Updated on July 25th, 2019 by Bob Ciura

The S&P 500 is the most widely-followed index of large-cap U.S. stocks. For this reason, it is an excellent place to look for potential investment ideas.

You can download an Excel document containing the S&P 500 index constituents, along with relevant financial metrics, below:

High yield investors will naturally be mostly interested in the highest-yielding stocks in the S&P 500.

With this in mind, today’s article covers the 10 highest yielding S&P 500 stocks in detail.

Table of Contents

- High Yield S&P 500 Stock #10: Occidental Petroleum (OXY)

- High Yield S&P 500 Stock #9: AbbVie Inc. (ABBV)

- High Yield S&P 500 Stock #8: Invesco Ltd. (IVZ)

- High Yield S&P 500 Stock #7: AT&T (T)

- High Yield S&P 500 Stock #6: Newell Brands (NWL)

- High Yield S&P 500 Stock #5: Altria Group (MO)

- High Yield S&P 500 Stock #4: Macy’s Inc. (M)

- High Yield S&P 500 Stock #3: Iron Mountain (IRM)

- High Yield S&P 500 Stock #2: CenturyLink (CTL)

- High Yield S&P 500 Stock #1: Macerich Co. (MAC)

High Yield S&P 500 Stock #10: Occidental Petroleum (OXY)

Dividend Yield: 6.1%

Market Capitalization: $39 billion

Sector: Energy

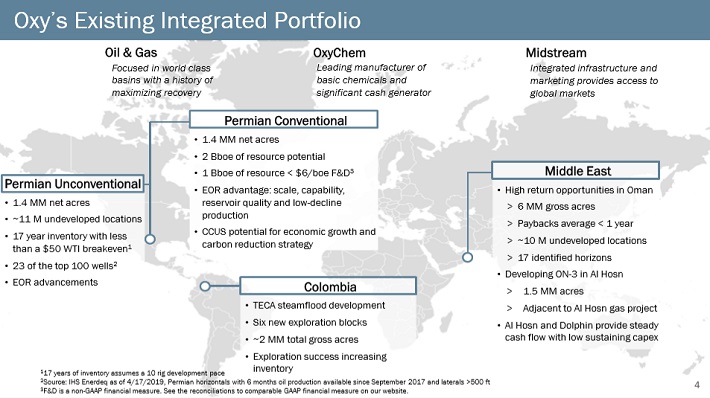

Occidental Petroleum is an international oil and gas exploration and production company with operations in the U.S., the Middle East, and Latin America. While the company also has a midstream and a chemical segment, it is more sensitive to the price of oil than the integrated oil majors.

Source: Investor Presentation

In early May, Occidental reported (5/5/19) financial results for the first quarter of fiscal 2019. Total production grew 3% sequentially and 18% on an annual basis. Production in the Permian grew 4% from the previous quarter, and 47% year-over-year. However, core earnings-per-share fell 31%, from $1.22 in the previous quarter to $0.84, primarily due to lower realized prices of oil and natural gas.

Management expects 9%-11% production growth this year, with more than 30% growth in Permian Resources. Occidental recently prevailed in a bidding war with Chevron over the acquisition of Anadarko, with an offer of $76 per share in a cash-and-stock deal. The shareholders of Anadarko will receive $59 in cash and 0.2934 shares of Occidental for each share of Anadarko they own.

Occidental pursued this acquisition thanks to the promising asset base of Anadarko in Permian, which will enhance the already strong presence of Occidental in the area, and the $3 billion annual synergies it expects to achieve from the integration of the two companies.

With that said, this is a huge acquisition, as the $38 billion value of the deal is almost equal to the market capitalization of Occidental ($39 billion). There are great concerns that the deal will stretch the balance sheet of the company to the extreme. Moody’s has stated that it will probably downgrade the company from A3 to B-.

Occidental has already agreed to sell many non-core assets of Anadarko (LNG and off-shore assets in Mozambique) to Total for $8.8 billion while it has secured $10 billion funding from Berkshire Hathaway in exchange for preferred shares.

