Updated on December 22nd, 2021 by Bob Ciura

The largest Canadian bank stocks have proven over the past decade that they not only endure times of economic duress, but that they can grow at high rates coming out of a recession as well.

Canadian bank stocks also pay higher dividends, making them attractive for income investors. Valuations have also remained quite low recently, boosting their respective total return profiles as a result.

In this article, we’ll take a look at four large Canadian banks – The Royal Bank of Canada (RY), The Bank of Nova Scotia (BNS), Bank of Montreal (BMO) and Toronto-Dominion Bank (TD) – and rank them in order of highest expected returns.

Note: Canada imposes a 15% dividend withholding tax on US investors. In many cases, investing in Canadian stocks through a US retirement account waives the dividend withholding tax from Canada, but check with your tax preparer or accountant for more on this issue.

The top four big banks in Canada are very shareholder-friendly, with attractive cash returns. With this in mind, we created a full list of financial stocks.

You can download the entire list (along with important financial metrics like dividend yields and price-to-earnings ratios) by clicking the link below:

More information can be found in the Sure Analysis Research Database, which ranks stocks based upon their dividend yield, earnings-per-share growth potential and valuation to compute total returns.

The stocks are listed in order below, with #1 being the most attractive for investors today.

Read on to see which Canadian bank is ranked highest in our Sure Analysis Research Database.

Table Of Contents

You can use the following table of contents to instantly jump to a specific stock:

- Canadian Bank Stock #4: Toronto-Dominion Bank (TD)

- Canadian Bank Stock #3: Bank of Nova Scotia (BNS)

- Canadian Bank Stock #2: Bank of Montreal (BMO)

- Canadian Bank Stock #1: Royal Bank of Canada (RY)

The top four Canadian bank stocks are ranked based on total expected returns over the next five years, from lowest to highest.

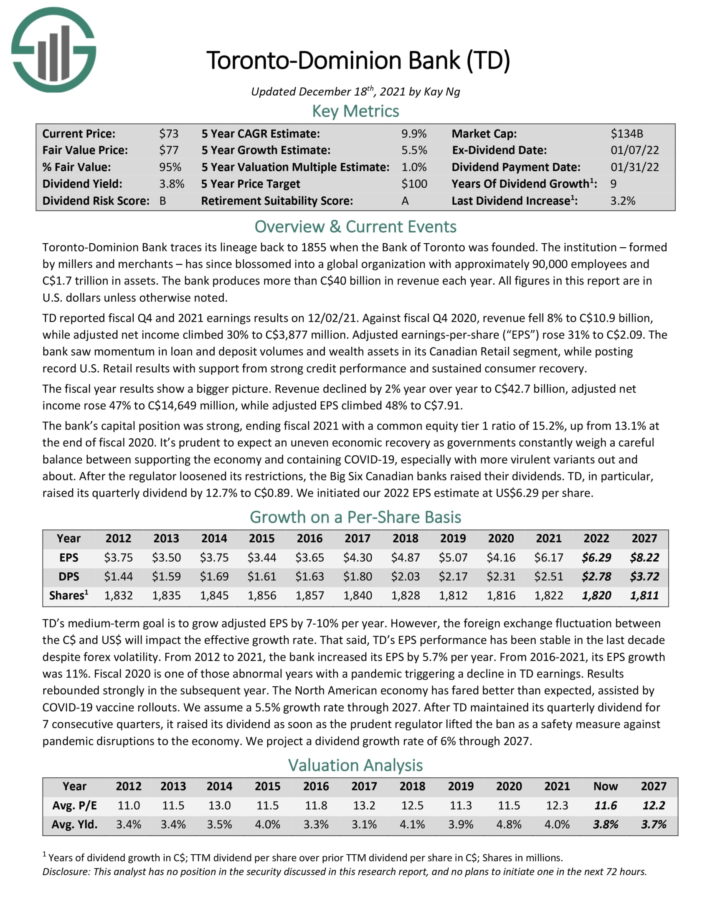

Canadian Bank Stock #4: Toronto-Dominion Bank (TD)

- 5-year expected returns: 9.8%

Toronto–Dominion Bank traces its lineage back to 1855 when the Bank of Toronto was founded. It is now a major bank with C$1.7 trillion in assets. The bank produces more than C$40 billion in revenue each year.

TD reported fiscal Q4 and 2021 earnings results on 12/02/21. Against fiscal Q4 2020, revenue fell 8% to C$10.9 billion, while adjusted net income climbed 30% to C$3,877 million. Adjusted earnings–per–share rose 31% to C$2.09.

