EBMT | Eagle Bancorp Montana, Inc. | 18.26 | 2.0 | 116.9 | 11.4 | 23.4 |

| EBTC | Enterprise Bancorp, Inc. | 30.00 | 2.1 | 354.5 | 11.0 | 23.0 |

| ECA | Encana Corp. | 4.09 | 1.6 | 5,587.8 | 3.5 | 5.7 |

| ECC | Eagle Point Credit Co., Inc. | 15.56 | 15.4 | 378.3 | -14.1 | -217.9 |

| ED | Consolidated Edison, Inc. | 94.29 | 3.1 | 31,317.9 | 22.3 | 68.8 |

| EE | El Paso Electric Co. | 67.24 | 2.2 | 2,742.8 | 30.3 | 66.1 |

| EFSC | Enterprise Financial Services Corp. | 44.09 | 1.3 | 1,173.4 | 12.7 | 16.7 |

| EFX | Equifax, Inc. | 137.69 | 1.1 | 16,644.5 | -39.1 | -44.3 |

| EGOV | NIC, Inc. | 20.37 | 1.6 | 1,364.6 | 26.6 | 41.7 |

| EGP | EastGroup Properties, Inc. | 133.78 | 2.2 | 5,024.7 | 53.5 | 115.2 |

| EL | The Estée Lauder Companies, Inc. | 187.57 | 0.9 | 67,736.0 | 38.2 | 34.0 |

| ELY | Callaway Golf Co. | 20.90 | 0.2 | 1,966.6 | 33.7 | 6.4 |

| EML | The Eastern Co. | 28.45 | 1.5 | 177.4 | 14.5 | 22.4 |

| EMR | Emerson Electric Co. | 69.88 | 2.8 | 42,983.3 | 19.7 | 55.0 |

| ENB | Enbridge, Inc. | 36.59 | 5.8 | 74,051.9 | 21.3 | 124.0 |

| ENR | Energizer Holdings, Inc. | 42.88 | 2.8 | 2,959.3 | 369.7 | 1,024.2 |

| ENS | EnerSys | 67.00 | 1.0 | 2,846.3 | 17.4 | 18.2 |

| EPM | Evolution Petroleum Corp. | 5.71 | 7.0 | 188.8 | 12.3 | 86.2 |

| EPR | EPR Properties | 78.95 | 5.6 | 6,123.1 | 23.3 | 130.3 |

| EQIX | Equinix, Inc. | 563.34 | 1.7 | 47,781.9 | 92.8 | 156.2 |

| EQT | EQT Corp. | 9.26 | 1.3 | 2,365.9 | -6.6 | -8.5 |

| ERF | Enerplus Corp. | 6.23 | 1.5 | 1,436.9 | 4.5 | 6.5 |

| ES | Eversource Energy | 86.20 | 2.4 | 27,894.5 | 31.8 | 76.7 |

| ESBK | Elmira Savings Bank | 14.41 | 6.4 | 50.2 | 14.5 | 92.3 |

| ESCA | Escalade, Inc. | 11.71 | 4.3 | 169.4 | 18.2 | 77.7 |

| ESLT | Elbit Systems Ltd. | 161.57 | 1.1 | 6,907.6 | 41.1 | 44.8 |

| ESP | Espey Manufacturing & Electronics Corp. | 21.60 | 4.6 | 51.9 | 22.0 | 101.6 |

| ESRT | Empire State Realty Trust, Inc. | 14.55 | 2.9 | 2,615.0 | 44.7 | 129.2 |

| ESSA | ESSA Bancorp, Inc. | 16.48 | 2.4 | 188.0 | 14.9 | 35.2 |

| ESV | Ensco Rowan Plc | 8.19 | 2.0 | 1,569.5 | -1.3 | -2.5 |

| ETM | Entercom Communications Corp. | 3.41 | 10.6 | 486.3 | -1.5 | -15.5 |

| ETR | Entergy Corp. | 121.25 | 3.0 | 24,108.1 | 23.4 | 70.0 |

| EVC | Entravision Communications Corp. | 2.56 | 7.8 | 217.5 | -36.1 | -281.7 |

| EVR | Evercore, Inc. | 74.29 | 2.9 | 2,962.1 | 8.4 | 24.4 |

| EXC | Exelon Corp. | 46.18 | 3.1 | 44,867.7 | 19.7 | 60.3 |

| EXPD | Expeditors International of Washington, Inc. | 74.41 | 1.3 | 12,703.3 | 20.2 | 25.8 |

| EXPE | Expedia Group, Inc. | 137.14 | 0.9 | 19,922.1 | 33.0 | 30.8 |

| EXPO | Exponent, Inc. | 65.19 | 0.9 | 3,384.6 | 43.3 | 40.5 |

| EXR | Extra Space Storage, Inc. | 115.55 | 3.0 | 15,649.2 | 34.0 | 102.5 |

| F | Ford Motor Co. | 8.60 | 7.0 | 34,313.9 | 15.6 | 108.8 |

| FAF | First American Financial Corp. | 61.88 | 2.7 | 6,936.7 | 12.9 | 35.1 |

| FBHS | Fortune Brands Home & Security, Inc. | 60.77 | 1.4 | 8,500.6 | 21.0 | 29.0 |

| FBNK | FaceBank Group, Inc. | 10.96 | 0.0 | 274.3 | -5.9 | 0.0 |

| FCAP | First Capital, Inc. | 60.85 | 1.5 | 204.7 | 19.5 | 30.1 |

| FDP | Fresh Del Monte Produce, Inc. | 28.05 | 1.1 | 1,356.4 | 73.2 | 78.2 |

| FDS | FactSet Research Systems, Inc. | 253.22 | 1.1 | 9,687.2 | ||

| FE | FirstEnergy Corp. | 48.29 | 3.1 | 26,076.0 | 23.2 | 71.2 |

| FF | FutureFuel Corp. | 12.29 | 2.0 | 537.6 | 26.2 | 51.3 |

| FFG | FBL Financial Group, Inc. | 56.47 | 3.3 | 2,785.0 | 13.5 | 45.0 |

| FFIC | Flushing Financial Corp. | 21.00 | 3.7 | 621.8 | 12.6 | 46.7 |

| FFNW | First Financial Northwest, Inc. | 14.09 | 2.3 | 146.1 | 14.1 | 33.0 |

| FGBI | First Guaranty Bancshares, Inc. | 21.70 | 2.9 | 191.1 | 15.5 | 45.6 |

| FIS | Fidelity National Information Services, Inc. | 129.21 | 1.0 | 79,263.1 | 55.6 | 57.7 |

| FLIR | FLIR Systems, Inc. | 53.61 | 1.2 | 7,269.8 | 26.2 | 32.3 |

| FLO | Flowers Foods, Inc. | 21.70 | 3.4 | 4,589.9 | 25.6 | 86.0 |

| FMBH | First Mid Bancshares, Inc. | 34.43 | 2.1 | 574.8 | 13.2 | 27.5 |

| FMNB | Farmers National Banc Corp. | 14.80 | 2.4 | 409.5 | 11.8 | 28.8 |

| FNB | F.N.B. Corp. (Pennsylvania) | 12.17 | 4.0 | 3,944.0 | 10.3 | 40.8 |

| FNF | Fidelity National Financial, Inc. | 45.99 | 2.7 | 12,620.4 | 16.7 | 44.4 |

| FNHC | FedNat Holding Co. | 14.82 | 2.2 | 196.0 | 101.0 | 218.0 |

| FNV | Franco-Nevada Corp. | 95.77 | 1.0 | 17,893.8 | 119.3 | 121.3 |

| FORR | Forrester Research, Inc. | 34.99 | 0.0 | 649.1 | -272.7 | 0.0 |

| FRME | First Merchants Corp. (Indiana) | 37.97 | 2.4 | 2,129.2 | 11.5 | 27.9 |

| FSFG | First Savings Financial Group, Inc. | 62.25 | 1.0 | 146.3 | 9.9 | 9.9 |

| FSS | Federal Signal Corp. | 33.50 | 1.0 | 2,021.9 | 19.2 | 18.4 |

| FTI | TechnipFMC Plc | 20.68 | 2.5 | 9,233.2 | -4.7 | -11.7 |

| FTR | Frontier Communications Corp. | 1.05 | 0.0 | 110.6 | 0.0 | 0.0 |

| FTV | Fortive Corp. | 71.51 | 0.4 | 23,994.0 | 9.1 | 3.6 |

| FULT | Fulton Financial Corp. | 16.78 | 3.0 | 2,790.0 | 12.0 | 36.5 |

| FWRD | Forward Air Corp. | 65.38 | 1.1 | 1,851.1 | 20.9 | 22.0 |

| G | Genpact Ltd. | 38.55 | 0.8 | 7,343.8 | 25.5 | 21.1 |

| GARS | Garrison Capital, Inc. | 6.67 | 14.5 | 107.0 | -40.6 | -590.0 |

| GATX | GATX Corp. | 79.85 | 2.3 | 2,850.6 | 14.2 | 32.3 |

| GBCI | Glacier Bancorp, Inc. | 42.23 | 2.6 | 3,892.8 | 18.0 | 46.0 |

| GBX | Greenbrier Cos., Inc. | 32.08 | 3.1 | 1,042.1 | 15.7 | 48.8 |

| GCAP | GAIN Capital Holdings, Inc. | 4.57 | 5.3 | 170.9 | -8.9 | -46.5 |

| GCI | Gannett Co., Inc. | 11.01 | 5.8 | 1,262.6 | 90.5 | 526.3 |

| GFF | Griffon Corp. | 20.18 | 1.4 | 954.3 | -114.3 | -161.2 |

| GG | 0.00 | 0.0 | 0.0 | |||

| GGB | Gerdau SA | 3.24 | 2.8 | 3,600.8 | 10.7 | 30.4 |

| GHL | Greenhill & Co., Inc. | 15.38 | 1.3 | 316.0 | -58.7 | -75.8 |

| GIL | Gildan Activewear, Inc. | 26.42 | 1.9 | 5,381.4 | 18.4 | 34.5 |

| GILD | Gilead Sciences, Inc. | 66.00 | 3.6 | 83,585.7 | 14.2 | 51.6 |

| GLPI | Gaming & Leisure Properties, Inc. | 39.29 | 6.8 | 8,434.9 | 25.0 | 170.2 |

