The Bull Continues

This coming week has a busy line-up of events, the heaviest of which is the Tax legislation. The proposed changes to the tax code are a blatant tax-cut to the richest corporations and individuals, and as such, there is a good chance that the GOP will be too divided to pass it in the present calendar year. That possibility, along with the post-thanksgiving/black Friday buyer’s remorse, may be the excuse that the market needs to let off some corrective steam.

Long-term, however, the current bull has a clean bill of health; interest rates are rising — as expected during secular bull markets (see below under Fundamentals) — and GDP forecasts are narrowing and moving in on the 3% level.

The probability of a 0.25% rate hike on December 13 is 91.5%, and even a half-point rate increase carries an 8.5% chance.

The Federal Reserve Bank of Atlanta’s GDP-NOW forecast is at 3.4% and the variance in the average of forecasts is narrowing to the upside.

The bull market is in its later stage, but is still many months away from its terminal stage.

Equities

Sentiment

{This section is for paid subscribers only. Join us at www.angtraders.com}

The chart below combines the AAII sentiment indicator and the Rydex fund asset allocation. The pink-shaded rectangles, highlight the similarity between 2015 and 2017. A serious correction continues as a possibility, like it did in the fall of 2015 (chart below).

{This section is for paid subscribers only. Join us at www.angtraders.com}

Nine out of the last ten times that the volatility index (VIX) has made a down-spike, the SPX has corrected. Even though the VIX crashed from 12 to 8.6, the fact that it recovered to just shy of 10, could mean that it is still in the process of making a down-spike. If so, this increases the likely-hood of a correction in the SPX (chart below).