In addition to trading on the New York Stock Exchange, TD stock trades on the Toronto Stock Exchange, as do the other stocks in this article.

You can download a full list of all TSX 60 stocks below:

We expect total returns of 9.8% per year for TD over the next five years, comprised of 5.5% annual EPS growth, the nearly 4% dividend yield and a small bump from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on TD (preview of page 1 of 3 shown below):

Canadian Bank Stock #3: Bank of Nova Scotia (BNS)

- 5-year expected annual returns: 10.1%

Bank of Nova Scotia (often called Scotiabank) is the third–largest financial institution in Canada. Scotiabank reports in 5 segments – Canadian Banking, International Banking, Global Wealth Management, Global Banking & Markets, and Other.

Scotiabank reported fiscal Q4 2021 results on 11/30/21. For the quarter, adjusted net income rose 40%, while adjusted EPS increased 45% year over year. The adjusted return on equity (ROE) was 15.6%, up from 11.3% a year ago.

We expect annual returns just above 10% for BNS stock, based on 5% expected EPS growth, the high dividend yield of 5%, and a relatively flat valuation multiple.

Click here to download our most recent Sure Analysis report on BNS (preview of page 1 of 3 shown below):

Canadian Bank Stock #2: Bank of Montreal (BMO)

- 5-year expected annual returns: 11.1%

Bank of Montreal was formed in 1817, becoming Canada’s first bank. The past two centuries have seen Bank of

Montreal grow into a global powerhouse of financial services and today, it has about 1,500 branches in North America.

Bank of Montreal generates about 60% of its earnings from Canada and about 32% from the U.S.

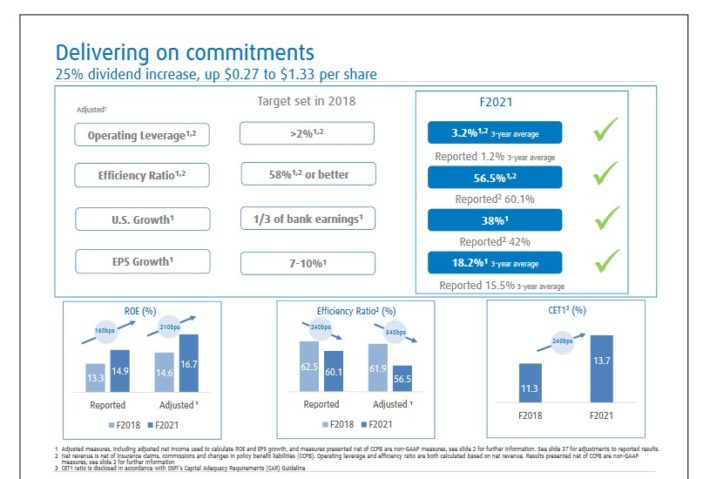

Bank of Montreal posted its fiscal Q4 and 2021 financial results on 12/03/21. For the quarter, net revenue climbed 10% while earnings-per-share increased 38% higher year over year.

Along with quarterly results, the company increased its dividend by 25%.

Source: Investor Presentation

We expect annual returns just above 11% per year, driven by 5.5% expected EPS growth, the nearly 4% dividend yield, and a ~1.5% annual boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on BMO (preview of page 1 of 3 shown below):

Canadian Bank Stock #1: The Royal Bank of Canada (RY)

- 5-year expected annual returns: 11.4%

The Royal Bank of Canada is the largest bank in Canada by market capitalization, and the country’s largest bank by total assets.

The financial institution operates in five business units: Personal & Commercial Banking, Wealth Management, Insurance, Investor & Treasury Services, and Capital Markets.

On 12/01/21, RBC reported its fiscal Q4 2021 earnings results. For the quarter, revenue increased 20% while adjusted EPS increased 19% year-over-year. Q4 return on equity was 16.9% (up from 16.0% a year ago).

We expect 11.4% annual returns for RBC stock, making it #1 among Canadian bank stocks right now.

Click here to download our most recent Sure Analysis report on RY (preview of page 1 of 3 shown below):

Final Thoughts

Canadian bank stocks do not get nearly as much coverage as the major U.S. banks. However, income and value investors should pay attention to Canadian bank stocks. Many have higher dividend yields and significantly lower valuations than their U.S. counterparts.

TD Bank, Bank of Nova Scotia, Bank of Montreal, and Royal Bank of Canada are all highly profitable banks that have grown their earnings-per-share at a high rate in 2021. And, all four have reasonable valuations with attractive dividend yields that are well above the U.S. bank stocks.