Updated August 5th, 2021 by Ben Reynolds

Some people retire much earlier than their 60’s.

Many people are retiring in their 50’s, 40’s, and even 30’s in some cases.

And the reality is you don’t have to be rich to retire early. But, you must be disciplined and invest wisely.

What makes me hopeful is that both discipline and wise investing are teachable.

This article includes tips on how to retire early

Table Of Contents

- What Does Retirement Mean?

- The 6 Factors That Determine When You Can Retire

- Dividend Stocks For Passive Income

- The 3 Best Dividend Stocks Now For Early Retirement

- Early Retirement Calculator

- Additional Resources

What Does Retirement Mean?

First off, lets define retirement. It doesn’t mean sitting on the couch all day every day. Retirement means you are financially free to live the life you’ve chosen. Simply put, retirement means you don’t have to work.

Retirement does not mean you won’t work at all. Those who retire early often work – doing the things they want to do, rather than what they have to do.

“If you’ve got the money, honey, I’ve got the time”

– Willie Nelson

You may be compensated monetarily for your passions; that’s not bad at all. You can be retired and get paid – if it is on your terms.

Early retirees often want to enjoy things when they are younger rather than older – it’s much easier to do a 12 mile hike when you are in your 30’s, 40’s, 50’s rather than at 75.

Note: With that said, there’s no reason a fit 75 year old couldn’t do a long hike!

Time is the ultimate currency of life. We only get so much of it, and then it’s gone.

Time is valuable. Few would disagree that someone who spends 1 hour a week making $75,000 a year will likely be happier (all other things being equal) than someone who spends 80 hours a week to make $75,000 a year.

One needs a balance, however. If you spend all your time providing value and saving money, you will have no time to enjoy the fruits of your work. On the other hand, if you don’t provide any value and make no money, you will not be able to do much with your time.

A balance between money, time, and life is critical. Passive income is the short-cut through the work-life balance conundrum. Passive income is money you make without having to spend additional time to make the money.

You are truly free when your passive income covers your expenses. This is when you have the ability to retire.

The 6 Factors That Determine When You Can Retire

The secret to early retirement is covering your expenses with passive income. There are 6 factors that determine the time it will take to reach a sustainable retirement:

- Working income

- Savings rate

- Expenses

- Starting investment account size

- Investment returns

- Investment portfolio dividend yield

The more money you can save, the quicker you can build your passive income. It really is that simple. The only way to save more is to either:

- Reduce expenses

- Increase income

Controlling expenses is critical to retiring early. The more you cut down on expenses, the sooner you can retire.

Small cuts here and there coupled with examining what you really need – and what you don’t – go a long way toward reducing budgets.

Lowering expenses is the single fastest way to retirement. That’s because you get a dual benefit from lowering expenses.

First, you have more money to invest every month. That means more money to build your retirement portfolio.

Second, the amount of passive income you need every month to cover your expenses is reduced. Lower expenses simply means an earlier retirement.

There are nearly infinite ways to raise your income, but they are beyond the scope of this article.

They all boil down to the same thing; the more value you provide, the greater your income will be. The more efficient you are with your time, the greater value you can provide per hour worked, and the higher your income will be.

The passive income aspect of early retirement involves investing wisely. This will be discussed in detail below.

Dividend Stocks for Passive Income

Can you retire early on dividend stocks? As this article discusses, passive income is critical for early retirement. And dividend growth stocks make excellent investments for growing passive income.

Passive income is scalable; investing $1,000,000 in Coca-Cola (KO) stock and receiving ~$30,000 a year in dividends takes just as much time as investing $100 in Coca-Cola stock and receiving ~$3.00 a year in dividends.

Passive income does not take up your time. Once you are invested in a dividend stock, you don’t have to do anything else to receive your dividend payments.

This is the opposite of being paid for your time – how most people generate income.

There are a nearly infinite amount of different styles of investing. I believe dividend investing in general – and investing in high quality dividend growth stocks specifically – to be the best fit for many individual investors; especially individual investors looking for growing passive income streams.

Here’s why…

Dividend growth stocks are able to grow their dividend payments over time.

Take PepsiCo (PEP) as an example. In year 2005, the company paid shareholders $1.01 per share in dividends. Now, the company pays its shareholders $4.30 a year in dividends. In 2005, PepsiCo shares traded around $55. Investors who purchased PepsiCo shares in 2005 are now enjoying a yield on cost of 7.8%.

You didn’t have to be some sort of genius to buy PepsiCo stock in 2005. The company has been a well-known blue-chip stock for decades. PepsiCo wasn’t extremely cheap in 2005 either – it was trading for a price-to-earnings ratio around 20. This is the type of ‘average’ performance one can expect from investing in high quality dividend growth stocks.

PepsiCo is a member of a select group of stocks called Dividend Aristocrats. These are the ‘gold standard’ of dividend stocks. To be a Dividend Aristocrat, a stock must pay increasing dividends for 25 or more consecutive years, be in the S&P 500, and meet certain minimum size and liquidity requirements.

