Published on June 24th, 2022 by Josh Arnold

Berkshire Hathaway (BRK.B) has an equity investment portfolio that rivals many asset managers, owning more than $360 billion in equities at the end of the first quarter of this year. The company is one of the largest investors in the world that uses its own capital.

The company’s investment philosophy has changed somewhat over the years, but the core principles are unmoved. Warren Buffett’s philosophy of finding great businesses to own for the long-term and holding them “forever” hasn’t wavered.

Buffett is a legendary investor and it has made him one of the richest people in the world. The good news is that individual investors can follow Buffett’s moves via 13F filings that are required disclosures once per quarter. Using these filings, investors can sort through the list of stocks owned by Berkshire, and perhaps follow along and own the same ones.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of the end of the first quarter, Berkshire owned about 4.8 million shares of Floor & Décor Holdings (FND), for a market value of about $330 million. That puts Floor & Décor towards the bottom in terms of outright position size for Buffett, but it’s still a significant amount of capital committed. It works out to about a five percent stake in the retailer as well.

In this article, we’ll take a look at Floor & Décor as an investment opportunity to see if it’s wise to follow Buffett into the retailer.

Business Overview

Floor & Décor is the leading specialty retailer of hard surface flooring in the US. The company aims to offer the broadest selection of in-stock tile, wood, stone, and related products such as tools and accessories at value prices.

The company’s stores are large format with designated vignettes showcasing various products to give the stores a showroom feel, rather than a warehouse. In addition, the company sources products locally to give each store a unique product assortment that matches that particular market.

The company has about 160 stores in the US today, and it chooses locations that have at least 350,000 residents in the trade area, at least 150,000 housing units, and at least $64,000 in median household income. These parameters mean that Floor & Décor only enters markets of sufficient size to support a large format flooring store, which preserves revenue and profit per store.