| GLW | Corning, Inc. | 29.79 | 2.6 | 23,262.0 | 16.7 | 42.6 |

| GM | General Motors Co. | 35.82 | 4.2 | 51,141.3 | 5.6 | 23.9 |

| GME | GameStop Corp. | 6.42 | 0.0 | 580.7 | -0.6 | 0.0 |

| GNL | Global Net Lease, Inc. | 19.36 | 9.2 | 1,635.6 | 159.1 | 1,458.5 |

| GOOD | Gladstone Commercial Corp. | 22.83 | 6.6 | 727.4 | 429.1 | 2,819.5 |

| GORO | Gold Resource Corp. | 4.17 | 0.5 | 265.6 | 93.9 | 46.4 |

| GPI | Group 1 Automotive, Inc. | 105.00 | 1.0 | 1,950.0 | 13.0 | 12.8 |

| GPIC | 0.00 | 0.0 | 0.0 | |||

| GPN | Global Payments, Inc. | 161.24 | 0.0 | 48,379.6 | 52.4 | 1.3 |

| GPRE | Green Plains, Inc. | 11.56 | 4.2 | 441.4 | -9.8 | -40.8 |

| GRA | W.R. Grace & Co. | 65.85 | 1.5 | 4,394.6 | 23.7 | 36.6 |

| GRC | The Gorman-Rupp Co. | 35.95 | 1.5 | 939.5 | 24.8 | 36.5 |

| GRFS | Grifols SA | 20.72 | 0.0 | 5,389.7 | 22.0 | 0.0 |

| GRIF | Griffin Industrial Realty, Inc. | 38.29 | 0.0 | 194.2 | 31.8 | 0.0 |

| GRMN | Garmin Ltd. | 86.39 | 2.5 | 16,422.9 | 22.1 | 55.2 |

| GROW | U.S. Global Investors, Inc. | 1.93 | 1.6 | 29.2 | -8.6 | -13.4 |

| GS | The Goldman Sachs Group, Inc. | 211.05 | 1.8 | 75,885.8 | 9.3 | 16.4 |

| GSB | GlobalSCAPE, Inc. | 9.68 | 0.5 | 167.7 | ||

| GT | Goodyear Tire & Rubber Co. | 15.69 | 4.1 | 3,520.4 | 8.1 | 33.3 |

| GWRS | Global Water Resources, Inc. | 12.03 | 2.4 | 259.1 | 131.5 | 311.6 |

| GWW | W.W. Grainger, Inc. | 315.21 | 1.8 | 17,201.4 | 21.4 | 37.4 |

| HAL | Halliburton Co. | 19.91 | 3.6 | 17,439.8 | 14.7 | 53.0 |

| HAYN | Haynes International, Inc. | 34.21 | 2.6 | 428.1 | 74.2 | 191.0 |

| HBI | Hanesbrands, Inc. | 15.95 | 3.8 | 5,766.6 | 10.3 | 38.6 |

| HCAP | Harvest Capital Credit Corp. | 9.94 | 10.7 | 60.3 | 27.3 | 292.3 |

| HCFT | Hunt Companies Finance Trust, Inc. | 3.34 | 7.9 | 79.1 | 35.7 | 283.1 |

| HCI | HCI Group, Inc. | 41.43 | 3.7 | 338.9 | 22.1 | 82.7 |

| HCSG | Healthcare Services Group, Inc. | 23.57 | 3.3 | 1,746.9 | 22.7 | 75.7 |

| HD | The Home Depot, Inc. | 233.89 | 2.0 | 256,144.6 | 23.2 | 47.4 |

| HE | Hawaiian Electric Industries, Inc. | 45.62 | 2.8 | 4,971.3 | 24.4 | 67.4 |

| HEES | H&E Equipment Services, Inc. | 31.72 | 3.5 | 1,134.9 | 13.6 | 47.2 |

| HES | Hess Corp. | 66.87 | 1.5 | 20,360.6 | -417.9 | -625.0 |

| HFC | HollyFrontier Corp. | 56.04 | 2.4 | 9,223.0 | 10.4 | 24.4 |

| HGT | Hugoton Royalty Trust | 0.00 | 0.0 | 0.0 | ||

| HI | Hillenbrand, Inc. | 31.26 | 2.7 | 1,959.0 | 13.9 | 37.3 |

| HIHO | Highway Holdings Ltd. | 1.76 | 0.0 | 6.7 | -8.2 | 0.0 |

| HII | Huntington Ingalls Industries, Inc. | 220.72 | 1.5 | 9,123.5 | 13.7 | 20.4 |

| HIW | Highwoods Properties, Inc. | 45.63 | 4.1 | 4,732.9 | 37.0 | 153.3 |

| HL | Hecla Mining Co. | 2.13 | 0.5 | 985.4 | -8.5 | -4.2 |

| HLI | Houlihan Lokey, Inc. | 45.91 | 2.4 | 3,062.4 | 16.5 | 40.0 |

| HLT | Hilton Worldwide Holdings, Inc. | 96.91 | 0.6 | 27,799.1 | 30.2 | 18.7 |

| HMN | Horace Mann Educators Corp. | 44.56 | 2.6 | 1,835.8 | 15.7 | 40.4 |

| HNI | HNI Corp. | 39.36 | 3.1 | 1,653.2 | 19.3 | 59.5 |

| HNNA | Hennessy Advisors, Inc. | 11.15 | 3.9 | 83.6 | 7.1 | 27.5 |

| HOFT | Hooker Furniture Corp. | 22.39 | 2.6 | 265.1 | 8.8 | 23.1 |

| HOG | Harley-Davidson, Inc. | 38.75 | 3.9 | 6,073.4 | 14.9 | 57.7 |

| HOMB | Home Bancshares, Inc. (Arkansas) | 18.51 | 2.7 | 3,088.6 | 10.9 | 29.5 |

| HON | Honeywell International, Inc. | 171.46 | 1.9 | 122,513.8 | 19.8 | 37.8 |

| HP | Helmerich & Payne, Inc. | 39.33 | 7.2 | 4,304.0 | -57.6 | -415.8 |

| HPP | Hudson Pacific Properties, Inc. | 34.33 | 2.9 | 10,628.8 | 1,505.5 | 4,384.0 |

| HRC | Hill-Rom Holdings, Inc. | 98.69 | 0.8 | 6,594.0 | 30.7 | 25.5 |

| HRS | Harris Corp. | 189.13 | 1.4 | 22,341.2 | 24.9 | 34.6 |

| HRTG | Heritage Insurance Holdings, Inc. | 13.79 | 1.7 | 415.6 | 21.4 | 37.0 |

| HSY | The Hershey Co. | 146.37 | 2.0 | 30,676.0 | 24.5 | 48.4 |

| HTHT | Huazhu Group Ltd. | 37.16 | 0.0 | 10,521.9 | 73.5 | 0.0 |

| HTLD | Heartland Express, Inc. | 22.22 | 0.4 | 1,821.5 | 22.4 | 8.1 |

| HTLF | Heartland Financial USA, Inc. | 45.44 | 1.3 | 1,667.2 | 11.1 | 14.7 |

| HUBB | Hubbell, Inc. | 138.76 | 2.4 | 7,549.8 | 20.5 | 48.6 |

| HUN | Huntsman Corp. | 21.24 | 2.8 | 5,392.5 | 16.2 | 44.8 |

| HVT | Haverty Furniture Cos., Inc. | 20.87 | 3.5 | 410.2 | 15.6 | 53.9 |

| HWC | Hancock Whitney Corp. | 39.69 | 2.7 | 3,581.4 | 10.4 | 28.5 |

| HY | Hyster-Yale Materials Handling, Inc. | 50.76 | 2.5 | 649.2 | 24.9 | 61.3 |

| IBKR | Interactive Brokers Group, Inc. | 45.62 | 0.9 | 22,452.7 | 21.6 | 18.9 |

| IBM | International Business Machines Corp. | 134.07 | 4.8 | 118,769.3 | 15.5 | 73.7 |

| ICBK | County Bancorp, Inc. (Manitowoc, Wisconsin) | 21.89 | 1.0 | 147.3 | 9.5 | 9.6 |

| ICE | Intercontinental Exchange, Inc. | 92.91 | 1.1 | 52,068.2 | 26.1 | 28.9 |

| ICL | ICL-Israel Chemicals Ltd. | 4.57 | 4.4 | 5,864.0 | 11.5 | 50.3 |

| IDT | IDT Corp. | 6.98 | 0.0 | 185.0 | 11,633.3 | 0.0 |

| IGT | International Game Technology Plc | 13.31 | 6.0 | 2,721.0 | -79.0 | -474.8 |