{This section is for paid subscribers only. Join us at www.angtraders.com}

Technical

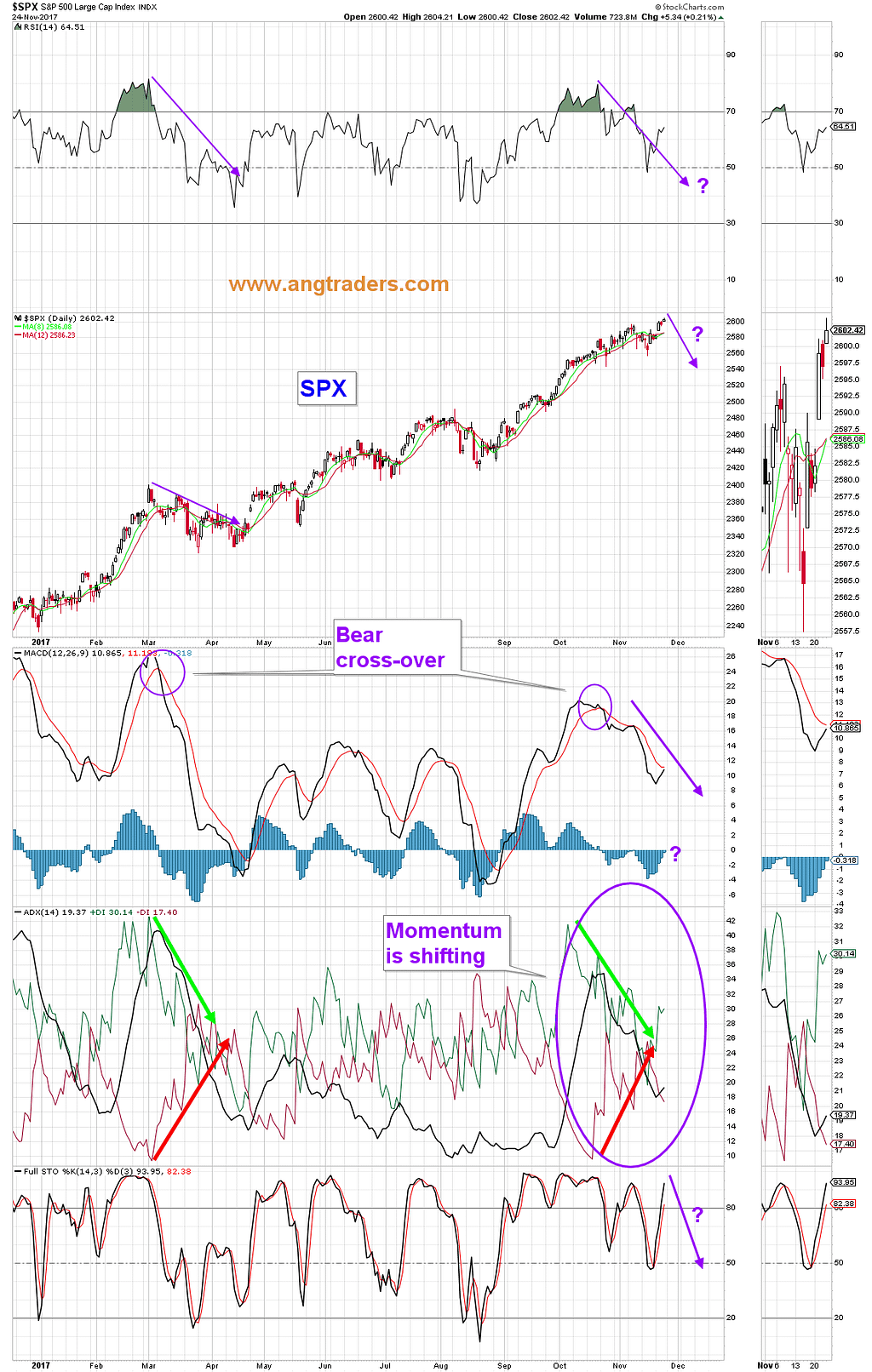

The long-term technical averages continue to demonstrate a late-stage bull market and no warning signs are evident. The 8-month moving average falling below the 12-month moving average, would be a long-term bear signal. The cyclical bull market is still in place (chart below).

Shorter-term, the indicators continue to point at a correction; even though the MACD has started to turn up (no bull cross at this time), bear momentum is increasing, and the stochastics, are in over-bought territory (chart below).

Fundamentals

{This section is for paid subscribers only. Join us at www.angtraders.com}

The important 10-year minus 2-year rate differential remains comfortably in positive territory, despite moving lower this week, and its slope points to an another 12-to-18-months before the probability of a recession becomes significant (chart below).

Our Price Modelling system is negative on the daily scale; negative on the weekly scale; and remains positive on the monthly scale. We continue to expect a correction in the near-term, while being bullish in the long-term.