Despite the uncertainty of the Anadarko acquisition, Occidental continues to increase its dividend on a regular basis. The company recently increased its dividend by 1.2%, its 17th consecutive year of a dividend hike. Occidental is a Dividend Achiever, a list of stocks with at least 10+ consecutive annual dividend increases.

High Yield S&P 500 Stock #9: AbbVie Inc. (ABBV)

Dividend Yield: 6.3%

Market Capitalization: $100 billion

Sector: Health Care

Pharmaceutical giant AbbVie is a Dividend Aristocrat, as it has raised its dividend for over 40 years in a row going back to its days as a subsidiary of Abbott Laboratories (ABT). The Dividend Aristocrats are a select group of 57 stocks in the S&P 500 Index, with 25+ years of consecutive dividend increases each year.

You can download an Excel spreadsheet of all 57 (with metrics that matter) by clicking the link below:

AbbVie’s most important product by far is Humira, the top-selling drug in the world. That said, Humira is now facing biosimilar competition in Europe. And, AbbVie will lose patent exclusivity for Humira in the U.S. starting in 2023.

This impacted AbbVie’s first-quarter results. Revenue of $7.8 billion increased 0.4% on an operational basis (excluding currency). Sales of Humira in the international markets declined 23% on an operational basis last quarter, which reflects the impact of biosimilar competition abroad.

New products will help AbbVie offset declines in Humira sales. For example, Imbruvica grossed sales of $1.02 billion, up 34% from the same quarter last year. In all, AbbVie’s hematologic oncology portfolio grew revenue by 43% last quarter. This helped AbbVie grow its adjusted earnings-per-share by 14% for the quarter, to $2.14.

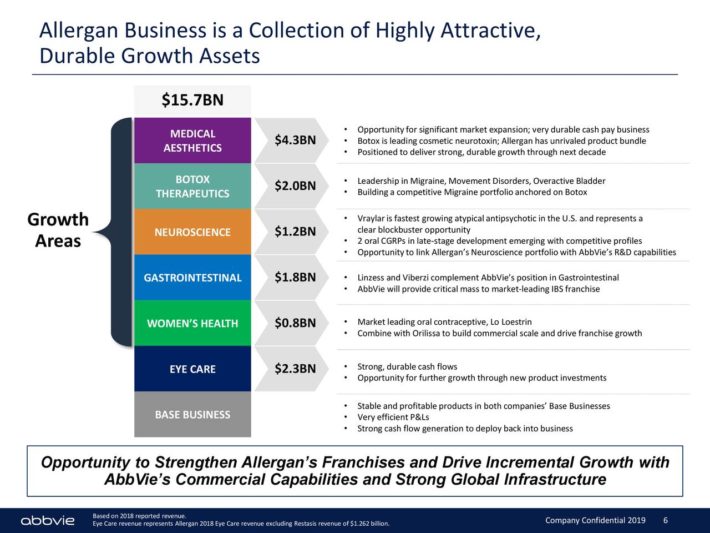

AbbVie’s organic growth will be supplemented by the recent acquisition of Allergan, a hugely transformative move. AbbVie has a long runway of growth up ahead, and the Allergan acquisition is a major step in that direction.

The total value of the acquisition is approximately $63 billion. Allergan has a large product portfolio of its own, including its most well-known product Botox.

Source: Investor Presentation

The acquisition accomplishes a number of strategic goals for AbbVie, such as broadening and diversifying its product offerings by adding exposure to new segments. It also enhances AbbVie’s position in multiple existing categories. The deal instantly makes AbbVie a global powerhouse. The combined company will have annual revenues of nearly $50 billion, based on 2018 results.

The deal should continue to allow AbbVie to increase its dividend each year. For now, AbbVie has a very high dividend yield above 6%, and we believe the dividend is very secure. You can see the below video which further details our analysis of AbbVie’s dividend safety:

High Yield S&P 500 Stock #8: Invesco Ltd. (IVZ)

Dividend Yield: 6.3%

Market Capitalization: $8 billion

Sector: Financial Services

Invesco is an asset management firm. It has more than 7,000 employees and serves customers in more than 150 countries.