| INTC | Intel Corp. | 52.23 | 2.4 | 231,378.9 | 12.0 | 28.2 |

| IP | International Paper Co. | 42.19 | 4.7 | 16,573.8 | 10.6 | 49.7 |

| IPG | Interpublic Group of Cos., Inc. | 21.48 | 4.3 | 8,317.6 | 12.7 | 53.9 |

| IPHS | Innophos Holdings, Inc. | 32.20 | 6.0 | 634.1 | 21.8 | 129.8 |

| IR | Ingersoll-Rand Plc | 119.75 | 1.8 | 28,928.8 | 20.5 | 36.3 |

| IRT | Independence Realty Trust, Inc. | 15.08 | 4.8 | 1,369.7 | 37.0 | 177.2 |

| ITIC | Investors Title Co. | 172.77 | 0.9 | 326.4 | 14.2 | 13.2 |

| ITT | ITT, Inc. | 59.70 | 0.9 | 5,253.6 | 17.4 | 16.4 |

| ITUB | Itaú Unibanco Holding SA | 9.15 | 6.3 | 43,064.7 | 13.2 | 82.3 |

| IVZ | Invesco Ltd. | 16.94 | 7.2 | 15,916.6 | 14.5 | 104.6 |

| JACK | Jack in the Box, Inc. | 83.51 | 1.9 | 2,156.6 | 24.2 | 46.4 |

| JBL | Jabil, Inc. | 36.45 | 0.9 | 5,574.2 | 19.9 | 17.5 |

| JBT | John Bean Technologies Corp. | 105.43 | 0.4 | 3,338.2 | 27.4 | 10.4 |

| JCOM | j2 Global, Inc. | 93.82 | 1.9 | 4,589.4 | 31.1 | 58.3 |

| JE | Just Energy Group, Inc. | 2.38 | 15.5 | 365.3 | -1.3 | -20.2 |

| JKHY | Jack Henry & Associates, Inc. | 139.02 | 1.1 | 10,697.6 | 39.5 | 43.7 |

| JLL | Jones Lang LaSalle, Inc. | 144.59 | 0.6 | 7,449.5 | 14.1 | 8.2 |

| JMP | JMP Group LLC | 3.37 | 0.0 | 65.1 | 17.9 | 0.0 |

| JNJ | Johnson & Johnson | 127.50 | 2.9 | 336,494.2 | ||

| JNPR | Juniper Networks, Inc. | 24.51 | 3.0 | 8,476.0 | 17.2 | 51.9 |

| JRVR | James River Group Holdings Ltd. | 34.59 | 3.5 | 1,050.7 | 14.0 | 48.6 |

| JWN | Nordstrom, Inc. | 36.28 | 4.1 | 5,620.3 | 11.9 | 48.5 |

| K | Kellogg Co. | 61.66 | 3.6 | 21,003.4 | 24.5 | 88.9 |

| KELYA | Kelly Services, Inc. | 23.53 | 1.3 | 927.6 | 8.1 | 10.2 |

| KEQU | Kewaunee Scientific Corp. | 15.50 | 4.9 | 42.6 | 71.7 | 351.5 |

| KEY | KeyCorp | 18.18 | 3.8 | 17,971.6 | 11.2 | 42.7 |

| KFRC | Kforce, Inc. | 39.21 | 1.8 | 951.0 | 18.1 | 33.3 |

| KHC | The Kraft Heinz Co. | 28.45 | 7.2 | 34,708.7 | -3.1 | -22.5 |

| KINS | Kingstone Cos., Inc. | 8.19 | 4.9 | 88.3 | -33.6 | -164.3 |

| KLAC | KLA Corp. | 168.74 | 1.8 | 26,739.0 | 22.3 | 39.7 |

| KNL | Knoll, Inc. | 26.24 | 2.4 | 1,305.6 | 15.1 | 35.8 |

| KNX | Knight-Swift Transportation Holdings, Inc. | 37.49 | 0.6 | 6,428.3 | 15.4 | 9.8 |

| KO | The Coca-Cola Co. | 54.61 | 2.9 | 233,949.2 | 30.2 | 87.9 |

| KR | The Kroger Co. | 24.93 | 2.3 | 19,984.4 | 12.2 | 28.3 |

| KRNY | Kearny Financial Corp. | 13.57 | 1.5 | 1,188.7 | 28.9 | 44.7 |

| KRO | Kronos Worldwide, Inc. | 12.13 | 5.8 | 1,404.7 | 12.1 | 69.7 |

| KSS | Kohl's Corp. | 52.32 | 4.9 | 8,325.5 | 11.5 | 56.1 |

| L | Loews Corp. | 50.84 | 0.5 | 15,373.0 | 20.8 | 10.2 |

| LABL | Multi-Color Corp. | 50.01 | 0.4 | 1,027.4 | -35.7 | -14.3 |

| LANC | Lancaster Colony Corp. | 138.98 | 1.8 | 3,821.0 | 25.4 | 46.6 |

| LAND | Gladstone Land Corp. | 11.93 | 4.5 | 248.3 | ||

| LB | L Brands, Inc. | 17.54 | 10.3 | 4,847.9 | 8.4 | 86.1 |

| LCNB | LCNB Corp. | 17.69 | 3.8 | 228.7 | 12.1 | 46.5 |

| LDOS | Leidos Holdings, Inc. | 80.04 | 1.6 | 11,510.4 | 17.8 | 28.5 |

| LEA | Lear Corp. | 123.79 | 2.4 | 7,415.4 | 8.9 | 21.2 |

| LFUS | Littelfuse, Inc. | 185.96 | 0.9 | 4,572.4 | 27.7 | 25.7 |

| LKSD | LSC Communications, Inc. | 1.13 | 92.0 | 37.9 | -0.2 | -20.4 |

| LLL | L3 Technologies, Inc. | 245.17 | 1.3 | 19,479.0 | 22.7 | 30.5 |

| LLY | Eli Lilly & Co. | 107.84 | 2.3 | 104,112.3 | ||

| LMAT | LeMaitre Vascular, Inc. | 34.37 | 0.9 | 682.1 | 36.5 | 32.9 |

| LMT | Lockheed Martin Corp. | 374.74 | 2.3 | 105,825.8 | 17.7 | 41.5 |

| LSTR | Landstar System, Inc. | 114.99 | 0.6 | 4,557.0 | 17.9 | 10.3 |

| LTC | LTC Properties, Inc. | 52.92 | 4.3 | 2,103.7 | 19.7 | 85.0 |

| LVS | Las Vegas Sands Corp. | 61.16 | 5.0 | 47,080.3 | 24.5 | 121.8 |

| LW | Lamb Weston Holdings, Inc. | 74.60 | 1.1 | 10,896.3 | 22.9 | 24.3 |

| LYB | LyondellBasell Industries NV | 88.36 | 4.6 | 29,622.3 | 9.2 | 42.4 |

| LZB | La-Z-Boy, Inc. | 35.64 | 1.4 | 1,662.0 | 24.5 | 35.1 |

| MAC | Macerich Co. | 28.00 | 10.7 | 4,247.0 | 36.5 | 389.7 |

| MAIN | Main Street Capital Corp. | 42.30 | 5.6 | 2,670.6 | 16.5 | 93.0 |

| MAN | ManpowerGroup, Inc. | 89.75 | 2.3 | 5,411.9 | 11.2 | 26.0 |

| MANT | ManTech International Corp. | 68.99 | 1.5 | 2,759.1 | 31.4 | 47.3 |

| MAR | Marriott International, Inc. | 124.30 | 1.4 | 40,939.3 | 28.2 | 38.8 |

| MARPS | Marine Petroleum Trust | 2.19 | 14.9 | 4.4 | 6.9 | 102.8 |

| MATW | Matthews International Corp. | 36.77 | 2.1 | 1,157.8 | 18.6 | 40.0 |

| MATX | Matson, Inc. | 38.31 | 2.2 | 1,641.8 | 17.6 | 38.6 |

| MBCN | Middlefield Banc Corp. | 46.35 | 2.4 | 148.9 | 11.6 | 27.9 |

| MBFI | 0.00 | 0.0 | 0.0 | |||

| MBWM | Mercantile Bank Corp. | 35.20 | 3.0 | 571.8 | 12.1 | 36.1 |

| MCD | McDonald's Corp. | 196.02 | 2.4 | 148,866.2 | ||

| MCHP | Microchip Technology, Inc. | 94.17 | 1.5 | 22,416.6 | 60.0 | 92.9 |

| MCO | Moody's Corp. | 215.58 | 0.9 | 40,787.7 | 33.0 | 28.8 |

| MCS | Marcus Corp. | 35.74 | 1.7 | 1,115.6 | 23.2 | 39.9 |

| MCY | Mercury General Corp. | 53.35 | 4.7 | 2,953.2 | 15.1 | 70.8 |

| MDP | Meredith Corp. | 36.81 | 6.1 | 1,664.9 | -52.2 | -317.7 |

| MEOH | Methanex Corp. | 36.51 | 3.7 | 2,781.9 | 7.5 | 27.9 |

| MET | MetLife, Inc. | 46.28 | 3.7 | 43,338.8 | 7.5 | 27.7 |

| MFC | Manulife Financial Corp. | 18.60 | 3.9 | 36,446.6 | 8.6 | 33.8 |

| MFSF | MutualFirst Financial, Inc. | 32.36 | 2.5 | 275.0 | 12.4 | 30.6 |

| MGA | Magna International, Inc. | 54.30 | 2.6 | 16,881.5 | 6.9 | 17.9 |

| MGEE | MGE Energy, Inc. | 76.86 | 1.8 | 2,664.6 | 31.2 | 54.8 |

| MGM | MGM Resorts International | 28.22 | 1.8 | 14,714.7 | 80.5 | 142.6 |

| MGPI | MGP Ingredients, Inc. | 48.24 | 0.7 | 821.3 | 21.5 | 16.1 |

| MIXT | MiX Telematics Ltd. | 12.70 | 1.4 | 288.3 | 15.9 | 22.7 |

| MKSI | MKS Instruments, Inc. | 109.46 | 0.7 | 5,965.6 | 27.7 | 20.2 |

| MLAB | Mesa Laboratories, Inc. | 222.60 | 0.3 | 970.1 | 110.1 | 31.6 |

| MLI | Mueller Industries, Inc. | 30.73 | 1.3 | 1,741.3 | 17.3 | 22.5 |

| MLM | Martin Marietta Materials, Inc. | 264.90 | 0.7 | 16,540.4 | 32.8 | 23.8 |

| MLR | Miller Industries, Inc. (Tennessee) | 33.51 | 2.1 | 382.0 | 9.8 | 21.1 |

| MMM | 3M Co. | 161.89 | 3.5 | 93,131.9 | 19.2 | 66.3 |

| MNR | Monmouth Real Estate Investment Corp. | 14.72 | 4.6 | 1,405.2 | -387.4 | -1,789.5 |