Dividend Aristocrats are by definition high quality businesses… How else could they raise their dividends for 25+ years in a row? They are also very shareholder friendly; again, as evidenced by their 25+ years of rising dividend payments.

Investors who stick to purchasing Dividend Aristocrat stocks and other blue-chip dividend growth stocks will likely see rising dividend income over time.

You can learn more about how to generate rising passive income through dividend investing by watching the webinar replay video below.

The 3 Best Dividend Stocks Now For Early Retirement

Dividend stocks with a history of rising dividend payments are a quality choice for passive income in retirement. But not all dividend stocks make equally good investments…

So what are the best dividend stocks for retirement?

The best early retirement dividend stocks will have a mix of a history of dividend growth for likely future dividend increases and a high yield for solid current income now. Our 3 top dividend stock selections for early retirement are analyzed below. Each of these securities have 25+ years of rising dividends and dividend yields of 4% or greater.

Early Retirement Dividend Stock #1: Altria (MO)

- Dividend Yield: 7.3%

- Consecutive Years Of Dividend Increases: 51

Altria Group is the leader of the U.S. tobacco industry. The company owns the Marlboro cigarette brand. Additionally, Altria owns the Skoal and Copenhagen chewing tabacco brands, Ste. Michelle wine, a 10% stake in Annheuser Busch Inbev (BUD), and large stakes in vaping company Juul and marijuana company Cronos (CRON).

The company has a long corporate history with many acquisitions and spin-offs. Adjusting for these, Altria has raised its dividend for an incredible 51 consecutive years. This makes it a member of the exclusive list of Dividend Kings.

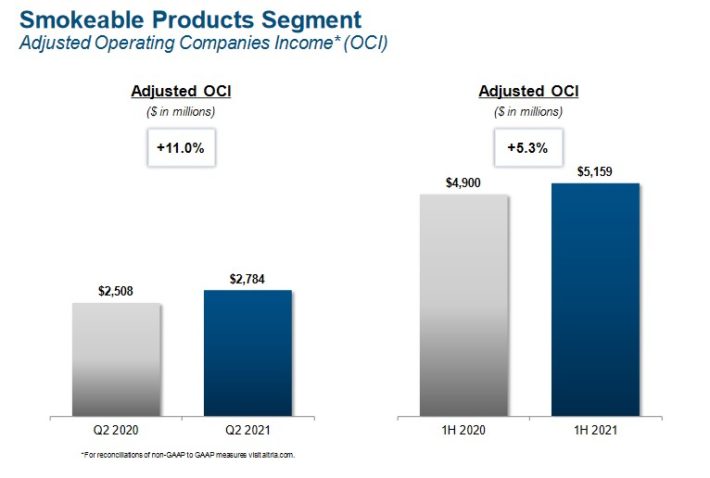

Altria reported second quarter earnings on July 29th. Revenue increased 9% to $6.9 billion, or 11% growth after excise taxes. The core smokeable products segment generated 8% revenue growth, driven by higher prices and volume growth.

Source: Investor Presentation

Adjusted earnings-per-share for the company came to $1.23, up 13% year-over-over year.

The long-term outlook for cigarettes is ultimately negative. That’s why Altria has invested heavily in adjacent categories to fuel its future growth.

The company purchased a 55% equity stake in Canadian marijuana producer Cronos Group, invested nearly $13 billion for a 35% equity stake in e-vapor manufacturer Juul Labs, and recently acquired the remaining 20% ownership stake in Switzerland-based Burger Söhne Group it didn’t already own, for its on! oral nicotine pouch brand.

Altria has also invested in its own heated tobacco product line called IQOS, which the company continues to expand.

We expect new products to fuel the company’s long-term growth. We forecast 3% annual EPS growth going forward, driven by revenue growth as well as share repurchases, partially offset by declines in cigarette revenue.

Altria enjoys significant competitive advantages. It operates in a highly regulated industry, which significantly reduces the threat of new competitors entering the market. And, Altria’s products enjoy tremendous brand loyalty, as Marlboro controls more than 40% of U.S. retail market share.

Altria is also highly resistant to recessions. Cigarette and alcohol sales fare very well during recessions, which keeps Altria’s strong profitability and dividend growth intact. With a target dividend payout of 80%, Altria’s dividend is secure given its stable cash flows.

Early Retirement Dividend Stock #2: AbbVie (ABBV)

- Dividend Yield: 4.5%

- Consecutive Years Of Dividend Increases: 49

AbbVie is a large pharmaceutical company spun off by Abbott Laboratories (ABT) in 2013. The company claims an exemplary 49 year streak of consecutive dividend increases including its time as part of Abbott Laboratories.

AbbVie’s most important product is Humira. Humira is a multi-purpose pharmaceutical product and was the top-selling drug in the world. Humira is now facing biosimilar competition in Europe, which has had a noticeable impact on the company. It will lose patent protection in the U.S. in 2023.

Meanwhile, the company continues to post strong results. Second quarter 2021 revenue increased 34% to nearly $14 billion. Adjusted earnings-per-share rose 33% to $3.11. For 2021, AbbVie expects adjusted earnings-per-share in a range of $12.52-$12.62. This is excellent growth for a large established company.

