Published on June 26, 2022 by Felix Martinez

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 533 thousand shares of Amazon (AMZN) for a market value exceeding $62.1 million. Amazon currently constitutes a little over 0.02% of Berkshire Hathaway’s investment portfolio.

This article will analyze this Internet and direct marketing retailer company in greater detail.

Business Overview

Founded in 1995 by Jeff Bezos, Amazon.com began as an online bookstore. Today the company has become one of the world’s largest online retailers and cloud services providers. Headquartered in Seattle, WA, the $1.14 trillion market cap company employs over 1,608,00 people.

On April 28, 2022, Amazon reported its first-quarter results, which ended on March 31, 2022. For the quarter, earnings missed expectation by $15.78. Net loss was $3.8 billion in the first quarter, or $7.56 per diluted share, compared with a net income of $8.1 billion, or $15.79 per diluted share, in the first quarter of 2021. First-quarter 2022 net loss includes a pre-tax valuation loss of $7.6

billion included in non-operating expenses from its common stock investment in Rivian Automotive, Inc.

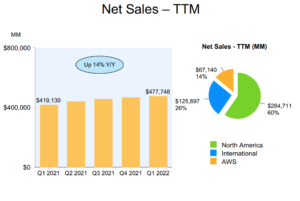

Revenue increased 7% to $116.4 billion in the first quarter, compared with $108.5 billion in the first quarter of 2021. This was in line with expectations. On a Trailing 12 Months (TTM) bases, revenues have been growing 14% year over year.

North America makes up 60% of the company’s total revenue, whereas 26% is from international.

Source: Investor Presentation

Growth Prospects

The growth driver for the company will come from its AWS segment and advertising. These segments earn higher margins than the rest of the business. We also expect them to drive margins higher over time.

Over the next five years, we project AWS revenue will grow at a 25% CAGR, and advertising revenue will grow at a 19% CAGR. In total, Amazon should grow around 15% CAGR through 2027.

We also expect e-commerce to continue to take share from brick-and-mortar retailers. Thus, we additionally expect Amazon to gain more online sales.

Competitive Advantages & Recession Performance

Amazon has a trifecta of competitive advantages in the way of a low-price offering coupled with exceptional logistical capabilities, execution, and customer experience. The “Amazon effect” weighs heavy on competitors, and it has become a real challenge for various industries. For almost two decades, Amazon has been disrupting the traditional retail industry.

Due to an outstanding operating history, Amazon’s balance sheet is in excellent shape. As of the most recent report, Amazon held $36.2 billion in cash, $161.6 billion in current assets, and $420.5 billion in total assets against $142.3 billion in current liabilities and $48.7 billion in total long-term debt. Overall, the company has a AA credit rating from S&P.

Amazon performed well in both the Great Recession and during the COVID-19 pandemic. Earning grew in 2008 by 25% compared to 2007. In 2009, earnings rose 46% compared to 2008. Durning the COVID-19 pandemic, earnings grew by 82% from 2019 to the end of 2020.

Valuation & Expected Returns

Earnings were down significantly for the first quarter. We think this will continue for the year. Thus, we expect the company to earn $0.76 per share.

Based on the current share price, this gives us a PE of 56.8X earnings. This looks to be very high, but Amazon always had a high PE. For example, over the past five years, the company has averaged a PE of 77.6X earnings.

After this down year in earnings, we expect the company to return to earning growth and grow earnings at a 15% annual rate over the next five years.

This should provide mid to low double-digit returns over the next few years.

Final Thoughts

Amazon is a great company and has performed very well over the last two decades. At the current price, the company looks to be slightly undervalued and presents a good buying opportunity.

The company has an outstanding balance sheet and is set to continue to grow earnings after this year.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 38 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.