| MNRO | Monro, Inc. | 68.85 | 1.2 | 2,287.5 | 28.0 | 33.3 |

| MOFG | MidWestOne Financial Group, Inc. | 30.76 | 2.6 | 498.8 | 12.3 | 31.9 |

| MOS | The Mosaic Co. | 19.92 | 0.6 | 7,686.5 | 29.8 | 18.7 |

| MOV | Movado Group, Inc. | 25.04 | 2.6 | 575.9 | 8.8 | 23.2 |

| MPC | Marathon Petroleum Corp. | 66.35 | 3.0 | 43,679.5 | 14.2 | 42.3 |

| MPX | Marine Products Corp. | 13.46 | 3.4 | 458.3 | 15.7 | 53.6 |

| MRO | Marathon Oil Corp. | 11.94 | 1.7 | 9,600.3 | 10.1 | 16.9 |

| MRTN | Marten Transport Ltd. | 22.22 | 0.5 | 1,213.5 | 19.9 | 10.3 |

| MSA | MSA Safety, Inc. | 111.77 | 1.4 | 4,327.6 | 35.4 | 49.4 |

| MSEX | Middlesex Water Co. | 65.58 | 0.0 | 1,086.5 | 31.8 | 0.0 |

| MSFT | Microsoft Corp. | 139.94 | 1.3 | 1,076,887.3 | 27.4 | 36.0 |

| MTB | M&T Bank Corp. | 156.28 | 2.6 | 20,675.6 | 11.2 | 28.7 |

| MTEX | Mannatech, Inc. | 16.39 | 7.6 | 39.2 | -68.8 | -524.3 |

| MTRN | Materion Corp. | 58.74 | 0.7 | 1,198.2 | 37.7 | 27.3 |

| MTX | Minerals Technologies, Inc. | 50.20 | 0.4 | 1,760.1 | 11.7 | 4.7 |

| MUR | Murphy Oil Corp. | 19.64 | 5.1 | 3,186.6 | 10.2 | 52.1 |

| MXIM | Maxim Integrated Products, Inc. | 57.13 | 3.2 | 15,487.7 | 18.9 | 61.0 |

| NAO | Hermitage Offshore Services Ltd. | 3.47 | 8.6 | 65.0 | -0.1 | -1.0 |

| NAT | Nordic American Tankers Ltd. | 3.80 | 5.0 | 544.8 | -9.3 | -46.4 |

| NATI | National Instruments Corp. | 40.86 | 2.3 | 5,388.8 | 35.7 | 83.8 |

| NAVG | The Navigators Group, Inc. | 69.96 | 0.4 | 2,096.7 | 1,231.7 | 493.0 |

| NAVI | Navient Corp. | 13.11 | 4.9 | 3,021.8 | 6.3 | 30.5 |

| NBHC | National Bank Holdings Corp. | 33.66 | 2.1 | 1,048.1 | 13.4 | 28.7 |

| NBTB | NBT Bancorp, Inc. | 37.34 | 2.8 | 1,634.6 | 13.8 | 38.1 |

| NC | NACCO Industries, Inc. | 64.11 | 1.1 | 448.1 | 10.3 | 11.0 |

| NCMI | National CineMedia, Inc. | 8.63 | 7.9 | 2,011.2 | 18.8 | 148.4 |

| NDAQ | Nasdaq, Inc. | 100.99 | 1.8 | 16,631.8 | 31.7 | 57.1 |

| NEE | NextEra Energy, Inc. | 237.55 | 2.0 | 116,102.8 | ||

| NEM | Newmont Goldcorp Corp. | 39.10 | 1.4 | 32,057.9 | -287.5 | -411.8 |

| NEWT | Newtek Business Services Corp. | 22.26 | 8.3 | 426.5 | 11.2 | 92.4 |

| NHC | National HealthCare Corp. | 80.49 | 2.5 | 1,233.0 | 16.5 | 41.5 |

| NKSH | National Bankshares, Inc. | 41.41 | 3.1 | 268.8 | 16.1 | 50.5 |

| NLSN | Nielsen Holdings Plc | 21.31 | 6.6 | 7,579.4 | -11.0 | -72.2 |

| NNA | Navios Maritime Acquisition Corp. | 8.14 | 14.7 | 1,163.1 | -1.6 | -23.8 |

| NNBR | NN, Inc. | 6.41 | 4.4 | 271.6 | -1.0 | -4.4 |

| NNI | Nelnet, Inc. | 60.21 | 1.2 | 2,389.3 | 18.7 | 21.8 |

| NOC | Northrop Grumman Corp. | 356.91 | 1.4 | 60,388.5 | 17.4 | 23.9 |

| NOV | National Oilwell Varco, Inc. | 20.73 | 1.0 | 7,999.6 | -1.5 | -1.4 |

| NP | Neenah, Inc. | 61.37 | 2.8 | 1,037.8 | 20.2 | 56.6 |

| NPO | EnPro Industries, Inc. | 69.48 | 1.4 | 1,430.8 | 42.2 | 59.5 |

| NRIM | Northrim BanCorp, Inc. | 37.73 | 3.0 | 251.8 | 13.9 | 41.9 |

| NSA | National Storage Affiliates Trust | 35.57 | 3.4 | 3,286.5 | -149.5 | -508.4 |

| NSC | Norfolk Southern Corp. | 183.18 | 1.9 | 48,250.9 | ||

| NSP | Insperity, Inc. | 106.16 | 0.9 | 4,402.8 | 26.5 | 24.8 |

| NTES | NetEase, Inc. | 282.88 | 0.9 | 36,197.5 | 28.3 | 26.5 |

| NUS | Nu Skin Enterprises, Inc. | 44.48 | 3.3 | 2,470.7 | 19.8 | 65.5 |

| NVDA | NVIDIA Corp. | 196.86 | 0.3 | 119,887.7 | 43.7 | 14.0 |

| NWE | NorthWestern Corp. | 74.28 | 3.0 | 3,746.9 | 17.4 | 52.7 |

| NWL | Newell Brands, Inc. | 19.45 | 4.7 | 8,235.1 | -1.2 | -5.7 |

| NWLI | National Western Life Group, Inc. | 269.99 | 0.0 | 981.7 | 7.3 | 0.0 |

| NX | Quanex Building Products Corp. | 18.59 | 1.7 | 616.5 | -64.1 | -110.4 |

| NXRT | NexPoint Residential Trust, Inc. | 48.19 | 2.2 | 1,155.0 | -64.4 | -143.6 |

| NXST | Nexstar Media Group, Inc. | 102.69 | 1.6 | 4,714.6 | 12.5 | 20.1 |

| NYLD | Clearway Energy, Inc. | 0.00 | 0.0 | 0.0 | ||

| NYRT | New York REIT, Inc. | 0.00 | 0.0 | 0.0 | ||

| O | Realty Income Corp. | 80.85 | 3.3 | 25,728.7 | 61.7 | 204.4 |

| OCSI | Oaktree Strategic Income Corp. | 8.12 | 7.6 | 239.3 | 19.4 | 148.1 |

| OCSL | Oaktree Specialty Lending Corp. | 5.17 | 7.4 | 728.8 | 5.0 | 36.8 |

| ODC | Oil-Dri Corp. of America | 33.25 | 2.9 | 253.0 | 18.3 | 53.5 |

| ODFL | Old Dominion Freight Line, Inc. | 183.18 | 0.3 | 14,708.4 | 23.2 | 7.6 |

| ODP | Office Depot, Inc. | 1.98 | 5.1 | 1,081.8 | 36.7 | 185.5 |

| OEC | Orion Engineered Carbons SA | 16.60 | 4.8 | 993.5 | 11.2 | 54.5 |

| OGS | ONE Gas, Inc. | 95.21 | 2.0 | 5,020.9 | 28.1 | 56.6 |

| OLBK | Old Line Bancshares, Inc. | 28.44 | 1.5 | 483.5 | 13.5 | 20.9 |

| OLED | Universal Display Corp. | 177.55 | 0.2 | 8,297.0 | 71.9 | 13.1 |

| OLN | Olin Corp. | 18.23 | 4.3 | 3,024.7 | 11.2 | 48.8 |

| OMI | Owens & Minor, Inc. | 7.11 | 4.8 | 447.6 | -1.5 | -7.1 |

| ONB | Old National Bancorp | 18.00 | 2.9 | 3,065.7 | 13.1 | 37.8 |

| OPOF | Old Point Financial Corp. | 24.10 | 1.9 | 125.4 | 18.8 | 36.0 |

| ORA | Ormat Technologies, Inc. | 76.04 | 0.6 | 3,877.4 | 43.5 | 24.0 |

| ORAN | Orange SA | 16.35 | 0.0 | 43,372.7 | 17.3 | 0.0 |

| ORC | Orchid Island Capital, Inc. | 5.75 | 16.9 | 362.6 | -20.2 | -341.4 |

| ORI | Old Republic International Corp. | 22.96 | 3.4 | 6,961.5 | 9.2 | 31.7 |

| ORIT | Oritani Financial Corp. | 18.73 | 5.3 | 844.7 | 15.8 | 84.6 |

| OSB | Norbord, Inc. | 28.50 | 15.8 | 2,328.5 | 28.6 | 450.8 |

| OTEX | Open Text Corp. | 39.94 | 1.6 | 10,768.1 | 37.6 | 59.4 |

| OTTR | Otter Tail Corp. | 55.38 | 2.5 | 2,201.6 | 27.7 | 68.6 |

| OUT | OUTFRONT Media, Inc. | 26.63 | 5.4 | 3,817.2 | 23.7 | 128.1 |

| PAAS | Pan American Silver Corp. | 17.35 | 0.9 | 3,406.2 | -86.1 | -74.1 |

| PAG | Penske Automotive Group, Inc. | 48.63 | 3.1 | 3,992.0 | 9.2 | 28.3 |

| PAHC | Phibro Animal Health Corp. | 22.44 | 2.0 | 910.6 | 16.6 | 33.9 |

| PBA | Pembina Pipeline Corp. | 35.52 | 4.9 | 18,168.5 | 15.5 | 75.6 |

| PBI | Pitney Bowes, Inc. | 5.16 | 9.2 | 885.3 | ||

| PBIP | Prudential Bancorp, Inc. | 17.37 | 1.2 | 154.4 | 16.4 | 18.8 |

| PBT | Permian Basin Royalty Trust | 4.03 | 12.2 | 187.8 | 8.2 | 100.0 |

| PCAR | PACCAR, Inc. | 75.30 | 1.7 | 26,031.2 | 10.7 | 18.3 |

| PCH | PotlatchDeltic Corp. | 43.19 | 3.7 | 2,894.4 | 32.3 | 119.9 |

| PEBK | Peoples Bancorp of North Carolina, Inc. | 30.42 | 1.8 | 179.8 | 12.4 | 22.5 |