The majro risk factor surrounding AbbVie is loss of exclusivity for the highly successful Humira. Fortunately, AbbVie has multiple growth opportunities to replace Humira, particularly in the therapeutic areas of immunology, hematology, and neuroscience. For example, last quarter AbbVie’s hematology revenue increased 14% to $1.8 billion.

Based on expected 2021 earnings-per-share of $12.57, AbbVie trades for a price-to-earnings ratio of just 9.1. Our conservative fair value estimate for AbbVie is a price-to-earnings ratio (P/E) of 10. An expanding P/E multiple could boost shareholder returns over the next five years.

In addition, we expect annual earnings growth of 3.0%, while the stock has a 4.5% dividend yield. All told, we expect annual returns of nearly 9% a year for AbbVie over the next 5 years.

Early Retirement Dividend Stock #3: Walgreens Boots Alliance (WBA)

- Dividend Yield: 4.1%

- Consecutive Years Of Dividend Increases: 46

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the company has a presence in more than 25 countries, employs more than 450,000 people and has more than 21,000 stores.

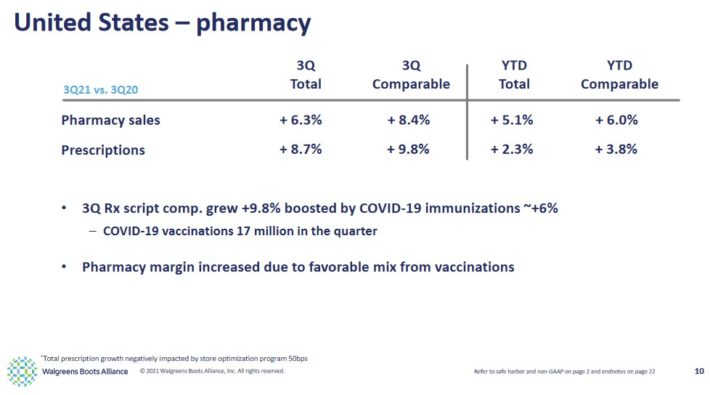

In its most recent quarter, Walgreens reported constant currency revenue growth of 10% from continuing operations. Once again the U.S. pharmaceutical segment led the way for the company.

Source: Investor Presentation

Year-to-date, Walgreens has posted 10% growth in adjusted EPS. This is a solid number for an established blue chip dividend stock like Walgreens.

Walgreens’ competitive advantage lies in its vast scale and network in an important and growing industry. Additionally, it provides a vital service (a place for consumers to conveniently pick up their pharmaceuticals) that is unlikely to become unnecessary in the foreseeable future.

However, a variety of headwinds had surfaced including reimbursement pressure, lower generic deflation and consumer market challenges that have hampered Walgreens. And this was before the COVID–19 pandemic.

But with that said, the company’s payout ratio remains reasonable at under 40% of expected adjusted EPS for the current fiscal year, implying a safe dividend. And the company’s long dividend streak shows that rising dividends are part of the corporate culture.

Wlagreens shares trade for a 2021 price-to-earnings ratio of just 9.0 using our expected fiscal 2021 adjusted EPS estimate of $5.20. This is below our conservative fair value estimate of 10.

In addition, we expect 5% annual EPS growth, while the stock has a 4.1% dividend yield. All together we expect annualized total returns north of 10% over the next five years for Walgreens.

Early Retirement Calculator

Exactly how much do you need to invest to live off dividends?

Use the link below download your copy of the early retirement calculator spreadsheet and fill in the numbers for your specific situation to find out.

Download Early Retirement Calculator

The early retirement calculator can be used to calculate how many years you have until retirement, given your current income, expenses, expected dividend yield at retirement, and expected inflation rate and total returns.

As a side note, most financial advisors and retirement planners have a ‘4% rule’. This rule says that you can safely withdraw 4% of your account value every year to live on during retirement without ever running out of money. If you plan on implementing the 4% rule, just change the expected dividend yield in the spreadsheet to 4%.

Additional Resources

The early retirement and personal finance communities are very active online. Several quality sites and forums are listed below:

Early Retirement Extreme: This is perhaps the best resource on radical, early retirement. The entire site is excellent and gives you a completely different way of looking at money, life, and what we spend. Do not miss the site’s lively forum.

The Retire Early Home Page: This site features several calculators to help plan for early retirement. The site also features articles on th3 ‘4% rule’, social security, retirement books to read, and more.

Early Retirement Forums: These forums have a wealth of information on early retirement and retirement investing.

Dividend Mantra: Dividend Mantra follows one man’s journey to early retirement at 40 using frugality and dividend stocks.

Money Ning: A personal finance blog where we share insights on carefully saving money, investing, frugal living, coupons, promo codes.

The Simple Dollar: The Simple Dollar is for people looking to fight debt and bad spending habits and build a financial future – all while enjoying a few luxuries here and there.

Mr. Free At 33: The story of Jason Fieber (formerly of Dividend Mantra) who retired at 33.