Published on July 15th, 2019 by Jonathan Weber

American Express (AXP) is one of the leading credit card & payment processing companies in the world. Thanks to industry tailwinds, American Express has generated highly attractive growth rates in the past, regarding both its earnings-per-share and its dividend payments.

American Express is a member of the closely-watched Dow Jones Industrial Average.

Shares are trading above our fair value estimate right now, but given the expected total returns over the coming five years American Express is a hold for current shareholders and a potential buy for those that seek exposure to the industry.

At or below our price target of $114, we believe American Express is a buy for those investor who seeks total returns and who are not exclusively focused on current income. It is, therefore, one of the more attractive Dow Jones stocks right now.

Business Overview

American Express offers pcredit payment cards, charge cards, travel-related services, etc. to customers around the globe. Its customers include consumers as well as businesses. American Express’ operations are divided into three segments, the Global Consumer Services Group, Global Commercial Services, and Global Merchant & Network Services.

American Express was founded in 1850, is headquartered in New York. American Express’ shares are trading for $125 right now, which gives the company a market capitalization of $105 billion.

Source: American Express presentation

American Express is a global company that has card holders in many different countries around the world, and that has established partnerships with many major companies from foreign countries. Credit card companies usually try to partner up with travel-focused companies such as airlines and hotel chains, and American Express has done this very successfully, being partnered with leading companies such as Hilton, British Airways, Singapore Airlines, and many more.

Its non-travel focused, commercial partners include major giants such as Amazon. The decision by these companies to partner with American Express is the result of American Express’ strong market share among high-spending card holders, which makes American Express an attractive partner for other companies.

American Express has also partnered with tech companies to enhance its position in digital payment markets, this includes partnerships with Apple, for Apple Pay, and with PayPal. The relationship with Amazon has resulted in new types of cards, such as an Amazon business card that is focused on small and medium sized companies.

Recent Events

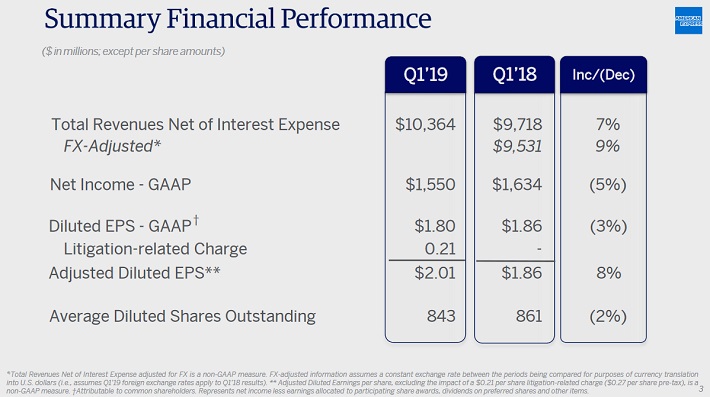

American Express reported its first quarter earnings results on April 18:

Source: American Express’ earnings presentation

During the first quarter, American Express’ revenues totaled $10.4 billion, which was up 7% from the first quarter of fiscal 2018. American Express’ revenues would have been even higher at constant currency rates, but even though forex rates were a headwind, American Express still managed to grow its revenues across its segments, as spend, lend, and fee revenues were up versus the previous year’s quarter.

Thanks to American Express’ integrated business model, the company can capture value across the whole payment processing value chain as long as the total market keeps growing. Earnings-per-share were up at a high single digit rate versus the previous year’s quarter, partially due to a lower share count.

Other news items during the last couple of months include the charge-off rates on American Express’ credit cards. Those ticked down in April, from 1.5% to 1.4%, and remained steady at that level during May. June charge-off rates have not yet been announced , but due to the low charge-off rates during the previous two months it is unlikely that there will be any surprises. Worries about the state of the global economy and slowing growth have so far not resulted in any meaningful headwinds for American Express’ charge-off rates.

Another item of note is that several politicians have introduced legislation that would cap interest rates for consumer loans at 15%. This would primarily hurt payday lenders, which charge interest rates of much more than 15%, but credit card companies such as American Express could be impacted to some degree as well.

It seems unlikely for such legislation to pass in the foreseeable future. And even if it does, American Express is likely be able to handle the impact relatively well — due to the above-average creditworthiness of its card holders compared to other credit card companies. American Express also charges lower absolute interest rates compared to many of its peers.

Growth Prospects

American Express has generated highly attractive earnings-per-share growth rates in the past, and we believe that the company will be able to grow its profits at a strong pace during the coming years as well. Between 2009 and 2018 American Express grew its earnings-per-share at a 10.1% rate annually. This growth came despite the fact that the company reported no meaningful growth between 2014 and 2017, when the company restructured and ended its partnership with Costco.

The fact that American Express nevertheless managed to generate a double digit growth rate during the last decade even though it lost a couple of years, shows the strong underlying growth momentum of American Express.

Revenue growth plays a large role when it comes to rising profits for American Express, and thanks to tailwinds for the industry it is likely that American Express’ revenues will grow very meaningfully over the coming years as well.

American Express’ revenues grew at a rate of 10% during 2018 on a constant currency basis. This enabled earnings-per-share growth of 13%. The company targets revenue growth of 8%-10% for 2019, while guiding for earnings-per-share to range from $7.85 to $8.35. At the guidance midpoint, this equates to an earnings-per-share growth rate of 10.7% versus the $7.32 that American Express earned during 2018.

Revenue growth during 2019 and beyond will be the result of several factors. The growing number of American Express card holders naturally results in an increasing number of transactions, and higher payment volumes are also processed through American Express’ network.