| PEG | Public Service Enterprise Group, Inc. | 63.20 | 2.9 | 31,956.2 | 21.8 | 63.4 |

| PEI | Pennsylvania Real Estate Investment Trust | 6.12 | 13.7 | 474.6 | -3.4 | -46.7 |

| PFBI | Premier Financial Bancorp, Inc. | 17.57 | 3.4 | 257.3 | 10.7 | 36.5 |

| PFE | Pfizer Inc. | 36.39 | 3.9 | 201,274.9 | 16.3 | 63.7 |

| PFG | Principal Financial Group, Inc. | 57.40 | 3.7 | 16,002.9 | 10.7 | 40.1 |

| PFIS | Peoples Financial Services Corp. | 48.14 | 2.8 | 356.2 | 13.1 | 36.9 |

| PFLT | PennantPark Floating Rate Capital Ltd. | 11.53 | 9.9 | 447.0 | 29.7 | 293.6 |

| PFS | Provident Financial Services, Inc. | 24.98 | 3.5 | 1,664.2 | 12.8 | 45.2 |

| PH | Parker-Hannifin Corp. | 185.75 | 1.7 | 23,868.7 | 16.0 | 27.1 |

| PHX | Panhandle Oil & Gas, Inc. | 14.11 | 1.1 | 231.2 | 14.9 | 16.9 |

| PII | Polaris Industries Inc. | 100.76 | 2.4 | 6,158.8 | 19.5 | 47.1 |

| PLD | Prologis, Inc. | 92.09 | 2.2 | 58,177.3 | 32.6 | 73.3 |

| PLOW | Douglas Dynamics, Inc. | 45.61 | 2.4 | 1,039.7 | 21.1 | 49.8 |

| PLT | Plantronics, Inc. | 37.46 | 1.6 | 1,482.5 | -7.5 | -12.1 |

| PME | Pingtan Marine Enterprise, Ltd. | 2.05 | 0.5 | 162.1 | 13.2 | 6.4 |

| PNW | Pinnacle West Capital Corp. | 95.09 | 3.1 | 10,679.0 | 21.2 | 64.8 |

| POPE | Pope Resources LP | 76.36 | 5.0 | 332.5 | 53.2 | 264.8 |

| POWI | Power Integrations, Inc. | 93.21 | 0.7 | 2,603.4 | 46.6 | 34.7 |

| POWL | Powell Industries, Inc. | 38.61 | 2.7 | 446.6 | 91.4 | 246.1 |

| PPG | PPG Industries, Inc. | 123.58 | 1.6 | 29,222.1 | 24.3 | 38.3 |

| PRGO | Perrigo Co. Plc | 53.99 | 1.4 | 7,345.6 | 83.8 | 121.1 |

| PRGS | Progress Software Corp. | 39.21 | 1.6 | 1,756.1 | 35.5 | 56.1 |

| PRI | Primerica, Inc. | 126.00 | 0.9 | 5,277.0 | 15.6 | 14.6 |

| PRK | Park National Corp. | 97.38 | 4.1 | 1,594.6 | 15.7 | 63.5 |

| PROV | Provident Financial Holdings, Inc. | 20.29 | 2.8 | 151.8 | 34.3 | 94.8 |

| PRU | Prudential Financial, Inc. | 91.26 | 4.2 | 36,686.5 | 9.2 | 38.1 |

| PSA | Public Storage | 241.37 | 3.3 | 42,142.7 | 28.8 | 95.4 |

| PSB | PS Business Parks, Inc. | 181.42 | 2.3 | 4,976.5 | 44.1 | 102.1 |

| PSX | Phillips 66 | 110.63 | 3.0 | 49,672.9 | 9.5 | 28.4 |

| PTEN | Patterson-UTI Energy, Inc. | 8.65 | 1.9 | 1,734.3 | -5.3 | -9.8 |

| PTVCA | Protective Insurance Corp. | 15.40 | 4.9 | 221.6 | -7.0 | -34.8 |

| PTVCB | Protective Insurance Corp. | 16.04 | 4.7 | 230.8 | -7.3 | -34.8 |

| PVH | PVH Corp. | 90.84 | 0.2 | 6,735.2 | 10.1 | 1.7 |

| PWOD | Penns Woods Bancorp, Inc. | 30.20 | 4.2 | 212.6 | 13.1 | 54.4 |

| PX | Praxair, Inc. | 0.00 | 0.0 | 0.0 | ||

| QCOM | QUALCOMM, Inc. | 78.99 | 3.1 | 96,025.0 | 27.7 | 87.0 |

| QUAD | Quad/Graphics, Inc. | 10.52 | 11.4 | 555.4 | -15.0 | -171.4 |

| R | Ryder System, Inc. | 53.39 | 4.0 | 2,847.6 | 8.9 | 35.9 |

| RBA | Ritchie Bros. Auctioneers, Inc. | 40.37 | 1.8 | 4,333.5 | 33.5 | 60.1 |

| RCKY | Rocky Brands, Inc. | 27.92 | 1.8 | 206.5 | 13.4 | 24.0 |

| RDN | Radian Group Inc. | 24.80 | 0.0 | 5,041.4 | 8.5 | 0.3 |

| RE | Everest Re Group Ltd. | 249.67 | 2.2 | 10,171.6 | 19.6 | 43.2 |

| RECN | Resources Connection, Inc. | 14.61 | 3.6 | 467.9 | 15.1 | 54.9 |

| REIS | Reis, Inc. | 0.00 | 0.0 | 0.0 | ||

| RES | RPC, Inc. | 4.64 | 0.0 | 997.8 | -19.3 | 0.0 |

| RGT | Royce Global Value Trust, Inc. | 10.30 | 0.0 | 107.8 | 100.7 | 0.0 |

| RHI | Robert Half International, Inc. | 58.08 | 2.0 | 6,827.9 | 15.1 | 30.7 |

| RICK | RCI Hospitality Holdings, Inc. | 19.83 | 0.7 | 190.7 | 11.9 | 7.8 |

| RLI | RLI Corp. | 95.95 | 0.9 | 4,301.6 | ||

| RMCF | Rocky Mountain Chocolate Factory, Inc. | 9.14 | 5.3 | 54.8 | 21.0 | 110.5 |

| RMD | ResMed, Inc. | 127.73 | 1.2 | 18,363.6 | 45.2 | 52.4 |

| RNR | RenaissanceRe Holdings Ltd. | 185.46 | 0.7 | 8,190.3 | 13.7 | 9.9 |

| ROIC | Retail Opportunity Investments Corp. | 18.85 | 4.2 | 2,149.1 | 48.0 | 200.3 |

| ROK | Rockwell Automation, Inc. | 173.63 | 2.2 | 20,316.1 | 20.1 | 44.4 |

| ROL | Rollins, Inc. | 38.60 | 1.1 | 12,641.0 | 62.1 | 65.7 |

| ROST | Ross Stores, Inc. | 110.44 | 0.9 | 39,949.5 | 24.9 | 21.6 |

| ROYT | Pacific Coast Oil Trust | 1.34 | 23.7 | 51.7 | 4.1 | 97.4 |

| RRC | Range Resources Corp. | 3.83 | 2.1 | 957.7 | -0.6 | -1.2 |

| RRD | R.R. Donnelley & Sons Co. | 4.79 | 2.5 | 339.1 | -89.5 | -224.3 |

| RS | Reliance Steel & Aluminum Co. | 113.51 | 1.9 | 7,521.4 | 12.8 | 23.7 |

| RWT | Redwood Trust, Inc. | 16.72 | 7.2 | 1,874.1 | 12.3 | 87.9 |

| RYAM | Rayonier Advanced Materials, Inc. | 4.48 | 6.2 | 284.0 | -172.3 | -1,074.5 |

| RYN | Rayonier, Inc. | 29.10 | 3.7 | 3,772.2 | 54.5 | 202.3 |

| SABR | Sabre Corp. | 21.35 | 2.6 | 5,837.5 | 24.3 | 63.7 |

| SAFT | Safety Insurance Group, Inc. | 99.51 | 3.2 | 1,530.9 | 14.7 | 47.2 |

| SALM | Salem Media Group, Inc. | 1.59 | 16.4 | 33.5 | -8.1 | -132.8 |

| SAMG | Silvercrest Asset Management Group, Inc. | 12.25 | 4.7 | 164.8 | 12.0 | 56.7 |

| SBGI | Sinclair Broadcast Group, Inc. | 42.04 | 1.9 | 3,831.0 | 12.2 | 22.9 |

| SBR | Sabine Royalty Trust | 38.47 | 9.2 | 560.9 | 11.2 | 102.9 |

| SBUX | Starbucks Corp. | 83.18 | 1.7 | 99,566.5 | 29.1 | 50.3 |

| SCHL | Scholastic Corp. | 37.60 | 1.6 | 1,313.3 | 74.6 | 118.5 |

| SCI | Service Corp. International | 45.90 | 1.5 | 8,370.4 | 20.1 | 30.7 |

| SCL | Stepan Co. | 95.12 | 1.1 | 2,145.6 | 20.3 | 21.3 |

| SCX | The L.S. Starrett Co. | 5.33 | 0.0 | 36.8 | 6.1 | 0.0 |

| SEE | Sealed Air Corp. | 41.22 | 1.6 | 6,369.6 | 17.6 | 27.4 |

| SELF | Global Self Storage, Inc. | 4.67 | 5.6 | 36.1 | 73.0 | 406.3 |

| SEMG | SemGroup Corp. | 15.99 | 11.8 | 1,258.2 | -18.5 | -219.1 |

| SF | Stifel Financial Corp. | 56.36 | 1.0 | 3,919.7 | 9.8 | 9.4 |

| SFL | SFL Corp Ltd | 14.97 | 9.4 | 1,610.9 | 17.5 | 163.5 |

| SGB | Southwest Georgia Financial Corp. | 20.31 | 2.4 | 51.7 | 10.1 | 23.9 |

| SHEN | Shenandoah Telecommunications Co. (Virginia) | 31.80 | 0.0 | 1,585.5 | 27.5 | 0.0 |

