Updated on July 19th, 2019 by Bob Ciura

The telecommunications sector has a longer history than most people realize. For example, AT&T (T) can trace its roots back to the founding of Bell Telephone Company in 1877.

The sector has changed a lot since 1877, and with new trends such as mobile phones, the internet, the emergence of cable TV and other developments telecommunications companies are active in many more areas than they were a century ago.

Today, the telecommunications sector is categorized by high capital investment, sluggish growth, and generous dividend payments. In short, the telecommunications sector is mature.

You can download a list of all 138 telecommunications sector stocks below:

In this article we will look at five major dividend-paying telecommunications companies that we believe will produce attractive returns, based on rankings in the Sure Analysis Research Database.

We further narrowed the list to include only stocks with a Dividend Risk score of ‘C’ or better, indicating sustainable dividend payouts.

The companies are ranked by total return potential over the coming five years.

Table of Contents

- Telephone & Data Systems (TDS)

- America Movil (AMX)

- Comcast Corporation (CMCSA)

- Verizon Communications (VZ)

- AT&T Inc. (T)

Telecom Stock #5: Telephone & Data Systems (TDS)

- Expected Returns: 6.1%

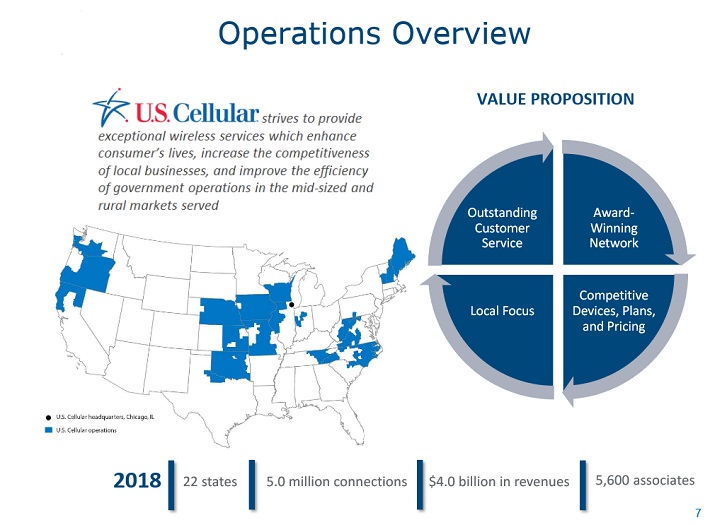

Telephone & Data Systems is the smallest company in this article, trading at a market capitalization of $3.6 billion. The company provides customers with cellular and landline services, wireless products, cable, broadband, and voice services across 24 states.

The company’s Cellular Division accounts for more than 75% of total operating revenue. TDS started in 1969 as a collection of 10 rural telephone companies. The company generates more than $5 billion in annual revenue.

The U.S. Cellular brand is the company’s major business segment.

Source: Investor Presentation

On May 2nd, 2019, TDS reported financial results for the first quarter of fiscal 2019. In the quarter, the company grew its total operating revenue by 2.6% year-over-year to $1.26 billion, primarily thanks to 2.6% revenue growth at U.S. Cellular, and a 16% increase in other revenue.

TDS Telecom segment revenue remained flat compared with the same quarter a year ago. Still, TDS nearly doubled its diluted earnings-per-share, from $0.34 to $0.50. At the midpoint of full-year guidance, management expects 3.4% revenue growth for U.S. Cellular and no revenue growth for the TDS Telecom division.

We see positive EPS growth starting in 2019, primarily due to growth from U.S. Cellular, but earnings growth will remain at a relatively muted level going forward. We expect EPS will grow by 2% annually over the next five years.

TDS has reported inconsistent and volatile profitability over the past decade, with multiple years of net losses. As a result, we believe it is better to perform valuation on the basis of book value and price-to-book, rather than EPS and price-to-earnings ratios.