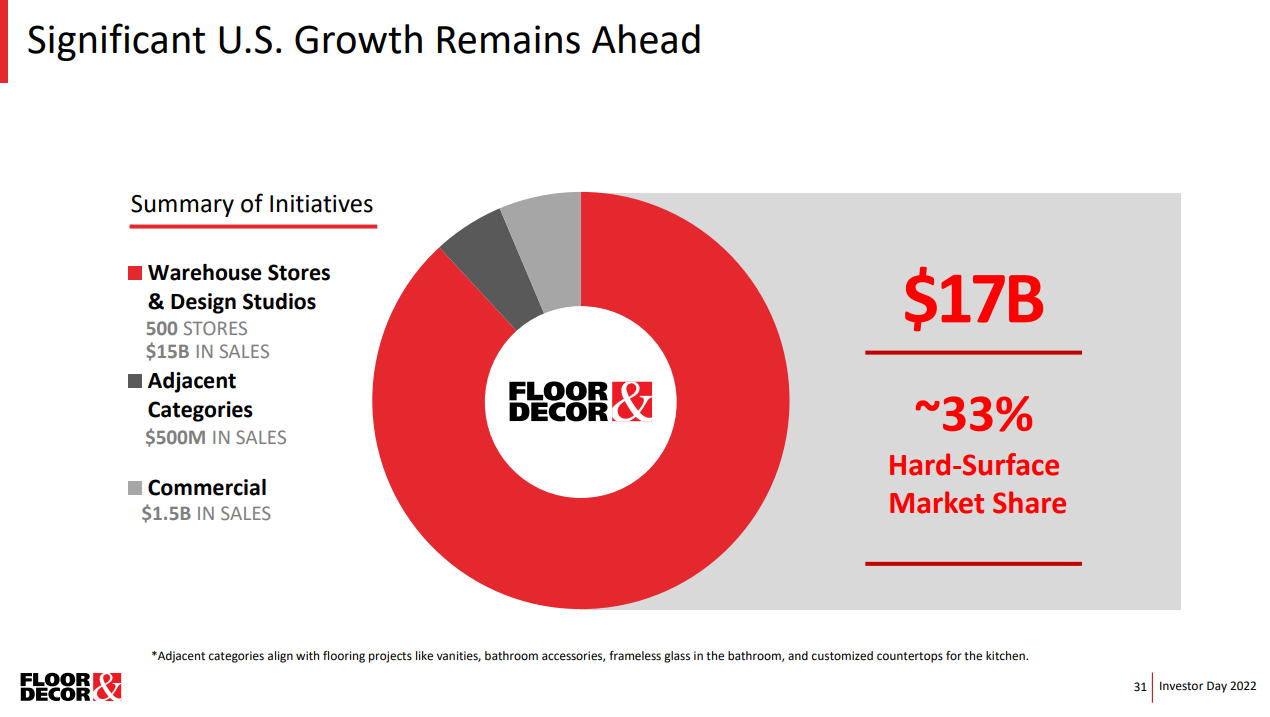

Even with these criteria, the company recently boosted its long-term guidance from 400 total stores to 500, which is about triple its current store count.

Floor & Décor was founded in 2000, generates about $3.5 billion in annual revenue, and trades with a market cap of $7.3 billion.

Growth Prospects

Floor & Décor is an exceptional growth story, and we see numerous tailwinds driving higher profitability over time. First, the aforementioned store count is a big tailwind. The company is set to triple its current store base over time, which will help drive incremental revenue for years to come.

Second, the company has a strong history of comparable sales gains, although we note home improvement stores tend to suffer somewhat during recessions. While we note some risk for Floor & Décor if there’s a recession, demand tends to rebound quite quickly, so any headwind would be transitory.

Third, Floor & Décor has acute exposure to the long-term trend in flooring that has seen demand move away from carpet and towards hard surfaces, exactly like the products Floor & Décor specializes in.

Source: Investor presentation, page 31

With these tailwinds in mind, we see the potential for 15%+ top line growth annually in the years to come. In addition, Floor & Décor has been improving its margins as the store base has grown. While we don’t see margin expansion as a huge opportunity, we do see incremental gains over time as Floor & Décor leverages down SG&A and back office support costs with higher revenue. This is a classic retail growth strategy and we see no reason it shouldn’t work in this case.

One headwind that is present that could slightly offset some of this growth is the company’s penchant for issuing common shares as compensation to employees. This has seen the share count grow over time, generally at a low-single digit rate, but it is something that will most likely at least partially offset revenue and margin growth in the years to come.

Even so, we see the potential for at least 15% growth in earnings-per-share over the next five years, with upside risk to that estimate if we do not see a housing-led recession.

Competitive Advantages & Recession Performance

We see Floor & Décor’s competitive advantages as quite meaningful given its relative leadership in the industry it serves. The company has gathered significant market share over the years by operating attractive stores that offer warehouse pricing in the right locations.

Flooring is an extremely fragmented market that is served by larger players like Home Depot (HD) and Lowe’s (LOW), but also countless small businesses. Floor & Décor is a large, focused player in the space with great brand recognition and the ability to execute longer-term to take market share.

That said, Floor & Décor is a somewhat cyclical business given that demand for home improvement products like flooring tends to go through cycles, and recessions are unkind to these sorts of products. A protracted recession would likely lead to a significant decline in earnings, so that’s something for prospective shareholders to keep in mind.

Valuation & Expected Returns

We expect $2.60 in earnings-per-share for this year, which is roughly congruent to last year’s earnings, which were a record. We see flat earnings growth this year simply because last year was a boom year for Floor & Décor given pent-up demand for housing products. We believe Floor & Décor will see some drop off from normal growth this year, but resume growth in the years to come.

Shares trade for about 26X earnings today, which is well below where we see fair value. The stock’s five-year average P/E ratio is 44X earnings, but we’re more conservative, estimating fair value at 32X earnings. Still, that leaves the potential for a ~4% tailwind to total returns from the valuation in the years to come.

Floor & Décor doesn’t pay a dividend, so total returns are expected to be around 19% annually for buyers of the stock today, the combination of strong earnings growth and a tailwind from the valuation.

Final Thoughts

Floor & Décor does pose a recession risk to investors, but it also appears to be priced for such an event today. We see massive total return potential from the company’s growth strategy, as well as the valuation. Even though Floor & Décor doesn’t pay a dividend, and very likely won’t for many years to come, the stock earns a buy rating based upon its immense growth potential.

Other Dividend Lists

Floor & Decor does not pay a dividend, but the following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 38 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.