| SHW | The Sherwin-Williams Co. | 574.05 | 0.7 | 52,959.6 | 37.8 | 28.0 |

| SIGI | Selective Insurance Group, Inc. | 72.28 | 1.1 | 4,298.4 | 18.2 | 19.6 |

| SIX | Six Flags Entertainment Corp. | 44.15 | 7.4 | 3,724.3 | 13.8 | 102.6 |

| SJI | South Jersey Industries, Inc. | 32.02 | 3.6 | 2,958.3 | 40.3 | 143.6 |

| SJM | The J. M. Smucker Co. | 108.37 | 3.2 | 12,359.4 | 23.0 | 72.8 |

| SJR | Shaw Communications, Inc. | 19.05 | 4.7 | 9,802.5 | 16.9 | 79.3 |

| SJT | San Juan Basin Royalty Trust | 2.55 | 0.0 | 118.9 | 6.9 | 0.0 |

| SJW | SJW Group | 73.40 | 1.6 | 2,087.6 | 40.0 | 63.2 |

| SLF | Sun Life Financial, Inc. | 44.72 | 3.4 | 26,460.9 | 15.0 | 50.6 |

| SLGN | Silgan Holdings, Inc. | 30.48 | 1.4 | 3,388.6 | 17.1 | 24.2 |

| SMG | Scotts Miracle-Gro Co. | 97.18 | 2.3 | 5,230.0 | 14.6 | 34.1 |

| SMMF | Summit Financial Group, Inc. (West Virginia) | 25.49 | 2.2 | 317.9 | 10.6 | 23.3 |

| SMP | Standard Motor Products, Inc. | 49.76 | 1.8 | 1,110.7 | 22.0 | 38.9 |

| SNA | Snap-On, Inc. | 165.55 | 2.3 | 9,079.8 | 13.1 | 30.2 |

| SNR | New Senior Investment Group, Inc. | 7.17 | 7.3 | 596.0 | -4.6 | -33.1 |

| SO | The Southern Co. | 61.95 | 3.9 | 64,752.0 | 14.5 | 56.5 |

| SON | Sonoco Products Co. | 57.81 | 2.9 | 5,785.5 | ||

| SPAR | Spartan Motors, Inc. | 15.45 | 0.6 | 551.0 | 45.5 | 29.1 |

| SPGI | S&P Global, Inc. | 248.40 | 0.9 | 61,180.9 | 31.3 | 27.0 |

| SPKE | Spark Energy, Inc. | 9.40 | 7.7 | 331.6 | -12.4 | -95.8 |

| SPNS | Sapiens International Corp. NV | 19.99 | 1.0 | 1,001.0 | 47.7 | 47.7 |

| SPOK | Spok Holdings, Inc. | 11.29 | 4.4 | 217.1 | -1,008.0 | -4,464.3 |

| SPTN | SpartanNash Co. | 13.65 | 5.4 | 496.0 | 110.3 | 598.2 |

| SQM | Sociedad Quimica y Minera de Chile SA | 26.40 | 3.0 | 3,346.5 | 20.3 | 61.0 |

| SSI | Stage Stores, Inc. | 2.45 | 0.0 | 70.7 | -0.6 | 0.0 |

| SSNC | SS&C Technologies Holdings, Inc. | 50.11 | 0.7 | 12,804.7 | 39.3 | 28.0 |

| SSNT | SilverSun Technologies, Inc. | 3.61 | 0.0 | 16.2 | 58.0 | 0.0 |

| STAG | STAG Industrial, Inc. | 30.87 | 4.6 | 4,227.0 | ||

| STBZ | State Bank Financial Corporation | 0.00 | 0.0 | 0.0 | ||

| STC | Stewart Information Services Corp. | 40.86 | 2.9 | 967.7 | ||

| STE | STERIS Plc (Ireland) | 137.43 | 1.0 | 11,635.1 | 36.5 | 36.1 |

| STFC | State Auto Financial Corp. | 34.30 | 1.2 | 1,493.5 | 28.4 | 33.2 |

| STI | SunTrust Banks, Inc. | 68.43 | 3.0 | 30,385.2 | 12.4 | 37.5 |

| STM | STMicroelectronics NV | 22.34 | 0.9 | 20,092.9 | 17.8 | 16.2 |

| STNG | Scorpio Tankers, Inc. | 33.71 | 1.2 | 1,765.3 | -11.2 | -13.2 |

| STRA | Strategic Education, Inc. | 128.18 | 1.6 | 2,827.9 | -498.6 | -774.0 |

| STRT | STRATTEC Security Corp. | 20.30 | 2.8 | 76.0 | -4.4 | -12.3 |

| SU | Suncor Energy, Inc. | 30.30 | 3.9 | 47,197.5 | 11.1 | 43.2 |

| SVM | Silvercorp Metals, Inc. | 4.14 | 0.0 | 686.6 | 16.9 | 0.0 |

| SWK | Stanley Black & Decker, Inc. | 146.43 | 1.8 | 22,219.7 | 30.7 | 55.3 |

| SWKS | Skyworks Solutions, Inc. | 89.69 | 1.7 | 15,400.0 | 17.0 | 28.8 |

| SWM | Schweitzer-Mauduit International, Inc. | 40.15 | 4.4 | 1,240.5 | 14.4 | 62.6 |

| SWX | Southwest Gas Holdings, Inc. | 89.03 | 2.4 | 4,836.5 | 23.5 | 56.1 |

| SXT | Sensient Technologies Corp. | 61.28 | 2.3 | 2,593.3 | 19.6 | 46.1 |

| SYBT | Stock Yards Bancorp, Inc. | 39.04 | 2.6 | 887.1 | 13.8 | 36.0 |

| SYMC | Symantec Corp. | 23.03 | 1.3 | 14,233.3 | 124.7 | 162.4 |

| TACT | TransAct Technologies, Inc. | 11.76 | 3.1 | 87.8 | 19.5 | 59.8 |

| TAP | Molson Coors Brewing Co. | 58.90 | 2.8 | 12,739.5 | 14.2 | 39.6 |

| TBNK | Territorial Bancorp, Inc. | 28.88 | 3.0 | 279.3 | 12.7 | 38.7 |

| TCBK | TriCo Bancshares | 36.22 | 2.0 | 1,107.8 | 12.9 | 26.3 |

| TCO | Taubman Centers, Inc. | 37.79 | 7.0 | 2,313.1 | 51.1 | 359.6 |

| TDS | Telephone & Data Systems, Inc. | 26.00 | 2.5 | 2,977.3 | 19.1 | 47.8 |

| TECK | Teck Resources Ltd. | 16.33 | 0.9 | 8,888.1 | 4.8 | 4.5 |

| TEF | Telefónica SA | 7.91 | 0.0 | 40,463.2 | 10.9 | 0.0 |

| TEL | TE Connectivity Ltd. | 93.88 | 1.9 | 31,537.6 | 10.0 | 18.9 |

| TEN | Tenneco, Inc. | 14.03 | 0.0 | 1,121.6 | -10.0 | 0.0 |

| TER | Teradyne, Inc. | 63.24 | 0.6 | 10,725.3 | 22.6 | 12.9 |

| TEVA | Teva Pharmaceutical Industries Ltd. | 8.07 | 0.0 | 8,919.7 | -2.1 | 0.0 |

| TEX | Terex Corp. | 28.49 | 1.5 | 2,016.4 | 548.9 | 814.1 |

| TFSL | TFS Financial Corp. | 18.93 | 5.3 | 5,300.0 | 65.5 | 345.9 |

| TFX | Teleflex, Inc. | 320.66 | 0.4 | 14,825.1 | 54.4 | 23.1 |

| TGI | Triumph Group, Inc. | 20.05 | 0.8 | 1,009.7 | -4.4 | -3.5 |

| TGT | Target Corp. | 110.25 | 2.3 | 56,329.9 | 18.1 | 42.3 |

| THFF | First Financial Corp. (Indiana) | 43.18 | 2.4 | 594.4 | 11.9 | 28.3 |

| THG | The Hanover Insurance Group, Inc. | 131.91 | 1.8 | 5,217.6 | 17.9 | 31.8 |

| TIER | TIER REIT, Inc. | 28.88 | 2.5 | 1,603.4 | -56.4 | -140.5 |

| TIVO | TiVo Corp. | 7.96 | 7.8 | 1,001.2 | -2.8 | -22.1 |

| TKC | TURKCELL Iletisim Hizmetleri AS | 5.57 | 0.0 | 4,867.6 | 13.4 | 0.0 |

| TKR | The Timken Co. | 46.54 | 2.4 | 3,539.0 | 11.2 | 27.1 |

| TLRD | Tailored Brands, Inc. | 4.78 | 15.1 | 242.1 | 3.9 | 58.9 |

| TNC | Tennant Co. | 70.00 | 1.2 | 1,274.4 | 33.6 | 41.8 |

| TOWR | Tower International, Inc. | 31.00 | 1.6 | 641.4 | 64.2 | 105.6 |

| TPVG | TriplePoint Venture Growth BDC Corp. | 16.47 | 8.7 | 409.4 | 7.2 | 62.9 |