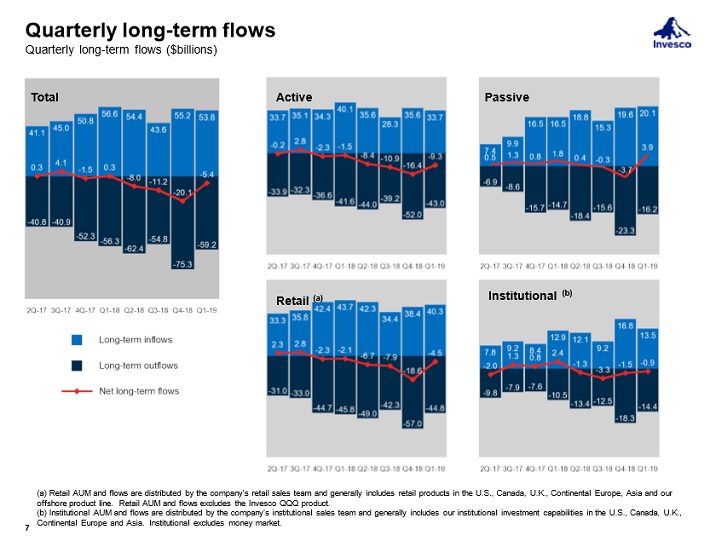

In late April (4/25/19) Invesco reported financial results for the 2019 first quarter. The first quarter was difficult for Invesco, as revenue and adjusted EPS declined 7% and 16%, respectively. The culprit for this was a decline in AUM to close out the year, as the global stock indexes dropped significantly in December 2018.

Fortunately, AUM has recovered in 2019. Through March 31st, Invesco’s AUM has increased 7.5% year-to-date.

Source: Earnings Slides

The continued strong performance of the U.S. stock market is a positive indicator for the remainder of 2019 as far as AUM. Invesco is also investing heavily in growth, mainly through acquisitions.

First, Invesco acquired OppenheimerFunds for ~$5.7 billion. This acquisition is expected to boost earnings-per-share by ~18% in 2019. Acquiring OppenheimerFunds grew Invesco into the 6th-largest U.S. retail investment management company by AUM.

Invesco also acquired the ETF business from Guggenheim Investments for $1.2 billion. Invesco also made a significant investment in financial technology with its acquisition of Intelliflo, a leading technology platform for financial advisors that supports approximately 30% of all financial advisors in the U.K. Overall, we conservatively expect 5% earnings growth annually for Invesco over the next five years.

Invesco ranks well in terms of dividend safety with an expected payout ratio of 53% for fiscal 2019. This should allow the company to continue increasing its dividend on an annual basis going forward. Invesco also has a strong balance sheet, with a credit rating of ‘A’ from Standard & Poor’s.

With a high dividend yield above 6% and a modest payout ratio, Invesco is an attractive high-yield stock for income investors.

High Yield S&P 500 Stock #7: AT&T Inc. (T)

Dividend Yield: 6.4%

Market Capitalization: $234 billion

Sector: Telecommunications

AT&T is a telecommunications giant based in the U.S., and it also has a significant presence in Latin America. AT&T is a highly attractive dividend stock because it combines a high yield above 6%, and it also has a long record of dividend increases. For these reasons, in our view AT&T is the best telecommunications stock.

Like AbbVie, AT&T is a Dividend Aristocrat. It has raised its dividend for over 30 years in a row, and we believe it can continue to raise the dividend each year due to its strong business model.

AT&T’s dividend safety is analyzed in detail in the below video:

Today AT&T is the largest communications company in the world, operating in four distinct business units: AT&T Communications (providing mobile, broadband, video and other communications services to more than 100 million U.S. consumers and more than 3 million businesses), WarnerMedia (including Turner, HBO and Warner Bros.), AT&T Latin America (offering pay-TV and wireless service to 11 countries) and Xandr (providing advertising).

AT&T’s biggest growth catalyst is the massive $85 billion acquisition of Time Warner Inc., a content giant that owns multiple media brands, including TNT, TBS, CNN, and HBO. Time Warner also owns a movie studio as well as sports rights across the NFL, NBA, MLB, and NCAA.

