Published by Nicholas McCullum on May 29th, 2017

When investors think of the companies owned by Berkshire Hathaway, many ‘boring’ legacy businesses come to mind – Kraft Heinz (KHC), Coca-Cola (KO), and IBM (IBM) are examples.

While these businesses are highly profitable and make solid investments, they do not have the curb appeal of a high-flying investment bank like Goldman Sachs.

Berkshire Hathaway (BRK.A) (BRK.B) owns $2.5 billion of Goldman Sachs common stock, making this investment bank the 14th largest holding in Warren Buffett’s investment portfolio.

You can see the rest Warren Buffett’s 47 individual stock holdings analyzed in detail here.

Warren Buffett’s Goldman Sachs investment can be traced back to the financial crisis when the Oracle of Omaha gave Goldman his vote of confidence by investing $5 billion of Berkshire Hathaway’s capital into the investment bank.

This came at a critical time. Lehman Brothers had just collapsed, and the financial markets were pessimistic about Goldman’s future.

In exchange for its $5 billion investment, Berkshire Hathaway received:

- $5 billion of callable perpetual preferred stock, repurchased by Goldman in March of 2011 for $5.64 billion.

- Warrants for 43.5 million Goldman Sachs common stock with a strike price of $115 and an expiration date of October 1, 2013.

The two counterparties later amended their warrant agreement so that Berkshire received (in Goldman stock) the same value as the difference between the stock price and the strike price for all outstanding warrants.

All said, Berkshire received 13.06 million common shares of Goldman Sachs. Today, Buffett’s portfolio contains just under 11 million, meaning that he has slightly reduced his share count over time.

The fact that Buffett has held onto his Goldman Sachs shares after all this time is indicative that Buffett believes Goldman is still a high-quality business. Buffett’s vote of confidence means that Goldman likely deserves further research from value investors and dividend growth investors.

This article will analyze the investment prospects of Goldman Sachs in detail.

Business Overview & Recent Financial Performance

Goldman Sachs is a diversified multinational financial institution that operates investment banking, investment management, securities underwriting, and prime brokerage divisions (among others).

Goldman was founded in 1869, had its initial public offering in 1999, and currently has a market capitalization of $89 billion. The corporate headquarters for Goldman Sachs lie in New York City, although the financial institution has a physical presence in all of the major financial centers around the world.

Today, Goldman Sachs is divided into four main segments for reporting purposes:

- Investment Banking (21% of 2016 net revenues)

- Institutional Client Services (47% of 2016 net revenues)

- Investing & Lending (13% of 2016 net revenues)

- Investment Management (19% of 2016 net revenues)

More details about each of Goldman’s operating segments can be seen below.

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 3

The major rainmaker for Goldman Sachs is its Institutional Client Services segment that contributed 47% of 2016’s net revenues.

This segment is differentiated from Goldman’s major peers since Goldman is one of the few major players to have a significant presence in both Equities and FICC (which stands for fixed income, commodities, and currency).

Goldman Sachs had a tough start to 2016.

The company’s net revenues declined by a staggering 28% during the first half of the year before rebounding by 16% in the back half.

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 4

Thinking back to the behavior of the financial markets during that time, it should be no surprise that Goldman experienced declining revenues during 1H2016 – the financial markets experienced a notable correction during January and February of that year, and Goldman’s performance is highly correlated to the financial markets (a theme that will recur in this analysis).

Fortunately, Goldman is able to mitigate some of the effects of declining revenues because much of its compensation is variable. If Goldman’s bankers are unable to generate revenues, then their bonuses (a large proportion of their total compensation) will be reduced accordingly.

This ‘operating leverage’ means that Goldman’s expenses tend to fluctuate in-line with its revenues, which minimizes margin compression during periods of poor revenue generation.

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 5

Controlling and monitoring compensation expenses is important for any business.

It is critical for Goldman Sachs.

This is because of the nature of Goldman’s business model. Banking is a people business, driven by relationships and talent.

Thus, Goldman’s Compensation and Benefits expense contributes the majority of its bank-wide expenses ($11.6 billion of Compensation and Benefits expense compared to $8.7 billion of non-compensation expenses in fiscal 2016).