| TRCO | Tribune Media Co. | 46.66 | 2.1 | 4,125.2 | 11.3 | 24.2 |

| TRI | Thomson Reuters Corp. | 66.53 | 2.2 | 33,642.7 | 68.5 | 152.5 |

| TRK | Speedway Motorsports LLC | 19.78 | 3.0 | 808.1 | 21.5 | 65.2 |

| TRMK | Trustmark Corp. | 34.17 | 2.7 | 2,200.6 | 14.6 | 39.2 |

| TROW | T. Rowe Price Group, Inc. | 113.35 | 2.6 | 26,701.3 | 14.1 | 36.2 |

| TROX | Tronox Holdings Plc | 8.03 | 2.2 | 1,156.3 | -11.9 | -26.2 |

| TRV | The Travelers Cos., Inc. | 131.43 | 2.4 | 33,923.8 | 14.7 | 35.5 |

| TSCO | Tractor Supply Co. | 98.00 | 1.3 | 11,688.0 | 21.6 | 28.2 |

| TSLX | TPG Specialty Lending, Inc. | 21.17 | 7.4 | 1,403.0 | 10.0 | 74.0 |

| TSN | Tyson Foods, Inc. | 77.82 | 1.9 | 22,931.7 | 12.7 | 24.4 |

| TSU | TIM Participações SA | 14.54 | 2.0 | 7,004.6 | 6.7 | 13.6 |

| TTEK | Tetra Tech, Inc. | 87.71 | 0.6 | 4,793.3 | 27.5 | 16.0 |

| TWO | Two Harbors Investment Corp. | 13.75 | 13.2 | 3,752.4 | -4.9 | -64.3 |

| TXRH | Texas Roadhouse, Inc. | 48.60 | 2.3 | 3,364.6 | 22.5 | 51.1 |

| UBCP | United Bancorp, Inc. (Ohio) | 11.77 | 4.5 | 69.6 | 12.0 | 54.6 |

| UBOH | United Bancshares, Inc. (Ohio) | 20.76 | 2.4 | 67.9 | 8.2 | 19.7 |

| UCBA | United Community Bancorp | 0.00 | 0.0 | 0.0 | ||

| UE | Urban Edge Properties | 21.05 | 4.2 | 2,565.2 | 29.6 | 123.2 |

| UFAB | Unique Fabricating, Inc. | 2.59 | 0.0 | 25.3 | -3.4 | 0.0 |

| UFCS | United Fire Group, Inc. | 45.42 | 2.8 | 1,147.2 | 51.8 | 143.7 |

| UFPI | Universal Forest Products, Inc. | 50.73 | 0.8 | 3,094.7 | 19.4 | 14.6 |

| UHS | Universal Health Services, Inc. | 144.70 | 0.3 | 12,804.4 | 16.4 | 4.5 |

| UHT | Universal Health Realty Income Trust | 112.28 | 2.4 | 1,544.6 | 89.3 | 214.7 |

| UL | Unilever Plc | 59.45 | 3.0 | 69,431.6 | 14.7 | 44.1 |

| UMH | UMH Properties, Inc. | 14.80 | 4.9 | 598.4 | -12.7 | -61.9 |

| UN | Unilever NV | 58.69 | 2.6 | 85,675.0 | 14.5 | 37.9 |

| UNH | UnitedHealth Group, Inc. | 244.51 | 1.6 | 231,717.5 | ||

| UNP | Union Pacific Corp. | 170.39 | 2.1 | 118,284.7 | 20.0 | 41.4 |

| UNTY | Unity Bancorp, Inc. | 21.25 | 1.4 | 231.0 | 9.9 | 13.9 |

| USLM | United States Lime & Minerals, Inc. | 80.25 | 0.7 | 450.4 | 22.6 | 15.2 |

| USPH | U.S. Physical Therapy, Inc. | 141.30 | 0.7 | 1,797.3 | 78.2 | 55.6 |

| UTX | United Technologies Corp. | 143.44 | 2.0 | 123,802.8 | 24.0 | 49.2 |

| UVE | Universal Insurance Holdings, Inc. | 28.82 | 2.2 | 984.5 | 9.2 | 20.5 |

| V | Visa, Inc. | 176.16 | 0.5 | 306,236.5 | 33.8 | 18.4 |

| VET | Vermilion Energy, Inc. | 15.27 | 13.7 | 2,369.3 | 8.8 | 120.4 |

| VFC | VF Corp. | 90.82 | 2.2 | 36,162.4 | 31.3 | 68.6 |

| VGR | Vector Group Ltd. | 12.19 | 12.2 | 1,801.6 | 22.8 | 278.2 |

| VHI | Valhi, Inc. | 1.90 | 4.2 | 644.5 | 3.4 | 14.4 |

| VIRT | Virtu Financial, Inc. | 16.75 | 5.7 | 3,192.7 | 34.2 | 196.3 |

| VIV | Telefonica Brasil SA | 13.34 | 8.1 | 14,932.0 | 11.8 | 95.6 |

| VLO | Valero Energy Corp. | 96.91 | 3.5 | 40,159.8 | 15.9 | 55.9 |

| VMC | Vulcan Materials Co. | 145.40 | 0.8 | 19,234.5 | 34.1 | 27.7 |

| VOYA | Voya Financial, Inc. | 54.43 | 0.1 | 7,662.3 | 12.8 | 0.9 |

| VSH | Vishay Intertechnology, Inc. | 18.07 | 1.9 | 2,598.6 | 8.7 | 16.9 |

| VVC | Vectren Corporation | 0.00 | 0.0 | 0.0 | ||

| VVV | Valvoline, Inc. | 21.52 | 1.8 | 4,048.0 | 18.0 | 32.8 |

| WBA | Walgreens Boots Alliance, Inc. | 54.45 | 3.2 | 49,176.1 | 10.7 | 34.4 |

| WEBK | Wellesley Bancorp, Inc. | 31.08 | 0.7 | 79.6 | 12.7 | 9.2 |

| WEC | WEC Energy Group, Inc. | 94.01 | 2.4 | 29,654.1 | 27.1 | 65.9 |

| WEN | The Wendy's Co. | 21.33 | 1.7 | 4,907.7 | 10.6 | 18.5 |

| WFC | Wells Fargo & Co. | 51.10 | 3.6 | 218,151.0 | 11.0 | 39.4 |

| WHR | Whirlpool Corp. | 160.53 | 2.9 | 10,198.0 | 9.6 | 28.2 |

| WINA | Winmark Corp. | 183.00 | 0.4 | 699.6 | 22.5 | 9.8 |

| WLK | Westlake Chemical Corp. | 61.83 | 1.6 | 7,930.9 | 12.9 | 20.9 |

| WM | Waste Management, Inc. | 113.17 | 1.8 | 48,010.3 | 27.4 | 48.4 |

| WMB | The Williams Cos., Inc. | 23.22 | 6.2 | 28,143.1 | 305.9 | 1,897.2 |

| WMS | Advanced Drainage Systems, Inc. | 35.96 | 0.9 | 2,452.3 | -10.8 | -9.9 |

| WOR | Worthington Industries, Inc. | 35.78 | 2.6 | 2,001.0 | 21.7 | 56.3 |

| WPG | Washington Prime Group, Inc. | 4.34 | 23.0 | 809.8 | 24.2 | 558.7 |

| WPM | Wheaton Precious Metals Corp. | 27.91 | 1.3 | 12,017.9 | -476.3 | -636.5 |

| WRB | W.R. Berkley Corp. | 70.68 | 0.6 | 12,946.9 | 19.4 | 11.5 |

| WRI | Weingarten Realty Investors | 29.58 | 5.3 | 3,806.1 | 17.3 | 92.3 |

| WSR | Whitestone REIT | 14.05 | 8.1 | 565.3 | 30.9 | 250.4 |

| WTR | Aqua America, Inc. | 46.25 | 1.9 | 9,979.7 | 60.5 | 114.6 |

| WTS | Watts Water Technologies, Inc. | 91.90 | 0.9 | 3,115.6 | 24.6 | 23.0 |

| WU | The Western Union Co. | 24.77 | 3.1 | 10,499.8 | 8.9 | 28.1 |

| WWE | World Wrestling Entertainment, Inc. | 66.66 | 0.7 | 5,264.7 | 67.7 | 48.6 |

| WY | Weyerhaeuser Co. | 29.14 | 4.7 | 21,707.2 | 6,334.8 | 29,565.2 |

| WYND | Wyndham Destinations, Inc. | 45.09 | 3.8 | 4,134.7 | 9.9 | 38.2 |

| X | United States Steel Corp. | 11.46 | 1.8 | 1,924.3 | 2.0 | 3.6 |

| XEC | Cimarex Energy Co. | 44.76 | 1.7 | 4,541.2 | 7.2 | 12.3 |

| XIN | Xinyuan Real Estate Co. Ltd. | 4.09 | 9.5 | 245.0 | 2.0 | 19.5 |

| XLNX | Xilinx, Inc. | 93.12 | 1.6 | 23,522.6 | 25.1 | 39.0 |

| XOM | Exxon Mobil Corp. | 69.09 | 4.8 | 292,327.4 | 16.6 | 80.2 |

| XYL | Xylem, Inc. | 81.98 | 1.1 | 14,758.8 | 25.7 | 28.3 |

| YUM | Yum! Brands, Inc. | 108.95 | 1.4 | 33,152.0 | 25.4 | 36.4 |

| ZEUS | Olympic Steel, Inc. | 14.33 | 0.6 | 156.2 | 11.4 | 6.3 |

| ZTS | Zoetis, Inc. | 122.95 | 0.5 | 58,715.8 | 42.9 | 21.6 |

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio |

Keep reading this article to learn more about how to use our list of stocks that pay dividends in December to improve your investing outcomes.

How To Use Our List of Stocks That Pay Dividends in December to Find Investment Ideas

Having a list of every stock that pays dividends in December can be extremely useful.

This database becomes even more valuable when combined with a working knowledge of Microsoft Excel.

With that in mind, this tutorial will show you how to implement two interesting investing screens to the list of stocks that pay dividends in December.

The first screen that we’ll implement is for stocks that pay dividends in December with price-to-earnings ratios below 15 and dividend payout ratios between 50% and 100%.

