This is Not What a Top Looks Like

Equities

As expected, the policy uncertainty associated with the French election was essentially eliminated (Europe’s break-up was avoided) and, as expected, fresh money flowed into the Euro FOREX pairs and the European stock markets. Also, as expected, the European indexes were flat this week since the bulk of the equity investment had already been made after the run-off vote two weeks earlier. The market now will focus on Macron’s parliamentary picks before it resumes its catch-up to the U.S. market. The chart below shows how the S&P 500 is 50% above its 2007 high (red dashed-line), while the IEV remains below its 2007 high (purple dashed-line).

Even though the technicals are extended, we think that both the U.S. and European equities have further to climb.

Despite the obvious lofty valuations of equities, we maintain the view that equities on both sides of the Atlantic will continue to rise. Pools of digital ink have been spilled writing about the impending stock market crash, but history shows that frightened markets do not form tops, euphoric markets do, and we fail to see any euphoria at the moment. The AAII investor sentiment index registered a drop of 5 percent down to 32.7% (average is 38.5%) in bullish sentiment, while the neutral sentiment increased 5 percent to 37%, and the bear sentiment remained at 30%; that doesn’t look like euphoria to us.

{This section is for paid subscribers only. Join us at www.angtraders.com}

The NAAIM (National Association of Active Investment Managers) index continues to rise which correlates with a rising SPX (chart below).

{This section is for paid subscribers only. Join us at www.angtraders.com}

The following chart remains our single most convincing visual that shows we are in a bull market. There is an assumption in the investment industry that raising rates will kill the bull, but the chart shows that, in fact, in three of the last four bull markets, the FED actually raised rates, and that not raising rates during the last bull market was actually an anomaly. The FED raising rates now during the present bull market simply brings us back to the norm.

{This section is for paid subscribers only. Join us at www.angtraders.com}

Gold

Gold has bounced off the $1220 support zone, but considering all the reasons it has for going up, it has not done much in the way of rallying; North Korea, Russia, the dollar has been weak, and rates have all pulled back, but gold couldn’t crack $1230. This makes gold look weak and its upside is limited (chart below). A bounce to the $1260 level is reasonable.

{This section is for paid subscribers only. Join us at www.angtraders.com}

The commitment of futures traders’ report, which measures positions up to last Tuesday, shows that the large speculators continued to reduce their long positions down to 73%, and the commercials have reduced their short positions to 72%. This type of reduction, increases the probability of a rally in gold since the large speculators are usually wrong at market turns. That is what makes the speculators a good contrarian indicator (chart below).

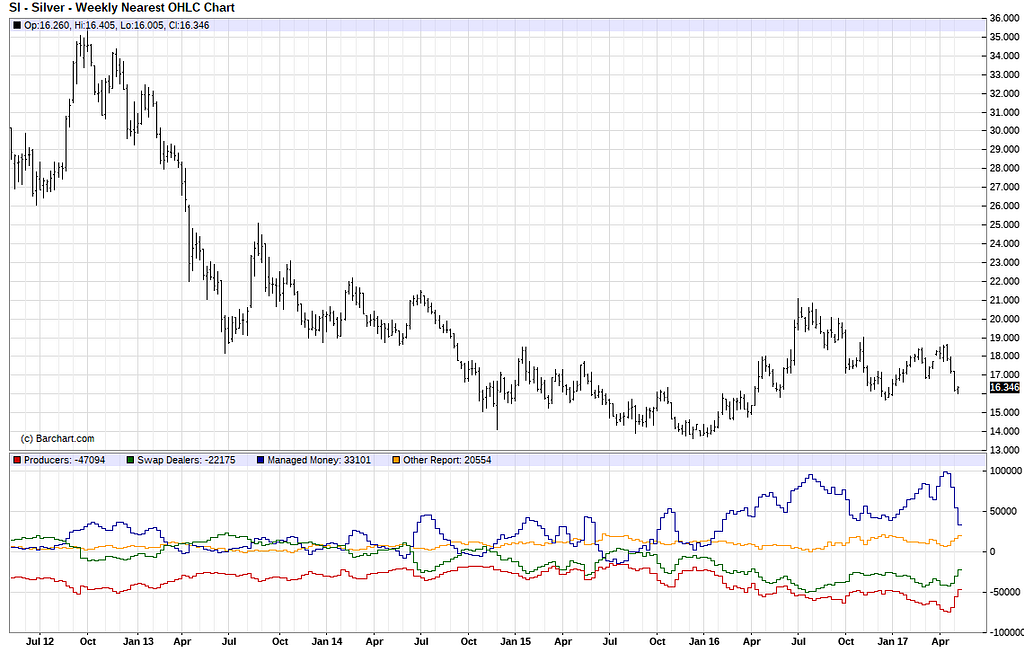

The silver futures traders’ positioning shows an even bigger change than gold does (chart below). The large speculators have reduced their long positions from 84% just three weeks ago down to 70% this week, and the commercials reduced their short position from 78% down to 71%.

{This section is for paid subscribers only. Join us at www.angtraders.com}

We wish our subscribers a profitable week ahead and ask that email be monitored for Trade Alerts.

Regards,

ANG Traders

Email queries to [email protected]

Disclaimer:

ANG Traders makes no guarantees concerning the profitability of our trades. Our trade notification service is not intended as investment advice in any way. It is simply providing information about the trades we ourselves are executing. Always consult a registered advisor for assistance with your investments. ANG Traders assumes no liability for any losses that may arise from replicating our trades.

Source: Nicholas Gomez