AT&T has made additional bolt-on acquisitions to boost its growing content businesses as well and is working to maximize the advertising capacity of its content.

On July 24th, 2019 AT&T reported second-quarter 2019 financial results. For the quarter the company generated $45.0 billion in revenue, up 15.3% from the year-ago quarter, primarily driven by the Time Warner acquisition. Declines in AT&T’s legacy wireline services and domestic and wireless video equipment were more than offset by the addition of WarnerMedia and improvement in the domestic wireless services.

Adjusted earnings-per-share totaled $0.89, a small 2.2% decline compared with $0.91 in the same quarter last year. However, AT&T reiterated its expectation for low single-digit adjusted EPS growth for the full year. In addition, AT&T forecasts a dividend payout ratio below 60% and an end-of-year net debt to adjusted EBITDA ratio in the 2.5x range. Debt reduction will help further secure AT&T’s dividend.

High Yield S&P 500 Stock #6: Newell Brands (NWL)

Dividend Yield: 6.4%

Market Capitalization: $6 billion

Sector: Consumer Defensive

Newell is a diversified consumer products manufacturer with brands across a wide variety of product categories. Its core brands include Rubbermaid, Oster, Sunbeam, Mr. Coffee, Ball, Sharpie, Paper Mate, Elmer’s, Yankee Candle, and Coleman.

The company is involved in a major turnaround, characterized by getting rid of legacy product categories that no longer offer satisfactory growth potential. There are many product categories that either have too low profit margins or are broadly seeing sales declines due to changing trends.

Newell’s turnaround strategy is to sell brands that are no longer deemed to be an important part of the company’s future direction, and reinvest the proceeds in new growth categories, paying down debt, and repurchasing stock.

For example, Newell sold the Waddington and Rawlings brands, as well as Goody Products. More recently, Newell sold its Pure Fishing and Jostens brands for $2.5 billion of after-tax proceeds. It also sold its Rexair and Process Solutions businesses for over $730 million. And, Newell recently sold its United States Playing Card Co., for an undisclosed sum.

Instead, Newell is focusing on its core brands in which it retains a leadership position.

Source: Investor Presentation

The impact of these divestitures will reduce sales, but Newell can use the proceeds of the asset sales to reduce debt, buy back stock, and invest in new growth areas.

The company has made notable progress in these efforts. Newell reported Q1 earnings on 5/3/19 and results were stronger than expected. Total sales were $1.7 billion, down only slightly from the $1.8 billion from the year-ago period, due to a 3% decline in core sales.

Newell continues to expect a decline in sales in 2019, due to its various divestitures. Earnings-per-share came in at $0.14 on an adjusted basis, compared with $0.28 in the year-ago period. That said, the company reiterated its guidance for this year and as a result, we’ve kept our estimate at $1.60 in earnings-per-share for 2019. We expect 5% annual EPS growth for Newell over the next five years.

With a projected dividend payout ratio of 58% for 2019, we expect Newell to maintain its dividend, making it an attractive stock for income investors.

High Yield S&P 500 Stock #5: Altria Group (MO)

Dividend Yield: 6.4%

Market Capitalization: $94 billion

Sector: Consumer Defensive

Altria is a consumer products manufacturer. Its core brand is its flagship Marlboro cigarettes, the leading brand in the U.S. Altria has also diversified itself in recent years, adding non-smokable brands Skoal and Copenhagen chewing tobacco, Ste. Michelle wine, and it also owns a 10% investment stake in global beer giant Anheuser Busch Inbev (BUD).

Related: The Best Tobacco Stocks Now, Ranked In Order

In late April (4/25/19) Altria reported first-quarter earnings. Revenue, net of excise taxes, declined 6.0% for the quarter, due primarily to falling shipment volumes. Adjusted earnings-per-share declined 5.3% for the first quarter.