Screen 1: Price-to-Earnings Ratios Below 15 and Payout Ratios Between 50% and 100%

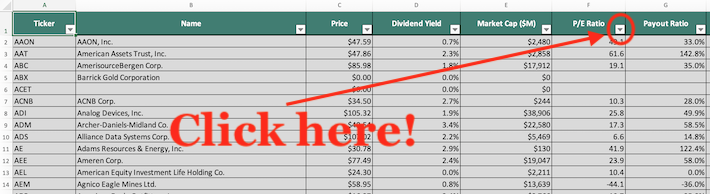

Step 1: Download your free list of stocks that pay dividends in December by clicking here. Apply the filter function to every column in the spreadsheet.

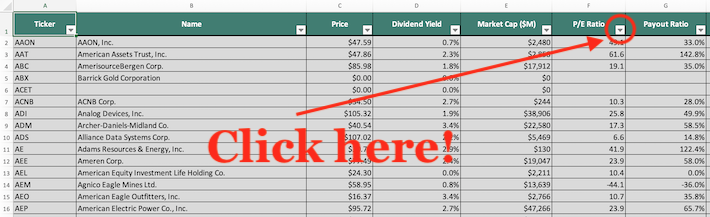

Step 2: Click the filter icon at the top of the price-to-earnings ratio column, as shown below.

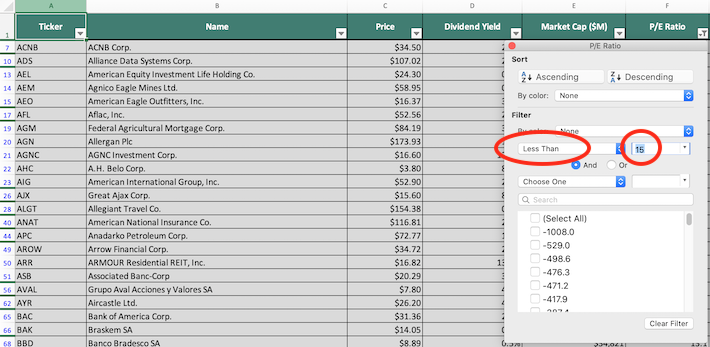

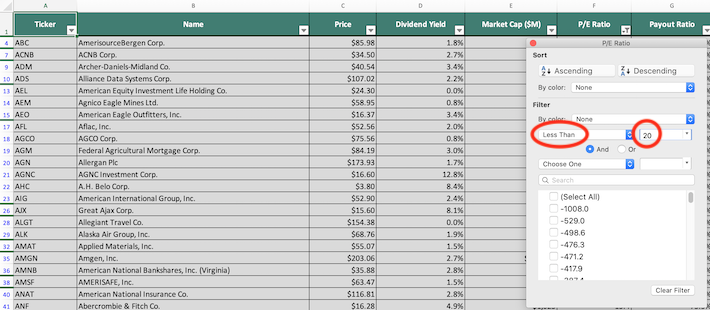

Step 3: Change the filter setting to “Less Than: and input 15 into the field beside it, as shown below. This will filter for stocks that pay dividends in December with price-to-earnings ratios below 15.

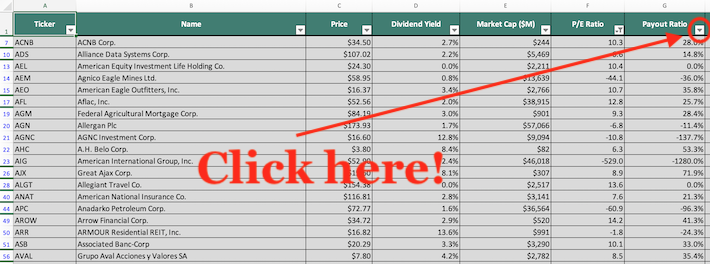

Step 4: Close out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button in the bottom right corner). Next, click the filter icon at the top of the payout ratio column, as shown below.

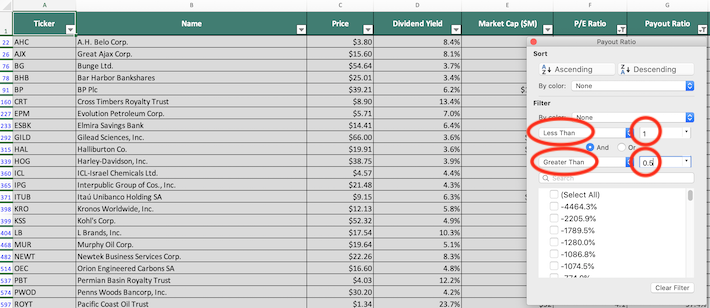

Step 5: Change the primary filter setting to “Less Than” and input 1 into the field beside it, as shown below. This will filter for stocks that pay dividends in December with dividend payout ratios below 100%.

Next, change the secondary filter setting to “Greater Than” and input 50% into the field beside it, as shown below.

The remaining stocks that show in this Excel sheet are stocks that pay dividends in December with price-to-earnings below 15 and dividend payout ratios between 50% and 100%.

The next screen that we’ll demonstrate how to implement is a filter designed to eliminate overvalued stocks. More specifically, we’ll demonstrate how to search for stocks with price-to-earnings ratios below 20 and dividend yields above 2%

Screen 2: Price-to-Earnings Ratios Below 20, Dividend Yield Above 2%

Step 1: Download your free list of stocks that pay dividends in December by clicking here. Apply the filter function to every column in the spreadsheet.

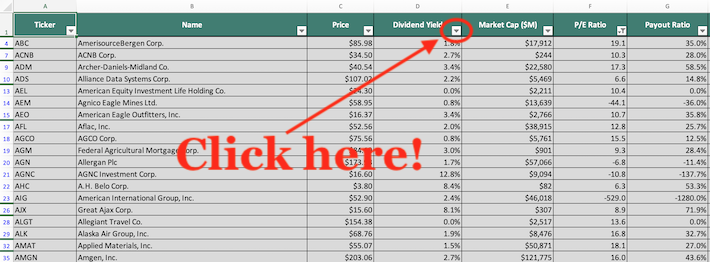

Step 2: Click the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter setting to “Less Than” and input 20 into the field beside it, as shown below. This will filter for stocks that pay dividends in December with price-to-earnings ratios below 20.

Step 4: Close out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button in the bottom right corner). Next, click the filter icon at the top of the dividend yield column, as shown below.

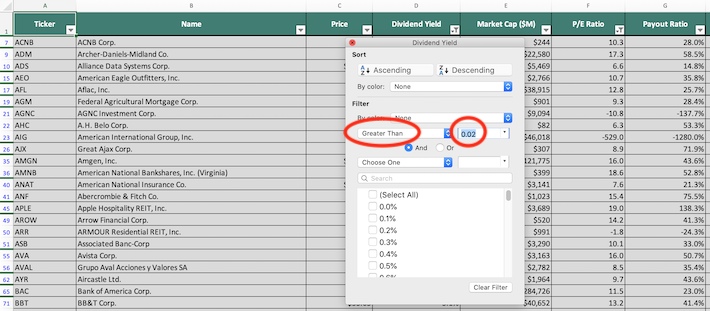

Step 5: Change the filter setting to “Greater Than” and type 2% into the field beside it, as shown below. This will filter for stocks that pay dividends in December with dividend yields above 2%.

The remaining stocks that show in this spreadsheet are stocks that pay dividends in December with price-to-earnings ratios below 20 and dividend yields above 2%.

You now have a solid, fundamental understanding of how to use the list of stocks that pay dividends in December to find investment ideas.

To close this article, we will introduce to you several other investing resources that will help you to make better decisions along your investing journey.

Final Thoughts: Other Useful Investing Resources

Having an Excel document that contains the name, tickers, and financial information for all stocks that pay dividends in December is quite useful – but it becomes far more useful when combined with other databases for the non-December months of the calendar year.

Fortunately, Sure Dividend also maintains similar databases for the other 11 months of the year. You can access these databases below:

- The Complete List of Stocks That Pay Dividends in January

- The Complete List of Stocks That Pay Dividends in February

- The Complete List of Stocks That Pay Dividends in March

- The Complete List of Stocks That Pay Dividends in April

- The Complete List of Stocks That Pay Dividends in May

- The Complete List of Stocks That Pay Dividends in June

- The Complete List of Stocks That Pay Dividends in July

- The Complete List of Stocks That Pay Dividends in August

- The Complete List of Stocks That Pay Dividends in September

- The Complete List of Stocks That Pay Dividends in October

- The Complete List of Stocks That Pay Dividends in November

These databases, used in conjunction with one another, will allow you to create a portfolio whose dividend income is diversified by calendar month.

Another important aspect of a well-diversified investment portfolio is sector diversification. For obvious reasons, having all of your money invested in energy stocks does not mean you’re diversified – even if you own 500 different energy stocks.

With this in mind, Sure Dividend maintains datbases for each of the 10 major sectors of the stock market. You can download these databases below:

- The Complete List of Dividend-Paying Utility Stocks

- The Complete List of Dividend-Paying Consumer Cyclical Stocks

- The Complete List of Dividend-Paying Consumer Staples Stocks

- The Complete List of Dividend-Paying Financial Sector Stocks

- The Complete List of Dividend-Paying Telecommunications Stocks

- The Complete List of Dividend-Paying Energy Stocks

- The Complete List of Dividend-Paying Technology Stocks

- The Complete List of Dividend-Paying Materials Stocks

- The Complete List of Dividend-Paying Healthcare Stocks

- The Complete List of Dividend-Paying Industrial Stocks

Diversification aside, we believe that some of the most compelling investment opportunities in the public markets exist with companies that have consistently increased they annual dividend payments over time.

With that principle in mind, the following Sure Dividend databases are great places to look for investment ideas:

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of consecutive dividend increases

- The Dividend Achievers List: dividend stocks with 10+ years of consecutive dividend increases

- The Dividend Kings List: dividend stocks with 50+ years of consecutive dividend increases

In fact, Sure Dividend’s entire research philosophy is focused on identifying companies with above-average total retru npotential combined with strong dividend growth prospects. We publish our research findings, which follow The 8 Rules of Dividend Investing, in the following monthly research publications:

- The Sure Dividend Newsletter: “normal” dividend growth stocks

- The Sure Retirement Newsletter: high yield dividend stocks

- The Sure Dividend International Newsletter: dividend growth stocks outside of the United States