On this basis, the stock appears to be undervalued. Based on a projected 2019 book value per share of $47, TDS stock is currently trading at a price-to-book ratio of 0.69, which is lower than its 10-year average of 0.76. If the stock reverts to its average valuation level over the next five years, it will enjoy a 2.0% annualized gain.

In addition, expected EPS growth (2%) and dividends (2.1%) fuel total expected returns of 6.1% per year over the next five years.

Telecom Stock #4: America Movil (AMX)

- Expected Returns: 7.2%

America Movil is a telecommunications company headquartered in Mexico. It is the largest wireless telecommunications provider in Latin America based on subscriber count. America Movil has the largest market share in Mexico, and the third-largest market share in Brazil.

America Movil stock trades through American Depository Receipts on the New York Stock Exchange, under the ticker AMX. The stock has a market capitalization of US$50 billion and is majority owned by Carlos Slim and family, the richest man in Mexico and one of the wealthiest individuals in the world.

On July 16th, America Movil reported financial results for the second quarter of fiscal 2019. Peso-denominated revenues decreased 2.7% but constant-currency service revenues rose 2.3% year-on-year. The company added 1.6 million postpaid subscribers in the quarter. More than half of subscriber additions came from Brazil, with Austria and Mexico adding approximately 200,000 subscribers each.

America Movil’s primarily growth catalyst is acquisitions, specifically the recent agreement to acquire 100% of Nextel Brazil from NII Holdings for $905 million. The acquisition is subject to approvals from regulatory authorities and the shareholders of NII. If the acquisition materializes, it will significantly strengthen the network capacity and subscriber base of America Movil in Sao Paulo and Rio de Janeiro.

We expect America Movil to generate 7% annual EPS growth over the next five years. In addition, valuation changes and dividends will contribute to total shareholder returns. America Movil stock trades for a P/E ratio of 15.1, which is above our fair value estimate of 13.5, meaning the stock appears to be slightly overvalued. Retracing of the P/E ratio could reduce annual returns by 2.2% over the next five years.

America Movil pays a semi-annual dividend that variates depending on the company’s financial performance each year. Its 2019 installments totaled approximately US$0.36 (after the 20-to-1 ADR conversion), which represents a dividend yield of approximately 2.4%.

The combination of EPS growth, dividends, and valuation changes results in annual expected returns of roughly 7.2% per year through 2024.

Telecom Stock #3: Comcast Corporation (CMCSA)

- Expected Returns: 7.9%

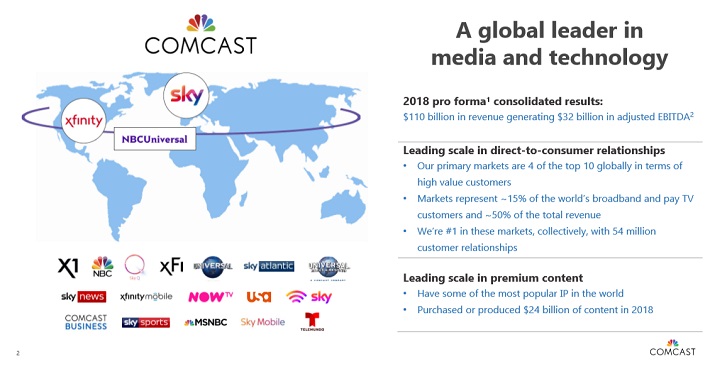

Comcast is not a telecommunications company in the sense that it is not focused on wireless services. Rather, Comcast generates the majority of its revenues from cable services. It also operates in other segments such as broadcast television, filmed entertainment and theme parks. Comcast has a market capitalization above $200 billion, making it a mega-cap stock.

Source: Annual Meeting

Comcast reported its first quarter earnings results on April 25th. The company reported revenues of $26.9 billion for the first quarter, an increase of 18% year-over-year. This tremendous top-line growth rate was possible due to the closing of the Sky acquisition in late 2018. Cable communications revenue rose 4.2% to $14.3 billion, while Filmed Entertainment revenue increased 7.4% year over year.