Many adults do not own a credit card, especially in foreign markets, and this represents significant market growth potential. As a leading credit card company, American Express should be able to capture some of the market’s growth, especially among the more affluent and more creditworthy consumers in developing countries with a fast-growing middle class, such as China and India.

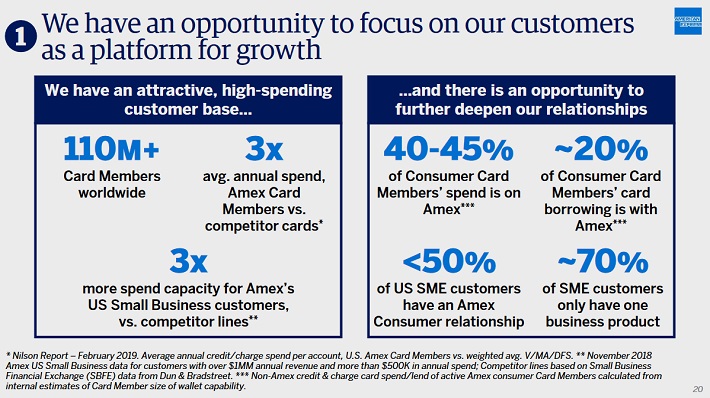

Increasing the number of customers is not the only way for American Express to grow revenue. The company is also able to increase the revenues it generates from existing customers. Management calls this focusing on the customer as a platform of growth, a strategy that includes increasing customers’ spending on American Express’ network, as well as increasing the rate of customers who borrow through American Express.

Source: American Express presentation

American Express points out that small businesses, for example, could increase their spending on American Express’ network by a factor of 3. It is unlikely that these businesses will do all of their spending with an American Express card, but if the rate of spending with an AmEx card rises from ~33% to ~50% in the future, that would result in a 50% revenue increase for American Express for these customers.

Selling additional business products to small businesses, or adding consumer cards for holders of business cards are other ways for American Express to capture value from existing customer relationships.

Referral programs, which utilize existing relationships with current customers to acquire new customers, are another pillar for revenue growth for American Express. Between 2015 and 2018, American Express’ billings that were acquired from referral programs rose by an incredible 500%, and its referral program has turned into the second largest acquisition channel for American Express.

In the past, American Express’ earnings-per-share grew faster than its revenues, and the same will likely happen in the future as well. American Express benefits from strong operating leverage, which allows for margin increases as revenues are rising. Proportional costs for each additional customer are quite low, as most of American Express’ costs are fixed, which means that increased revenues allow for high additional gross profits.

Another factor that has resulted in additional earnings-per-share growth in the past are American Express’ share repurchases. The company has reduced its share count by close to 30% over the last decade, and it is likely that the company will continue to return a lot of surplus cash to its owners via share repurchases.

All in all, we believe that American Express’ growth outlook is strong, and that the company should be able to generate an earnings-per-share growth rate of 9%-10% annually over the coming five years, with revenue growth and share repurchases providing most of the growth.

Recession Performance

Companies with a more recession-resistant business model will have a less volatile share price during economic downturns, and the risk of a dividend cut is lower as well. These companies, therefore, are especially suitable for risk-averse investors. American Express’ performance during the last financial crisis looked like this:

- 2007 earnings-per-share of $3.34

- 2008 earnings-per-share of $2.32 (31% decline)

- 2009 earnings-per-share of $1.54 (34% decline)

- 2010 earnings-per-share of $3.35 (118% increase)

We see that profits took a large hit during 2008 and 2009, as spending across the company’s network declined for both consumers and business customers. Earnings recovered relatively fast, though, marginally surpassing the previous record level from 2007 in 2010.

The dividend remained well-covered during the last financial crisis, but American Express is nevertheless not a recession-resilient company, and will likely trade in a volatile way during future recessions.

Valuation And Expected Total Returns

American Express’ shares are trading for $125 right now, which is 15.4 times this year’s forecasted net profit, using management’s guidance midpoint. This is not a high valuation in absolute terms, but it represents a small premium relative to how American Express’ shares were valued in the past.

Our fair value estimate is $114, which reflects a price to earnings multiple of 14. Shares are thus overvalued by roughly 10% right now, relative to what we deem a fair value multiple. If American Express’ valuation declined to 14 over the coming 5 years, this would result in a 2% annual headwind for total returns.

American Express’ forecasted total returns are still not bad at all, though, thanks to the high expected earnings-per-share growth rate. We believe that American Express should generate total annual returns of roughly 9%, consisting of earnings-per-share growth of 9%-10%, a dividend that yields 1.2%, partially offset by multiple compression headwinds of ~2%.

If American Express’ shares could be bought at $114, which is our fair value estimate, our total annual return estimate would be ~11%, which is why we deem American Express an attractive buy at or below that level. Even though American Express’ shares look slightly overvalued right here the forecasted returns are not bad at all, which is why American Express is a hold for existing shareholders.

Investors that seek exposure to the industry and that do not mind paying a premium could enter a position right here if they do not want to wait for American Express’ shares to trade at a lower level.

Final Thoughts

American Express is an attractive business fundamentally. The credit card company benefits from industry tailwinds, generates attractive returns on capital, offers significant shareholder payouts, primarily through share repurchases, and generates attractive revenue and earnings growth rates.

We believe that American Express will continue to be a growth company, and our forecasts see strong high single digit earnings-per-share growth through the coming five years. American Express does not offer a high dividend yield, thus it is not suitable for income-oriented investors. Total return focused investors should keep an eye on American Express, though. Its stock is a hold right now, and would be a compelling buy at or below our fair value price target of $114.