Source: Goldman Sachs 2016 Annual Report, page 202

The ability for Goldman to adjust its expenses in-line with its performance is a key advantage for this business.

Moving on, the next section will discuss the growth prospects of Goldman Sachs in detail.

Growth Prospects

There are a number of catalysts capable of propelling Goldman’s growth in the near term.

The first thing to note is that Goldman’s quarter-to-quarter financial performance is highly dependent on the performance of the financial markets. Accordingly, the strong market performance of 1Q2017 led Goldman to call this a ‘period of recalibration’ on its most recent quarterly conference call:

“The first quarter of 2017 can be characterized as a period of recalibration. In the fourth quarter, strong economic data, the prospect of higher rates and the potential for more pro growth policies in the United States drove improved sentiment and greater investor conviction. Equity markets responded accordingly, reaching new highs. However, during the first quarter, the market began to reconsider both the pace and strength of economic growth, particularly in light of uncertainty regarding upcoming European elections and legislative challenges in the United States. This confluence of events resulted in tempered expectations, a modest retreat in equity prices from intra-quarter highs, and a more benign market environment.”

Investors should note that the economy looks strong right now, and macro trends are tending to improve across a variety of broad-based economic metrics.

These trends will increase Goldman’s client activity and improve its revenue generation capabilities.

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 10

Goldman will also continue to benefit from its increasingly important implementation of technology.

Technology has the capability to either increase revenues (by improving productivity and keeping inputs constant) or reduce expenses (by keeping output constant and reducing inputs). In either case, profits are increased.

For a (perhaps extreme) example of Goldman’s emphasis on technology, consider the following:

“At its height back in 2000, the U.S. cash equities trading desk at Goldman Sachs’s New York headquarters employed 600 traders, buying and selling stock on the orders of the investment bank’s large clients. Today there are just two equity traders left.

Automated trading programs have taken over the rest of the work, supported by 200 computer engineers.”

Source: As Goldman Embraces Technology, Even The Master Of The Universe Are Threatened

Goldman’s focus on technology will be a key contributor to the firm’s future growth.

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 12

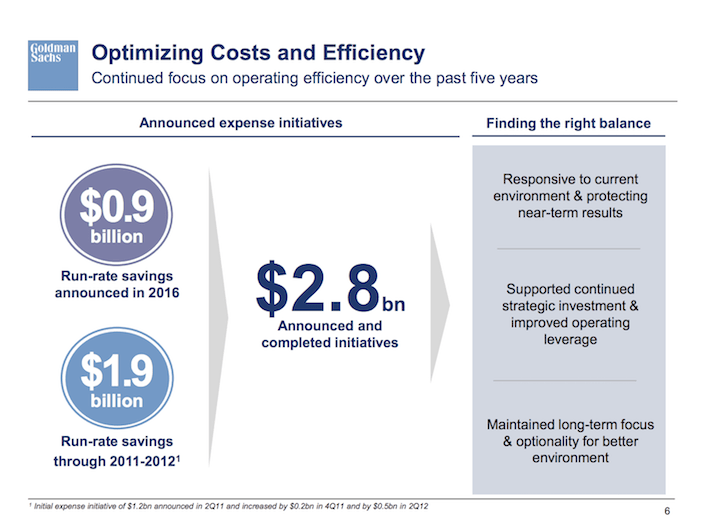

Goldman remains focused on expense control.

The company closed on cost savings of $900 million per year in 2016, and in 2011-2012 completed a comprehensive cost savings program that created a run-rate of savings of $1.9 billion per year.

Finding cost savings is a tricky balance of investing for the long-term without compromising near-term financial results. Goldman’s efforts appear to be successful thus far.