Comcast generated earnings-per-share of $0.76 for the first quarter, up 17% compared to the first quarter of fiscal 2018. We see Comcast generating 6%-7% earnings per share growth over the coming years, primarily through a combination of low single-digit revenue growth and share repurchases.

Margin expansion will be harder to achieve, as programming and content costs are rising. Revenue growth will be limited due to the impact of cord-cutting, although higher growth rates in the film entertainment, theme parks and broadcast TV segments should mitigate rising content costs.

Comcast stock has a fairly low dividend yield of 1.9%, but there is significant potential for dividend growth, as the company’s expected payout ratio is just 31% for 2019. Investors can expect that the dividend will continue to grow at an attractive pace over the coming years.

Comcast stock trades for a P/E ratio of 15.9, slightly above our fair value estimate of 15.5. The effect of slight overvaluation could reduce annual returns by 0.5% per year through 2024. However, expected EPS growth of 6.5% and the 1.9% dividend yield can offset this. Overall, we expect total returns of 7.9% per year over the next five years for Comcast stock.

Telecom Stock #2: Verizon Communications (VZ)

- Expected Returns: 11.5%

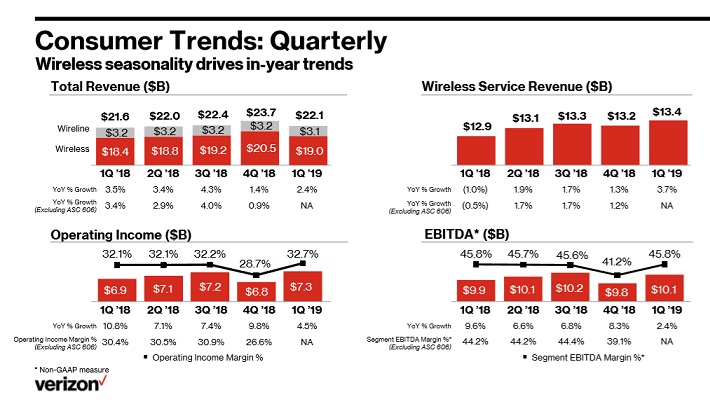

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June, 2000. Today, Verizon is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~298 million people and 98% of the U.S.

Verizon has annual sales of $131 billion. The company reported financial results for the first quarter on 4/23/2019. Revenue of $32.1 billion increased 1.1% year-over-year, while earnings-per-share increased 3%. Verizon had 61,000 retail postpaid net additions in the first quarter and 174,000 postpaid smartphone net additions.

The company’s wireless segment continues to be its primary growth driver.

Source: Analyst Presentation

Revenues for wireless grew almost 4% to $22.7 billion, while higher priced plans helped grow service revenues by 4.4%.

Postpaid phone churn was just 0.84%, a slight increase from the previous quarter, but still one of the lowest rates among wireless carriers. Verizon’s wireline business experienced a revenue decline of 3.9% to $7.3 billion.

Based on first quarter results, Verizon now expects low single-digit revenue growth, along with EPS growth at a similar rate for the full year.

Future growth will be driven by the continued strength of its Wireless segment as well as new initiatives such as the introduction of a 5G network.

Another growth catalyst for Verizon is the Internet of Things, or IoT, which will power connectivity outside of just smartphones and tablets. Verizon has made multiple acquisitions to boost its IoT business in recent years, including the $2.5 billion acquisition of Fleetmatics, and the $900 million acquisition of Telogis.

Verizon’s dividend safety following its first-quarter earnings report can be seen in the video below:

Verizon is a high-quality dividend growth stock. It has increased its dividend for 12 consecutive years, making it a member of the Dividend Achievers list.

Verizon’s current dividend yield of 4.2% will add to its expected returns, as will its expected annual EPS growth of 4% through 2024. Verizon stock also appears to be undervalued.