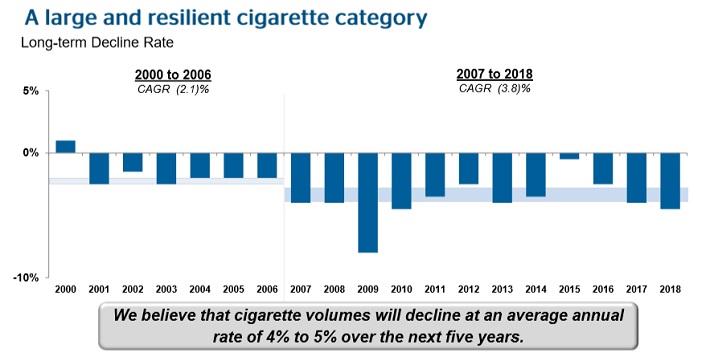

Falling volumes pose a major challenge for Altria. U.S. consumers are increasingly quitting cigarettes, which means Altria needs to adapt to these changing consumer preferences. Altria expects the smoking declines to continue over the next several years at a mid-single-digit rate over the next several years.

Source: 2019 CAGNY Presentation

Altria is investing heavily in arguably the two most important growth catalysts for tobacco companies: vaping, and cannabis. First, Altria made a $1.8 billion investment in Canadian marijuana producer Cronos Group. Altria purchased a 45% equity stake in the company, as well as a warrant to acquire an additional 10% ownership interest exercisable over the next four years.

Altria also invested nearly $13 billion in e-vapor manufacturer JUUL Labs for a 35% equity stake in the company, valuing JUUL at $38 billion. This was a huge investment, but JUUL has captured a huge market share lead in an increasingly-important growth category.

Altria remains a highly profitable company with positive EPS growth. Altria expects full-year adjusted diluted EPS to be in a range of $4.15 to $4.27 for 2019, which would be 4% to 7% growth from last year. This will sufficiently cover Altria’s dividend, with room for continued dividend growth.

The video below examines Altria’s dividend safety in detail.

Altria stock has a secure dividend. The company maintains a target dividend payout ratio of 80% of annual adjusted EPS. This gives the company the ability to maintain its dividend and raise the dividend each year, without sacrificing investment in growth initiatives.

And, Altria has an impressive history of dividend growth. The company has increased its dividend 53 times in the past 49 years.

High Yield S&P 500 Stock #4: Macy’s Inc. (M)

Dividend Yield: 6.7%

Market Capitalization: $7 billion

Sector: Consumer Cyclical

Macy’s operates department stores in the U.S. and internationally. Macy’s reported its first quarter earnings results on May 15. The company reported that its sales totaled $5.5 billion during the first quarter. This was slightly less than what the analyst community forecasted, and Macy’s revenues were also down 0.7% versus the previous year’s quarter.

Sales on a comparable store basis were up 0.7%, easily beating the analyst consensus, as the analyst community had expected a comps sales growth rate of just 0.3%. E-commerce sales grew by double-digits once again, and that mobile sales were the fastest-growing channel during the first quarter,

Macy’s closed a number of stores during the last year, which explains why total company-wide sales were down slightly, despite comparable store sales being up versus the previous year’s quarter. Macy’s gross margins fell 80 basis points compared to the prior year’s quarter, which, coupled with lower sales, resulted in lower net profits for the company. Macy’s generated earnings-per-share of $0.44 during the first quarter, which was down slightly from $0.48 during the previous year’s quarter, but which was more than the analyst consensus estimate.

Macy’s expects to generate earnings-per-share of $3.05 to $3.25 during fiscal 2019. This is significantly above the annualized dividend payout of $ per share, meaning Macy’s high dividend yield appears to be sustainable.

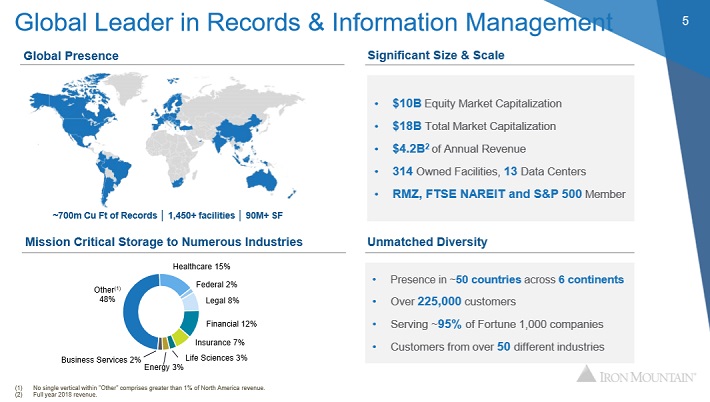

High Yield S&P 500 Stock #3: Iron Mountain (IRM)