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 6

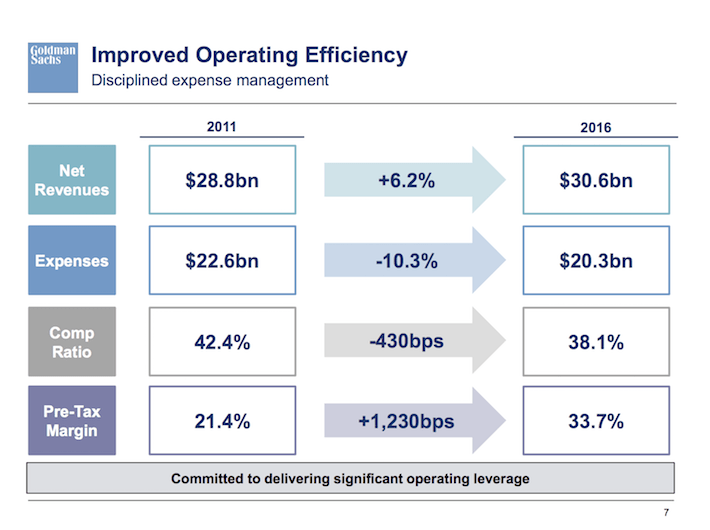

Importantly, Goldman’s cost saving initiatives have been a larger contributor to profit growth than its revenue growth, at least since 2011.

During this time, Goldman increased its revenues by 6.2% while decreasing its expenses by 10.3%. These two factors combined have decreased the proportion of revenues spent on compensation by 430 basis points and increased Goldman’s pre-tax profit margin by 1,230 basis points.

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 7

Goldman has made this progress while simultaneously de-risking its business model in response to regulatory pressures after the global financial crisis of 2007-2009.

The company has reduced its gross leverage by 62% while nearly doubling its common equity and tripling its global core liquid assets.

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 8

Lastly, Goldman is focused on growing its lending business.

This segment (Investing & Lending) of the Goldman Sachs business contributed only 13% of 2016’s net revenues, yet the bank is investing heavily to strengthen this component of its business.

Investing and lendhave has a fundamentally different risk profile than Goldman’s trading or investment banking businesses. While the other segments depend on trading volumes and mergs & acquisitions activity, investing and lending is exposed to counterparty default risk.

Diversifying into this segment reduces Goldman’s company-wide dependence on trade volumes of M&A, de-risking its business model even further.

To grow the Investing & Lending segment, Goldman has been issuing more loans to corporate counterparties – $63.9 billion in 2016, up from $23.0 billion in 2012.

Further, the company recently launched Marcus by Goldman Sachs, which is a no-fee personal loan service aimed at United States consumers. Taking personal loans (rather than just corporate loans) gives Goldmans a more diversified business mix.

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 11

To conclude, there are a number of factors – a growing economy, technology cost savings, improved effiency, and a bolstered loan portfolio – that will contribute to Goldman’s profit growth moving forward.

Competitive Advantage & Recession Performance

As the leader in investment banking and mergers & acquisitions advising, Goldman Sachs’ largest competitive advantage comes from its talent base.

Accordingly, the bank devotes a substantial amount of resources to attracting and retaining talented employees.

Goldman continues to be seen as one of the preferred employers for finance graduates. The bank received 131,000 applicants for 5,000 summer internships in 2016, which equates to a hire rate of ~4%. Further, the bank has a strong acceptance rate, with ~8 out of 10 candidates accepting job offers.

Goldman’s talent efforts can be seen outside of its core finance business.

2016 saw the bank employ 9,000 individuals in various engineering roles across the bank. Further, the bank is increasingly hiring non-finance majors for its analyst positions. ~37% of 2016’s new campus analysts had college degrees from the science, technology, engineering, and mathematics (STEM) disciplines.

After the hiring process is complete, Goldman’s employees often stay at the firm long-term. The median tenure of Goldman Sachs partners and managing directors is 15 years, and the majority (nearly 60%) of these high-level employees joined the firm as either an analyst or an associate.

This is likely due to the company’s strong workplace environment – Goldman was ranked as one of Fortune “100 Best Companies To Work For” every year since its inception in 1984, an accolade held by only 5 companies.

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 13

Goldman’s talent-based competitive advantage has the unique characteristic of being self-reinforcing. The company’s current talent base attracts more high-quality individuals, and this process continues repeatedly.

With that said, Goldman Sachs’ talent-based competitive advantage does not mean that this company will be a strong performer in a recession. As mentioned in the ‘Growth Prospects’ section, Goldman’s stock price and fundamental performance are highly correlated with the performance of the broader financial markets.

Investors should not forget that during the last major recession, Goldman took a $5 billion cash infusion from Berkshire Hathaway and cut its dividend while many of its smaller peers filed for bankruptcy.