Based on expected EPS of $4.80 for 2019, Verizon stock has a P/E ratio of 11.9. This is below our fair value estimate of 14, which is the 10-year average valuation. If Verizon stock returns to its historical average, it would boost annual shareholder returns by 3.3% per year through 2024.

The combination of valuation changes, EPS growth, and dividends results in expected annual returns of 11.5% over the next five years.

Telecom Stock #1: AT&T Inc. (T)

- Expected Returns: 14.6%

Like Verizon, AT&T sits atop the U.S. telecom industry. It offers communications and digital entertainment services, such as internet access, TV and wireless services. AT&T offers its services in the U.S., but it also operates sizeable businesses in other parts of the world such as Latin America.

AT&T’s impressive dividend history helps it to stand out from its peers as an investment. AT&T is a Dividend Aristocrat, a select group of 57 S&P 500 stocks with 25+ years of consecutive dividend increases.

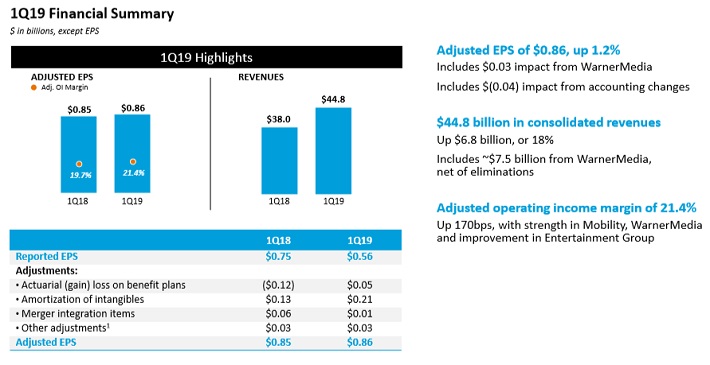

In late April, AT&T reported (4/24/19) financial results for the 2019 first quarter. Revenue of $44.8 billion missed analyst estimates by $270 million, while adjusted earnings-per-share of $0.86 matched analyst expectations.

Revenue increased 18% for the first quarter, primarily driven by the Time Warner acquisition that closed in June 2018. Adjusted earnings-per-share of $0.86 rose 1.2% from the same quarter a year ago.

Source: Investor Presentation

Revenue growth was heavily offset by rising expenses and a higher share count. AT&T’s core mobility segment grew revenue by 2.9% for the quarter, thanks to 179,000 net postpaid smartphone customer additions during the quarter.

AT&T’s dividend safety following the company’s first-quarter earnings report is analyzed in detail in the below video:

AT&T’s biggest growth catalyst is the massive $85 billion acquisition of Time Warner Inc., a content giant that owns multiple media brands, including TNT, TBS, CNN, and HBO. Time Warner also owns a movie studio as well as sports rights across the NFL, NBA, MLB, and NCAA.

AT&T has made additional bolt-on acquisitions to boost its growing content businesses as well and is working to maximize the advertising capacity of its content. We are conservatively anticipating annualized earnings-per-share growth of ~3% per year for the foreseeable future.

Importantly, AT&T paid off over $2 billion of debt in the first quarter, ending the period with a net-debt-to-adjusted-EBITDA ratio of 2.8x. AT&T will pursue additional debt reduction in part through asset sales, such as the recent deals to sell its stake in Hulu, and the $2.2 billion sale of its Hudson Yards space. AT&T expects to end 2019 with a leverage ratio of 2.5x, which will further help secure its dividend.

AT&T stock trades for a price-to-earnings ratio of 9.2, based on expected EPS of $3.60 for 2019. Our fair value estimate for AT&T is a P/E ratio of 12, meaning the stock is significantly undervalued. Expansion of the P/E ratio could boost annual returns by 5.5% per year through 2024.

In addition, the 6.1% dividend yield and 3% expected EPS growth results in annual expected returns of 14.6% per year over the next five years. The combination of a high dividend yield and high expected returns make AT&T stock a compelling buy for income investors.