Dividend Yield: 8.0%

Market Capitalization: $9 billion

Sector: Real Estate

Iron Mountain is a provider of physical and digital document management and destruction services to both government and corporations in the United States and worldwide. Iron Mountain converted to a real estate investment trust in 2014. The company provides services to more than 90,000 corporate clients and owns 1,400 facilities in 53 countries worldwide.

Source: Investor Presentation

Iron Mountain reported its first quarter earnings results on April 25. The company reported revenues of $1.05 billion during the first quarter, up 1% from the previous year’s quarter. This was less than what the analyst community had forecast. Iron Mountain grew its organic revenues by 1.9% compared to the previous year’s quarter. Service revenues were up 1.8% organically, as destruction revenues were lower compared to recent quarters, while storage rental revenues were up 2.0% organically.

Iron Mountain’s funds from operations, which excludes the impact of non-cash depreciation charges, totaled $0.48 during the first quarter, which was below the analyst consensus. Iron Mountain guides for revenues of $4.3 billion during 2019, while EBITDA is seen flat to up 8% year over year on the back of a stronger second half.

Iron Mountain is not a high growth company, but it still managed to increase its cash flows per share by 3% annually since 2009. Growth has been driven by several contributing factors. The first is organic revenue growth, primarily through pricing increases. Iron Mountain guides for organic revenue growth of 3% to 5% annually through 2020.

Iron Mountain’s management forecasts that its revenues could rise by up to 5% a year on an organic basis in the long run, and that EBITDA could rise by 5%+. Iron Mountain has guided for 4% annual dividend increases through 2020.

High Yield S&P 500 Stocks #2: CenturyLink Inc. (CTL)

Dividend Yield: 9.0%

Market Capitalization: $12 billion

Sector: Telecommunications

CenturyLink is a telecommunications stock serving customers in 60 different countries, and should produce $22 billion in revenue this year. CenturyLink reported Q1 earnings on May 8, 2019 and posted total revenue of $5.65 billion, down 5% from the same quarter a year ago.

Source: Earnings Slides

The revenue decline was due primarily to an 8% drop in the Consumer business unit, and a 7% drop in their Wholesale unit. Diluted net loss per share was $5.77 for this quarter, as the company took a $6.5 billion goodwill impairment charge, and faced $34 million in integration and transformation costs. Excluding these one-time items, adjusted EPS actually increased 36%.

Total consumer broadband subscribers fell less than 1% quarter over quarter as weakness in the lowest tier of service was mostly offset by strength in the two higher tiers, which are generally accompanied by higher revenue per account. However, on a yearly basis, total consumer broadband subscribers fell by 3.6%.

CenturyLink made progress in reducing its leverage to its target range of 2.75x to 3.25x adjusted EBITDA, and as of this quarter stand at 3.9x. The company expects to reach their new target range in approximately 3 years. The company increased its adjusted EBITDA margin, from 36.7% last year to 40.1% in the most recent quarter.

Management expects $9 billion to $9.2 billion in adjusted EBITDA for fiscal year 2019. It also expects free cash flow of $3.1 billion to $3.4 billion and a full-year effective income tax rate of around 25%. We are increasing our 2019 earnings outlook to $1.20 per share.

This would cover the company’s dividend, currently at $1 per share annualized.

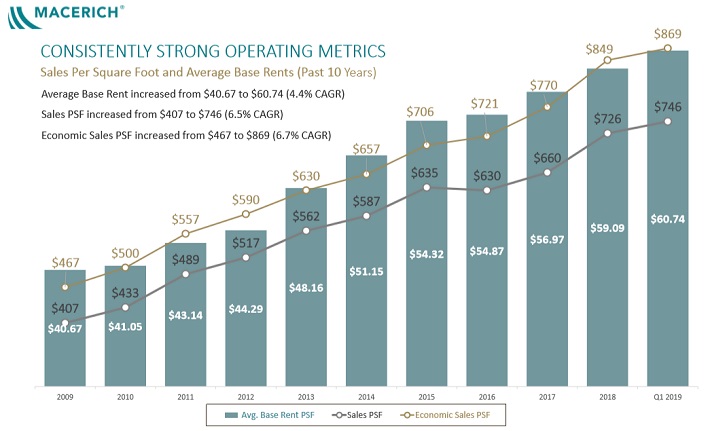

High Yield S&P 500 Stocks #1: Macerich Co. (MAC)

Dividend Yield: 9.1%

Market Capitalization: $5 billion

Sector: Real Estate

Macerich Company is one of the country’s leading owners, operators, and developers of major retail real estate. The company is incorporated as a real estate investment trust (REIT) and owns 51 million square feet of real estate consisting primarily of interests in 47 regional shopping centers. The company has a significant presence in the West Coast, Arizona, Chicago, and the Metro New York to Washington, DC corridor.

Macerich has a long history of steady growth.

Source: Investor Presentation

In early May, Macerich reported (5/2/19) financial results for the first quarter of fiscal 2019. Funds from operations per share (FFOPS) fell marginally, from $0.82 in last year’s quarter to $0.81. Nevertheless, the company performed well on a number of important operating metrics. Mall tenant annual sales per square foot increased 8.7% year-on-year, while releasing spreads (the difference between rent per square foot on a new lease compared to the rent that was previously paid for the same space) expanded by 11.0%.

The company ended the quarter with average rent per square foot up by 3.9% over last year’s quarter, while mall portfolio occupancy increased from 94.0% in last year’s quarter to 94.7%. This year started with a heavy volume of bankruptcies, which the company had anticipated. Management is now focused on leasing and redeveloping the locations of Sears.

Recent years have been particularly challenging as the company’s revenue has actually declined. U.S. retailers have closed 5,994 stores so far this year, exceeding the 5,864 closures reported in the full year 2018. Moreover, while the U.S. economy has grown for a whole decade, mall vacancy rates have increased to a 7-year high of 9.3%

Fortunately, management reiterated its past guidance for funds from operations of $3.50-$3.58 for 2019. With an annualized dividend payout of $3.00 per share, Macerich is expected to generate more than enough FFO to maintain its dividend payout. Macerich currently yields 9%, making it the highest-yielding stock in the S&P 500 Index.

Final Thoughts

In this article, we examined the 10 S&P 500 stocks with the highest dividend yields. Interestingly, each of the companies in this article are generating sufficient cash flow or earnings to fund their dividend for the foreseeable future.

This article may be just the beginning of your search for investment opportunities. If you’re looking for other dividend stocks with specific yield and payout characteristics, the following Sure Dividend databases will be useful:

- The Complete List of High Dividend Stocks With 5%+ Dividend Yields

- The Complete List of 40+ Monthly Dividend Stocks

Alternatively, you may be looking for high yield dividend stocks from other stock market indices. Sure Dividend maintains stock market databases of the following public equity indices:

- The Complete List of Russell 2000 Stocks

- The Complete List of Dow Jones Industrial Average Stocks

- The Complete List of NASDAQ-100 Stocks

- The Complete List of Wilshire 5000 Stocks

- The Complete List of S&P/TSX Composite Index Stocks

- The Complete List of TSX 60 Stocks

Lastly, you may want to invest in high yield dividend stocks from a particular sector of the stock market. If that is the case, you will find the following resources useful:

- The Complete List of Dividend-Paying Telecommunications Stocks

- The Complete List of Dividend-Paying Consumer Cyclical Stocks

- The Complete List of Dividend-Paying Consumer Staples Stocks

- The Complete List of Dividend-Paying Energy Stocks

- The Complete List of Dividend-Paying Healthcare Stocks

- The Complete List of Dividend-Paying Financial Sector Stocks

- The Complete List of Dividend-Paying Industrial Stocks

- The Complete List of Dividend-Paying Utility Stocks

- The Complete List of Dividend-Paying Materials Stocks

- The Complete List of Dividend-Paying Technology Stocks