Thus, Goldman should not be viewed as a defensive position in one’s portfolio, although the company will likely perform well during a bull market.

Valuation & Expected Total Returns

Expected total returns for Goldman Sachs shareholders will be composed of valuation changes, earnings-per-share growth, and dividend payments.

Related: How To Calculate The Expected Total Return of Any Stock

Goldman reported earnings-per-share of $16.29 in fiscal 2017. The company’s current stock price of $222.47 is trading at a price-to-earnings ratio of 13.7. While this might seem like an absolute bargain relative to the S&P 500’s average price-to-earnings ratio of ~25.5, it is actually above Goldman’s valuation in recent years.

Thus, valuation compressions may be a negative contributor to Goldman’s future shareholder returns.

Goldman’s growth prospects for its earnings-per-share are difficult to estimate. Over the last four years, the bank has compounded its bottom line at a rate of 3.7% per year. Looking back further creates comparison difficulties because of the restructuring that Goldman executed after the financial crisis.

Over full economic cycles, I conservatively believe Goldman has the potential to grow its bottom line at a rate of 4%-6% per year.

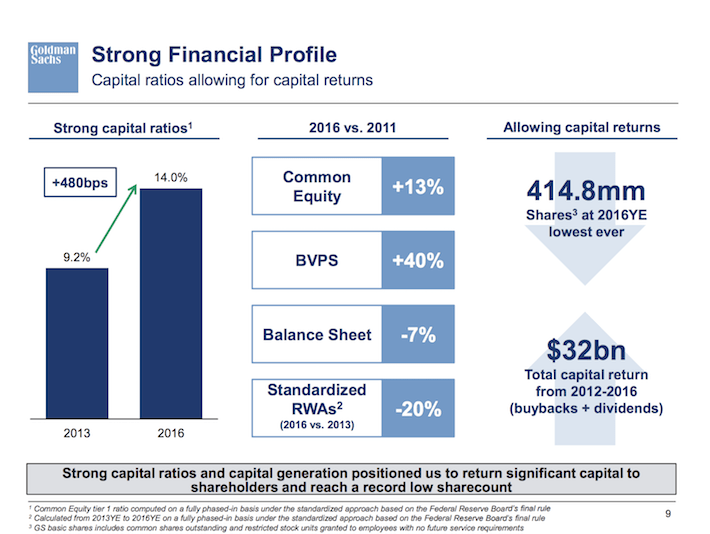

This growth will be boosted by the company’s shareholder-friendliness. Goldman has repurchased shares aggressively in recent years so that its current share count of ~415 million is its lowest ever.

This has seriously impact Goldman’s per-share value. While the bank’s common equity has increased by 13% since 2011, its book value per common share has increased by 40% – a 27% difference!

Source: Goldman Sachs Presentation at the Credit Suisse Financial Services Conference, slide 9

The remainder of Goldman’s returns will come from its quarterly dividend payment.

Goldman Sachs currently pays a quarterly dividend of $0.75 per share, yielding 1.3% on the company’s current stock price of $222.47.

Goldman’s’ dividend is not the most recession-proof, as the financial institution cut its dividend by ~30% during the last recession. Goldman has increased its dividend in recent years, and I would expect continued dividend growth so long as the economy remains sound.

To sum up, Goldman’s expected total returns are composed of:

- 4%-6% earnings-per-share growth

- 1.3% dividend yield

For expected total returns of 5.3%-7.3% before the effect of valuation changes.

Final Thoughts

Goldman Sachs’ leadership in the investment banking industry and its investment from Warren Buffett are two reasons why this stock may catch the eye of the self-directed investor.

Goldman’s business model, while significantly less risky than its pre-crisis-era counterpart, is still highly dependent on the behavior of the financial markets. And, Goldman Sachs’s expected total returns do not stand out among the other dividend stocks covered on this website.

Thus, I believe that Goldman offers an unappealing investment proposition, particularly on a risk-adjusted basis. If you agree, then another attractive holding of Warren Buffett from the financial industry with less inherent risk is Well Fargo (WFC).

Alternatively, if you’re interested in reading more about Buffett’s investment in Goldman Sachs, the following articles may be of interest: