Published on June 25th, 2022 by Felix Martinez

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned just over 64.3 million shares of Activision Blizzard (ATVI), for a market value exceeding $5 billion. This makes Activision Blizzard one of the top holding for Berkshire Hathaway. Activision Blizzard currently constitutes over 1.6% of Berkshire Hathaway’s investment portfolio.

This article will analyze the video game publisher in greater detail.

Business Overview

Activision Blizzard is one of the world’s largest third-party video game publishers and owns some of the largest and most well-known video game franchises. Some game franchises it owns are Call of Duty, Crash Bandicoot, Warcraft, Overwatch, Diablo, StarCraft, Candy Crush, Bubble Witch, Pet Rescue, and Farm Heroes.

Source: Investor Presentation

The company has a market capitalization of $59.2 billion. Also, the company has agreed to be taken over by Microsoft in an all-cash deal. This values the company at $68.7 billion. This is about a $95 per share price point, which was about 46% above the share price at the time of the announcement in January.

The company generated nearly $8.8 billion in revenue for 2021, with a net income of $2.7 billion. Most of the company revenue comes from In-game, subscriptions, and other revenue; only about 30% is from product sales.

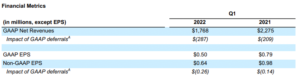

ATVI reported first-quarter results on April 25th, 2022. Revenue for the quarter was down 22.4% to $1.77 billion, missing estimates by $30 million. Earnings were also down by 34.7%, from $0.98 per share in the first quarter of 2021 to $0.64 per share. The company missed estimates by $0.06 per share.

Source: Investor Presentation

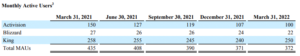

Overall, Activision Blizzard Monthly Active Users (MAUs) for the quarter were 372 million, which decreased by 14.5% compared to 1Q2021.

Source: Investor Presentation

Growth Prospects

Growth drivers for the company will come from growing market shares of major AAA blockbuster titles on one side and more minor indie games on the other. However, the company focuses on the higher end of the market, using its capital to fund higher-budget blockbusters and its marketing scale to support its titles across multiple advertising platforms. Activision Blizzard’s primary competition remains other large third-party publishers, such as Take-Two and EA, and console manufacturers Sony and Microsoft.

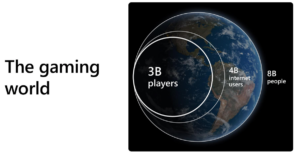

As most people in the world start to have internet access, this will also lead to more players. Thus, helping Activision Blizzard grow its MAUs.

Source: Investor Presentation

Another growth driver for the company will come from the firm monetizing its intellectual property year after year by providing content via sequels, expansion packs, downloadable content, or DLC, and toys, illustrated by the decade-old World of Warcraft franchise and the annual versions of Call of Duty. These franchises can also generate games that move the company into new areas, such as F2P (Hearthstone from WoW) and mobile (Call of Duty Mobile).

Competitive Advantages & Recession Performance

Activision Blizzard’s competitive advantage is its world-leading franchise titles. This will allow the company to continue to grow those franchise titles and possibly make spinoffs from those titles.

While the company is not immune to downturns, its fee model is more resilient to such conditions. However, in a server recession, the company MAUs will start to decline as people will start to cut back on their monthly expenses.

As of the most recent report, the company held $10.97 billion in cash and $25 billion in total assets against $7.2 billion in total liabilities. Long-term debt stood at $3.6 billion as of March 31st, 2022.

ATVI is forecasted to pay out only 16% of its earnings in fiscal 2022. This payout is very safe, and we expect it to continue to grow in the double digits annually in the years to come. For example, over the past ten years, the company has had an average annual dividend growth rate of 11%. So far, the company has increased the dividend for twelve consecutive years.

Valuation & Expected Returns

Because of its lousy quarter results, we expect the company to make $2.92 per share. This will decrease 22% from 2021, when the company made $3.72 per share. However, we expect a five-year earning growth of about 10%.

Shares trade for about 23.4X earnings today, a little below our fair value. The stock’s five-year average P/E ratio is 23.7X earnings. Still, that leaves the potential for a ~1% tailwind to total returns from the valuation in the years to come.

The company pays out a minimal dividend. The current dividend yield is 0.6%. Thus, most of the return will come from earnings growth and valuation.

Final Thoughts

Activision Blizzard looks to be fairly valued at the current price. This was due to the Microsoft buy-out announcement, which helped the stock price shoot up. Because of this, we give ATVI a hold rating at today’s price.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 38 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.