Oil

{This section is for paid subscribers only. Join us at www.angtraders.com}

Gold

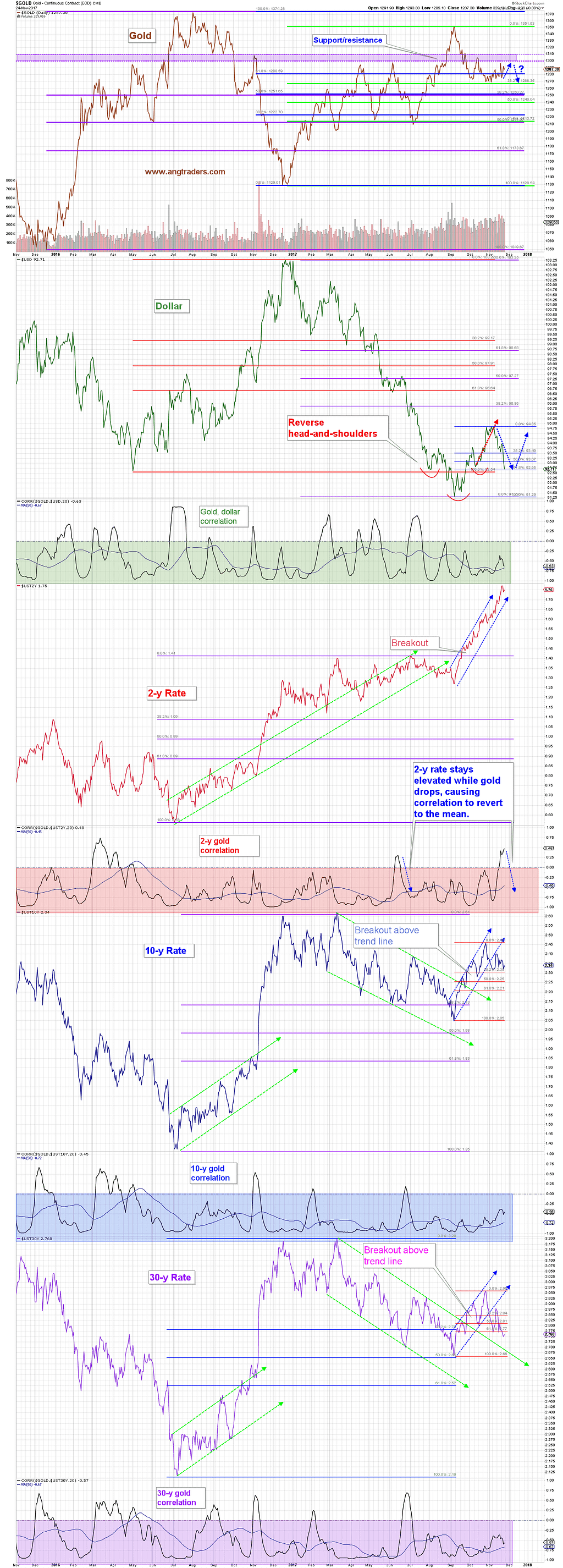

The dollar sold-off this past week, reaching an important support zone around 92.5 from which it should rally. Significantly, gold did not react to the dollar weakness. The 2-year rate remained elevated, and its normally negative correlation to gold, stayed at an anomalous +0.48 (average -0.45). With the Fed bias on rates being firmly to the upside (see introduction above), we think gold will continue to be pressured.

{This section is for paid subscribers only. Join us at www.angtraders.com}

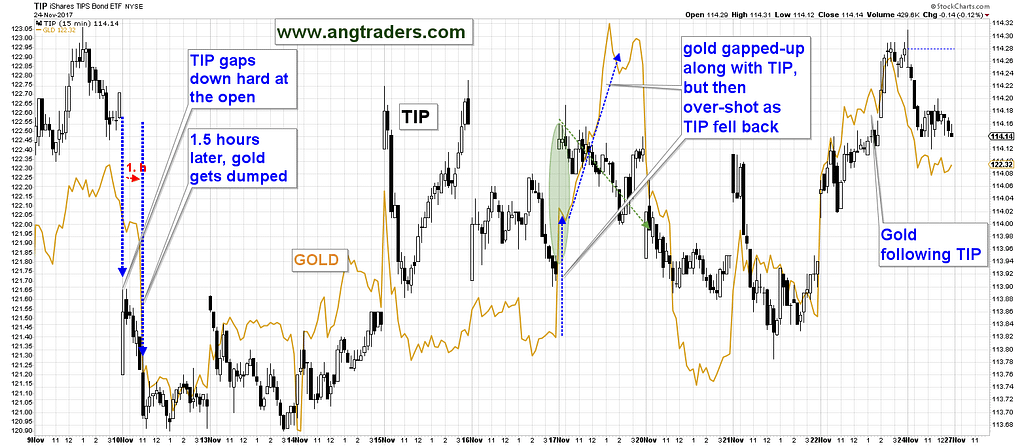

Gold has followed TIP closely during that last three days.

{This section is for paid subscribers only. Join us at www.angtraders.com}

We wish our subscribers a profitable week ahead.

Regards,

ANG Traders

Email queries to [email protected]

Source: Nicholas Gomez